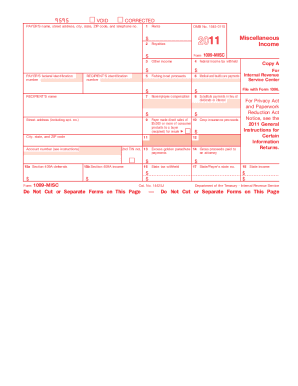

Get the free Form 1099-A - IRS

Show details

2012. Cat. No. 14412G. Acquisition or. Abandonment of. Secured Property. Copy A. For. Internal Revenue. Service Center. Department of the Treasury Internal ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 1099-a - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1099-a - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 1099-a - irs online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 1099-a - irs. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

How to fill out form 1099-a - irs

How to fill out form 1099-A - IRS:

01

Gather all necessary information: Before filling out the form, make sure you have all the required information at hand. This includes the borrower's name, address, social security number, as well as the property address and its fair market value.

02

Fill out the borrower's information: Start by entering the borrower's name, address, and social security number in the specified fields on the form. Ensure that all the information is accurate and up to date.

03

Provide the property information: Fill in the details about the property that had been foreclosed upon or transferred. This includes the property address, city, state, zip code, and the date of acquisition.

04

Enter the fair market value: Determine the fair market value of the property at the time of acquisition. This can be found in the original documentation or by obtaining a professional appraisal.

05

Indicate the borrower's personal use: If the borrower used the property as a personal residence, mark the appropriate box on the form. Otherwise, leave it blank if the property was not used for personal purposes.

06

Determine the transaction codes: Use the provided list of codes to identify the reason for the transfer or foreclosure. Select the code that applies to the specific situation and enter it in the designated field on the form.

07

Complete all required fields: Make sure all the necessary fields are filled out accurately, including the date, signature, and contact information. Failure to provide complete and correct information may delay the processing of the form.

Who needs form 1099-A - IRS:

01

Lenders and financial institutions: If you are a lender or financial institution that has foreclosed on or transferred a property due to default on a loan, you are required to file form 1099-A with the IRS.

02

Borrowers who received a foreclosure notice: If you are a borrower who has received a foreclosure notice or experienced a transfer of property due to default on a loan, you may receive form 1099-A from the lender or financial institution involved in the transaction.

03

Tax professionals and accountants: Tax professionals and accountants also need to be familiar with form 1099-A as they may be responsible for helping clients fill out and file this form accurately.

Note: It is always advisable to consult with a tax professional or the IRS website to ensure you are meeting all the necessary requirements when filling out form 1099-A.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 1099-a - irs?

Form 1099-A is an IRS form used to report the acquisition or abandonment of secured property by a lender. It is typically sent to borrowers who have had a foreclosure, repossession, or deed in lieu of foreclosure.

Who is required to file form 1099-a - irs?

Lenders, financial institutions, and government agencies who become aware of an abandonment or acquisition of secured property must file Form 1099-A with the IRS.

How to fill out form 1099-a - irs?

To fill out Form 1099-A, you must provide information such as the lender's name and contact information, the borrower's identification number, and details about the property involved, including the principal amount of the loan and the fair market value of the property.

What is the purpose of form 1099-a - irs?

Form 1099-A is used to report the acquisition or abandonment of secured property for tax purposes. It helps the IRS track and ensure accurate reporting of these transactions.

What information must be reported on form 1099-a - irs?

Form 1099-A requires reporting of details such as the borrower's identification number, acquisition or abandonment date, the lender's contact information, property description, and the fair market value of the property.

When is the deadline to file form 1099-a - irs in 2023?

The deadline to file Form 1099-A with the IRS in 2023 is typically January 31st, following the end of the tax year in which the acquisition or abandonment occurred.

What is the penalty for the late filing of form 1099-a - irs?

The penalty for late filing of Form 1099-A depends on the size of the business or organization. For small businesses, penalties can range from $50 to $270 per form, with a maximum penalty of $1,113,000 per year.

Can I create an electronic signature for signing my form 1099-a - irs in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your form 1099-a - irs and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I edit form 1099-a - irs on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing form 1099-a - irs, you need to install and log in to the app.

How do I complete form 1099-a - irs on an Android device?

Complete your form 1099-a - irs and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your form 1099-a - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.