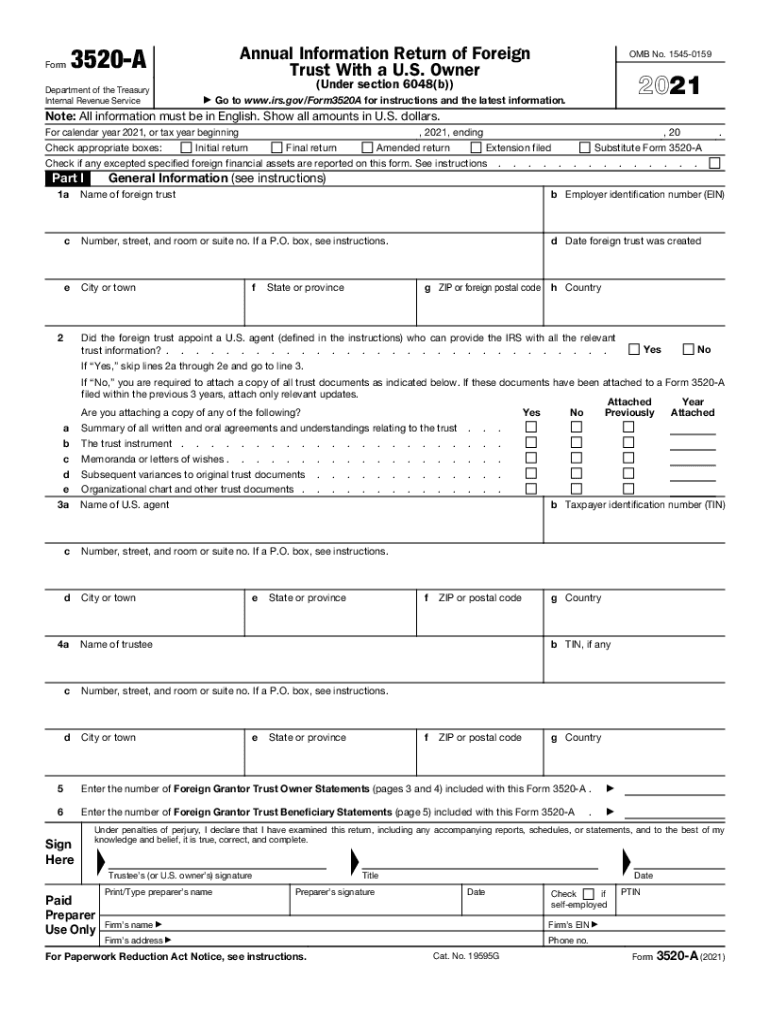

What is Form 3520-A 2021?

The purpose of Form 3520-A is to report essential information about a trust with one or more US owners on an annual basis. Form 2350-A shouldn’t be confused with Form 3520. While the recipient of foreign assets uses the former to document and report them to IRS, the latter needs to be filed by a trustee. Please note that failure to file either form correctly and on time may lead to substantial penalties from IRS. You should talk to an international tax specialist before filing the document.

Who must file Tax Form 3520-A 2021?

Form 3520-A must be submitted by the trustee of a foreign grantor trust with a U.S. owner. However, the owner (a particular beneficiary or an entrepreneur who owns the foreign trust fully or partially) is responsible for ensuring the form is filed by a trustee according to all requirements and deadlines.

What information needs to be included in 2350-A Form?

Tax Form 2350-A includes several fundamental points. It requires general data such as the name of the trust, address, insurance details, etc. The second part comprises entering the amounts from record books (interests, dividends, capital gains, gross rents, and so on). The third part is for depicting the foreign trust balance sheet.

How do I fill out 2350-A Form in 2022?

You can easily complete Form 3520-A online without the need to print and scan by using pdfFiller.

Follow these steps to fill out the form with pdfFiller:

- Click Get Form to open up the form.

- Start filling out the required fields by entering text.

- Manipulate the text by using the available editing and annotation tools.

- Sign and date the document using the respective tools from the top toolbar.

- Click Done to save the changes to the form.

- Select the option to download the form Form 3520-A or send it via USPS.

Is 3520-A must be accompanied by other forms?

3520-A Form may be accompanied by 7004 Form to request the automatic time extension. Depending on your unique case, Form 3520-A may require a trustee to attach additional documents, such as copies of trust documents, organizational charts, etc. Read over the instructions on the IRS website before completing the document.

When is 3520-A Form due?

Applicants must submit the form through the Internal Revenue Service Center on the 15th day of every 3rd month when the trust's tax year has finished. Prepare all additional documents and form details in advance to file them on time and without delays.

Where do I send Form 3520-A?

Submit 2350-A Form with all supporting documents and statements to IRS (P.O. Box 409101, Ogden, UT 84409).