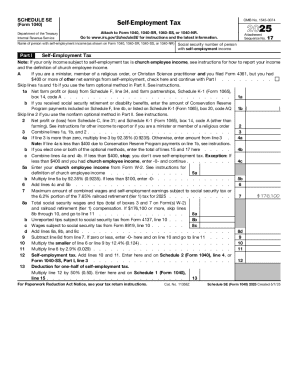

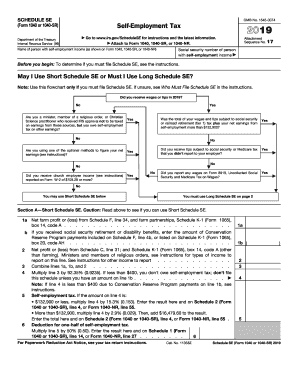

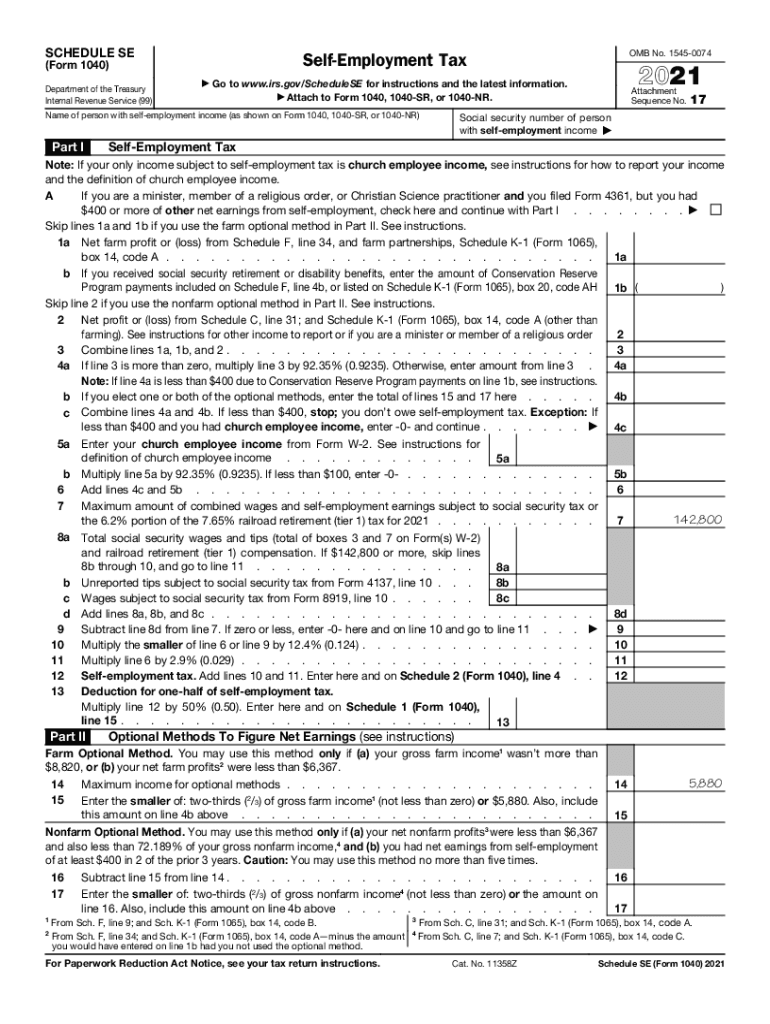

IRS 1040 - Schedule SE 2021 free printable template

Instructions and Help about IRS 1040 - Schedule SE

How to edit IRS 1040 - Schedule SE

How to fill out IRS 1040 - Schedule SE

About IRS 1040 - Schedule SE 2021 previous version

What is IRS 1040 - Schedule SE?

Who needs the form?

What are the penalties for not issuing the form?

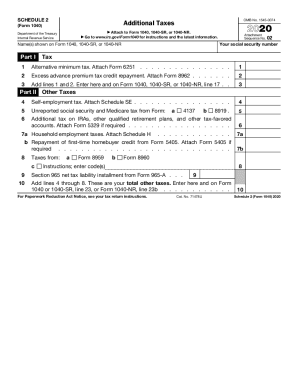

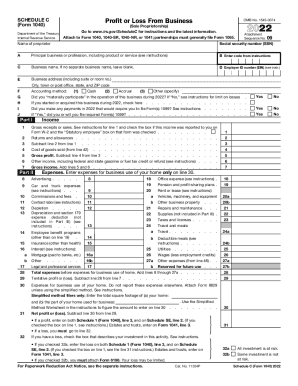

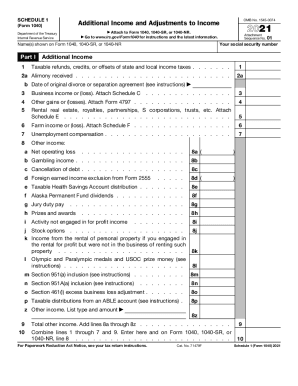

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1040 - Schedule SE

What should I do if I need to correct mistakes on my IRS 1040 - Schedule SE after submitting?

If you discover errors on your IRS 1040 - Schedule SE after filing, you can submit an amended return using Form 1040-X. It's essential to explain the changes you are making and ensure that the amended form is filed within the applicable time frame to avoid penalties.

How can I verify the status of my submitted IRS 1040 - Schedule SE?

To verify the status of your submitted IRS 1040 - Schedule SE, you can use the IRS 'Where's My Refund?' tool online or contact the IRS directly. Keep in mind that processing times may vary, and any rejection would typically come with a specific code indicating the issue.

Are e-signatures acceptable for submitting IRS 1040 - Schedule SE?

Yes, e-signatures are acceptable for IRS 1040 - Schedule SE when filed electronically. However, ensure that you follow IRS guidelines regarding authentication and the use of reliable electronic signature solutions to safeguard your personal data.

What common errors should I avoid when completing my IRS 1040 - Schedule SE?

Common errors when filling out the IRS 1040 - Schedule SE include miscalculating self-employment taxes and failing to report all income. Double-checking numbers and ensuring all information matches your records can help minimize these mistakes.

What should I do if I receive an IRS notice regarding my 1040 - Schedule SE?

If you receive an IRS notice related to your 1040 - Schedule SE, carefully read the notice to understand the issue. Gather necessary documentation and respond promptly according to the instructions provided in the notice to resolve any discrepancies.

See what our users say