Get the Get the free ifta fuel tax report supplement form - pdfFiller

Show details

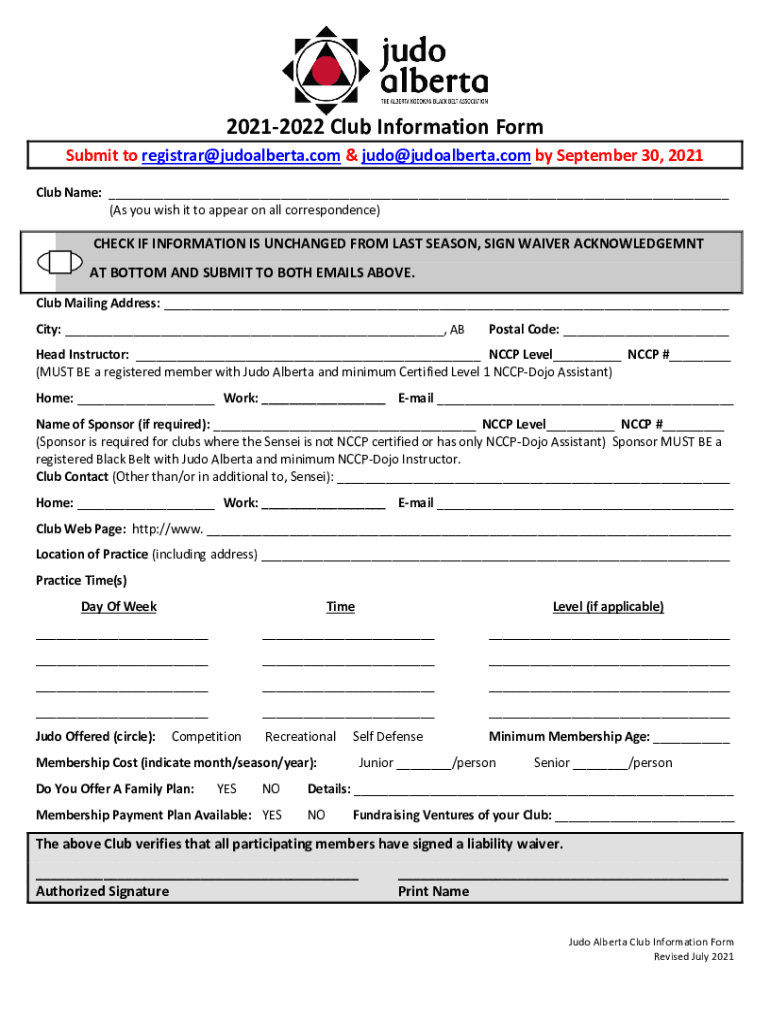

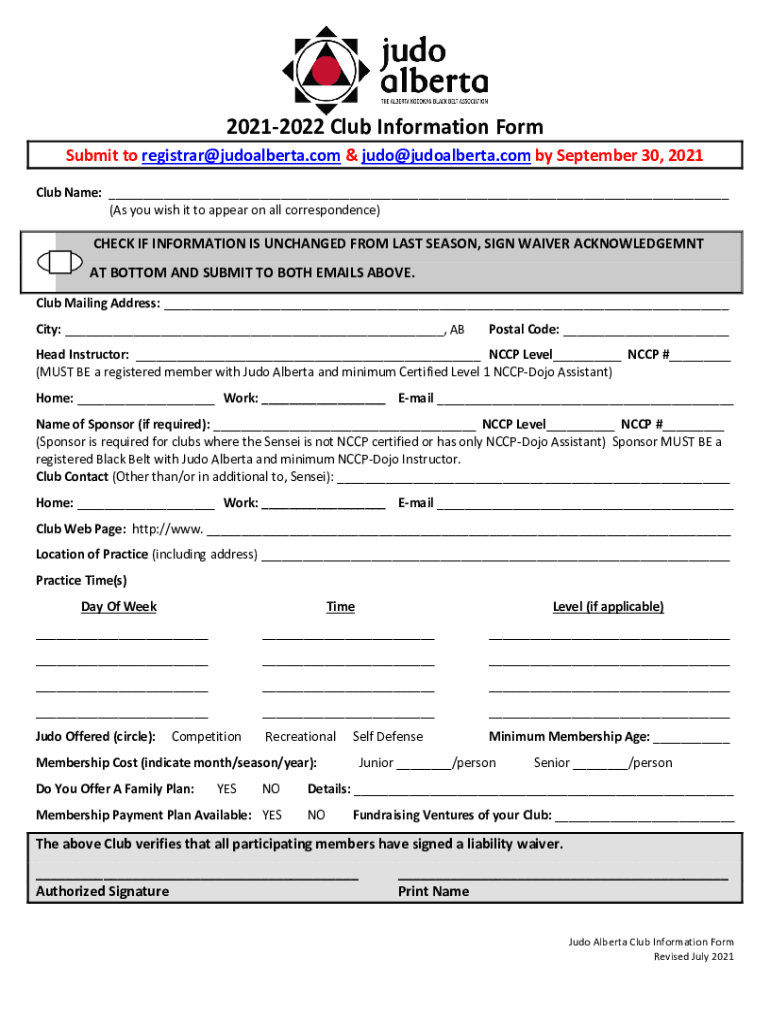

20212022 Club Information Form Submit to registrar judoalberta.com & judo judoalberta.com by September 30, 2021, Club Name: (As you wish it to appear on all correspondence)CHECK IF INFORMATION IS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ifta fuel tax report

Edit your ifta fuel tax report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ifta fuel tax report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ifta fuel tax report online

In order to make advantage of the professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ifta fuel tax report. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ifta fuel tax report

How to fill out ifta fuel tax report

01

To fill out an IFTA fuel tax report, follow these steps:

02

Gather all the necessary information, such as your fuel receipts, mileage records, and fuel purchase details.

03

Calculate the total miles traveled in each jurisdiction during the reporting period.

04

Determine the total gallons of fuel purchased in each jurisdiction during the reporting period.

05

Divide the total gallons of fuel purchased by the total miles traveled in each jurisdiction to calculate the average fuel consumption rate.

06

Convert the average fuel consumption rate to miles per gallon (MPG).

07

Multiply the MPG by the total taxable gallons to calculate the total taxable miles.

08

Calculate the tax liability by multiplying the total taxable miles by the fuel tax rate of each jurisdiction.

09

Fill out the IFTA fuel tax report form with the calculated values for each jurisdiction.

10

Double-check all the entered information and calculations for accuracy.

11

Submit the completed IFTA fuel tax report by the deadline to the appropriate tax authority, along with any required payment.

Who needs ifta fuel tax report?

01

IFTA fuel tax reports are needed by commercial motor carriers who operate vehicles that are used for transporting goods or passengers across multiple jurisdictions.

02

This includes trucking companies, freight carriers, bus companies, and any other businesses or individuals who have vehicles that travel interstate.

03

Motor carriers who are registered under the International Fuel Tax Agreement (IFTA) are required to file IFTA fuel tax reports on a quarterly basis.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ifta fuel tax report without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including ifta fuel tax report, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send ifta fuel tax report to be eSigned by others?

Once your ifta fuel tax report is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I sign the ifta fuel tax report electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your ifta fuel tax report in seconds.

What is ifta fuel tax report?

The International Fuel Tax Agreement (IFTA) fuel tax report is a report that allows for the efficient collection and distribution of fuel tax revenues among member jurisdictions.

Who is required to file ifta fuel tax report?

Motor carriers who operate qualified motor vehicles in more than one jurisdiction and are involved in the transportation of goods are required to file IFTA fuel tax reports.

How to fill out ifta fuel tax report?

To fill out an IFTA fuel tax report, motor carriers must provide detailed information on the total distance traveled, fuel consumed, and taxes paid in each jurisdiction.

What is the purpose of ifta fuel tax report?

The purpose of the IFTA fuel tax report is to simplify the reporting and payment of fuel taxes for motor carriers operating in multiple jurisdictions.

What information must be reported on ifta fuel tax report?

Motor carriers must report the total distance traveled, fuel consumed, and taxes paid in each jurisdiction on the IFTA fuel tax report.

Fill out your ifta fuel tax report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ifta Fuel Tax Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.