Get the Get the free EXEMPTION OF LEASED PROPERTY USED EXCLUSIVELY ...

Show details

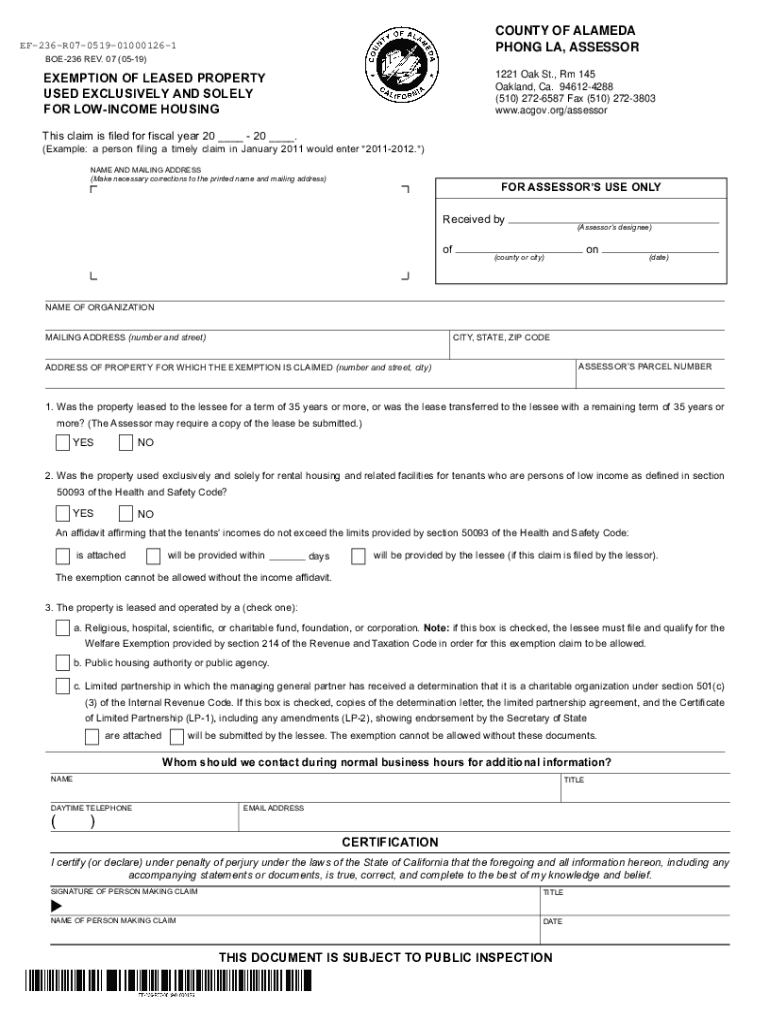

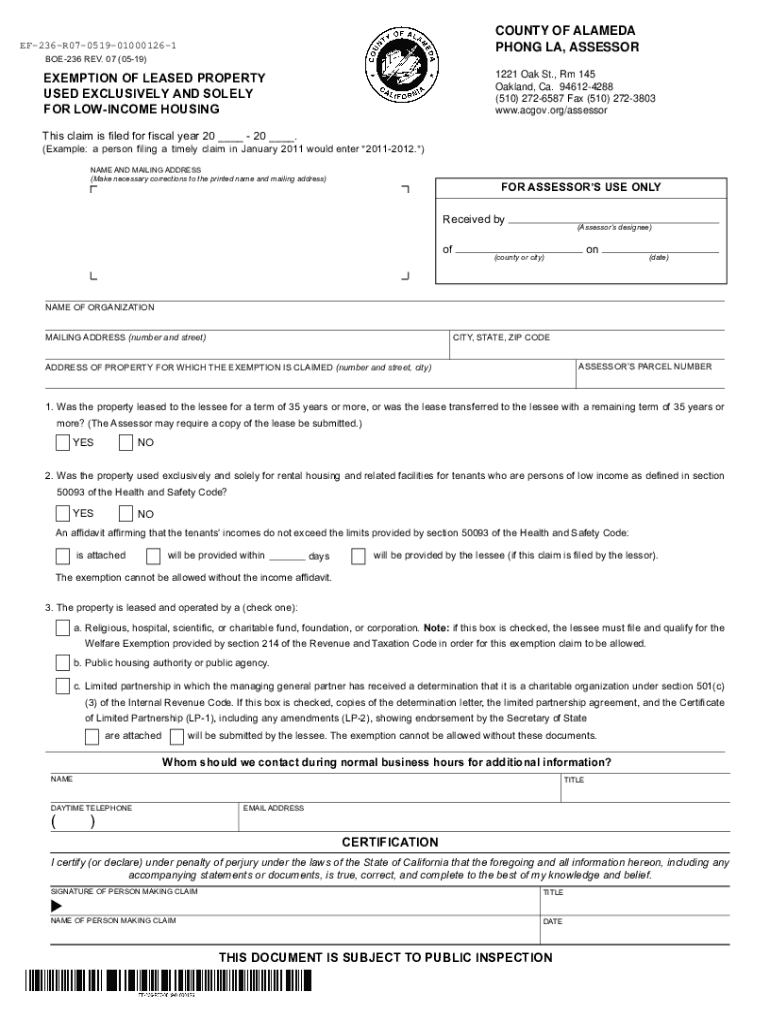

COUNTY OF ALAMEDA PHONE LA, ASSESSOREF236R070519010001261 BOE236 REV. 07 (0519)EXEMPTION OF LEASED PROPERTY USED EXCLUSIVELY AND SOLELY FOR INCOME HOUSING1221 Oak St., Rm 145 Oakland, Ca. 946124288

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your exemption of leased property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your exemption of leased property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit exemption of leased property online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit exemption of leased property. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out exemption of leased property

How to fill out exemption of leased property

01

To fill out the exemption of leased property, follow these steps:

02

Obtain a copy of the exemption form from the local tax authority.

03

Read the instructions carefully to understand the eligibility requirements for the exemption.

04

Gather all the necessary documents and information, such as the lease agreement, property details, and proof of occupancy.

05

Complete the form accurately, providing all the requested information. Ensure that all personal and property details are correct.

06

Double-check the form for any errors or missing information before submitting it.

07

Attach any supporting documentation, if required, such as proof of income or financial statements.

08

Submit the completed form and supporting documents to the local tax authority, either in person or by mail.

09

Keep a copy of the completed form and supporting documents for your records.

10

Wait for the tax authority's response regarding the exemption. They may require additional information or verification before approving the exemption.

11

Follow up with the tax authority if you don't receive a response within a reasonable time frame.

Who needs exemption of leased property?

01

Exemption of leased property is typically needed by individuals or businesses who are leasing property for commercial or residential purposes.

02

The specific eligibility requirements may vary depending on the jurisdiction, but generally, those who meet the following conditions may need exemption of leased property:

03

- Leasing a property for business operations, such as offices, retail stores, or factories.

04

- Renting a property for residential purposes, such as an apartment or house.

05

- In some cases, landlords may also be eligible for certain exemptions related to leasing their properties.

06

It is important to consult with the local tax authority or seek professional advice to determine if you qualify for exemption of leased property in your specific situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit exemption of leased property from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including exemption of leased property, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I create an electronic signature for the exemption of leased property in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your exemption of leased property and you'll be done in minutes.

Can I edit exemption of leased property on an Android device?

You can edit, sign, and distribute exemption of leased property on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your exemption of leased property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.