Get the free No known loss letter fillable form

Show details

ENVIRONMENTAL CONTRACTORS AND CONSULTANTS APPLICATION

This application is for use in applying for Commercial General Liability, Environmental Contractor's Pollution Liability and Environmental Consultant's

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign no known loss letter

Edit your no known loss letter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your no known loss letter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing no known loss letter online

To use our professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit no known loss letter. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

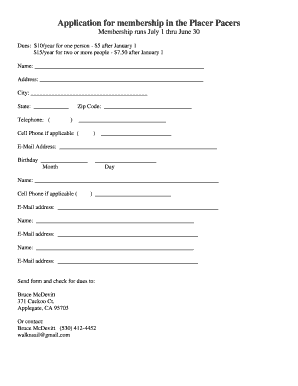

How to fill out no known loss letter

How to fill out no known loss letter:

01

Start by addressing the letter to the appropriate recipient, which is usually the insurance company or the party requesting the letter.

02

Include the date on the top right corner of the letter.

03

Begin the letter with a formal salutation, such as "Dear Sir/Madam" or the recipient's name followed by a comma.

04

State that you are writing the letter to confirm that there have been no known losses or claims related to the insurance policy in question.

05

Provide the relevant policy information, such as the policy number or any other identification details requested.

06

Clearly specify that there have been no losses or claims filed within a specific time period (e.g., for the duration of the policy term or within the past year).

07

If applicable, mention any exceptions or qualifications to the statement, such as ongoing investigations or pending claims that have not yet been resolved.

08

Close the letter with a polite and professional ending, such as "Sincerely" or "Best regards."

09

Sign the letter with your name and include any additional contact information, if required by the recipient.

Who needs no known loss letter:

01

Insurance companies often require a no known loss letter from policyholders when renewing insurance policies or making certain changes to existing policies.

02

Some organizations or government agencies may request a no known loss letter when engaging in contracts or business agreements to verify that a party has not suffered any significant losses or claims.

03

No known loss letters can also be requested during mergers and acquisitions to evaluate the financial risk associated with insurance coverage.

Note: The requirements and usage of no known loss letters may vary depending on the specific situation and the policies of the requesting party. It is always advisable to consult with the insurance company or the recipient of the letter to ensure compliance with their requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my no known loss letter in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your no known loss letter as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I complete no known loss letter online?

Easy online no known loss letter completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit no known loss letter on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign no known loss letter. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is no known loss letter?

A no known loss letter is a document that states a party's confirmation that there have been no losses, damages, or claims during a specific period of time.

Who is required to file no known loss letter?

The party responsible for providing insurance coverage, such as an insurance company or a self-insured entity, is generally required to file a no known loss letter.

How to fill out no known loss letter?

To fill out a no known loss letter, you usually need to provide information about the insured party, the policy details, the period of time covered, and a statement confirming no losses, damages, or claims during that period.

What is the purpose of no known loss letter?

The purpose of a no known loss letter is to certify that there have been no losses, damages, or claims during a specific period, often required for various business transactions or to demonstrate the absence of liabilities.

What information must be reported on no known loss letter?

The information typically reported on a no known loss letter includes the insured's name and contact information, policy details, the period covered, and a statement confirming no losses, damages, or claims.

Fill out your no known loss letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

No Known Loss Letter is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.