Get the free Traditional IRA Application - the Berwyn Funds

Show details

TRADITIONAL IRA Including: Disclosure Statement Custodial Agreement Financial Disclosure Application Transfer Form Table of Contents HOW TO ESTABLISH YOUR IRA PLAN ....................................................

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your traditional ira application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your traditional ira application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

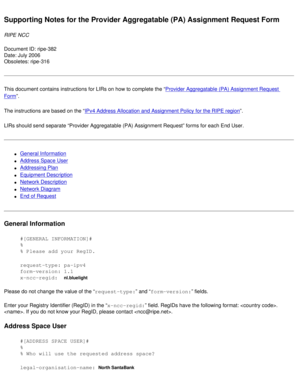

Editing traditional ira application online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit traditional ira application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out traditional ira application

How to fill out traditional IRA application?

01

Gather necessary documents: Before starting the application, make sure you have all the required documents handy. This typically includes your Social Security number, employment information, financial information, and beneficiary details.

02

Choose a financial institution: Decide on the financial institution where you want to open your traditional IRA. Research different institutions and compare their fees, investment options, and customer reviews to make an informed decision.

03

Obtain the application form: Contact the chosen financial institution either through their website, phone, or in person, and request the traditional IRA application form. They will provide you with a physical or digital form that needs to be filled out.

04

Personal information: Begin the application by providing personal details such as your full name, date of birth, contact information, and Social Security number. Ensure the information is accurate and up to date.

05

Employment details: Provide information about your current employment, including your employer's name, address, and contact information. If you are self-employed, provide details about your business or profession.

06

Financial information: Fill in the application with your financial information, including your annual income, sources of income, and any existing retirement accounts you may have. This helps the financial institution assess your eligibility and determine your contribution limits.

07

Beneficiary designation: Designate beneficiaries for your traditional IRA. These are the individuals who would inherit the funds in your account in case of your demise. Provide their full names, dates of birth, and their relationship to you.

08

Review and sign: Once you have completed filling out the application form, thoroughly review all the information you have provided. Ensure there are no errors or missing details. Sign and date the application as required.

09

Submit the application: Depending on the financial institution, you can either submit the application form physically by mail or in person at their branch office. Alternatively, some institutions also offer the option to submit the application online through their website.

Who needs a traditional IRA application?

01

Individuals planning for retirement: A traditional IRA application is essential for individuals who want to save for their retirement. It allows them to contribute pre-tax income and potentially grow their savings over time.

02

Those seeking tax advantages: Traditional IRAs offer tax advantages, such as tax-deductible contributions and tax-deferred growth. Anyone looking to optimize their retirement savings while enjoying potential tax benefits should consider opening a traditional IRA.

03

Individuals without employer-sponsored plans: If you do not have access to an employer-sponsored retirement plan like a 401(k), a traditional IRA provides a valuable alternative for saving for retirement.

04

Individuals wanting more investment options: Traditional IRAs often offer a wide range of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Those looking for flexibility and control over their retirement investments may find a traditional IRA appealing.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is traditional ira application?

A traditional IRA application is a form or document that individuals use to open and contribute to a traditional Individual Retirement Account.

Who is required to file traditional ira application?

Any individual who wants to open and contribute to a traditional IRA is required to file a traditional IRA application.

How to fill out traditional ira application?

To fill out a traditional IRA application, you typically need to provide personal information such as your name, address, social security number, and employment details. You also need to specify the amount you want to contribute and any investment preferences.

What is the purpose of traditional ira application?

The purpose of a traditional IRA application is to establish an account where individuals can contribute pre-tax income toward retirement savings and potentially receive tax deductions and tax-deferred growth.

What information must be reported on traditional ira application?

The information reported on a traditional IRA application typically includes personal details such as name, address, social security number, employment information, contribution amount, and investment instructions.

When is the deadline to file traditional ira application in 2023?

The deadline to file a traditional IRA application in 2023 is April 18th, 2023, as the usual tax deadline is extended due to the 15th falling on a weekend and Emancipation Day.

What is the penalty for the late filing of traditional ira application?

The penalty for the late filing of a traditional IRA application is typically a 6% excise tax on the excess contribution amount for each year the application is delayed, as per the IRS guidelines.

How can I manage my traditional ira application directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your traditional ira application and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send traditional ira application to be eSigned by others?

Once your traditional ira application is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete traditional ira application on an Android device?

Use the pdfFiller mobile app and complete your traditional ira application and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your traditional ira application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.