Get the free how to add someone to us bank account form

Show details

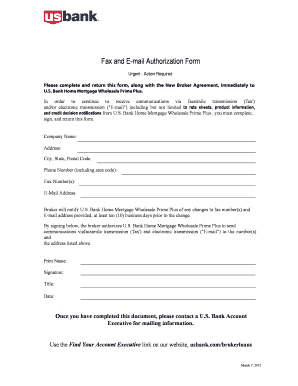

Joint Owner A Joint Owner a.k. a. Secondary Account Holder is a person you add to your U.S. Bank Premier Line Account who will be jointly liable for any balance owed on your account. For your protection we require your written authorization to add an individual to your Account and we require the signature and agreement of the Joint Owner. To request an addition fax or mail this completed form back to us at the number/address noted below. For your...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your how to add someone form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to add someone form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing how to add someone to us bank account online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit u s bank add joint owner to checking account form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out how to add someone

How to fill out u s bank add:

01

Gather all necessary information, such as your personal details, including name, address, and social security number, as well as any financial information required for the add.

02

Make sure you have the correct form or application for the u s bank add. You can usually find the form on the bank's website or obtain it from a local branch.

03

Carefully read through the instructions provided with the form to ensure that you understand all the requirements and guidelines for filling it out correctly.

04

Begin filling out the form, providing all the requested information accurately and completely. Make sure to double-check your inputs for any errors or typos before moving on.

05

If there are any sections or fields that you are unsure of or don't understand, don't hesitate to seek clarification from a u s bank representative or customer service agent.

06

Once you have completed filling out the form, review it one last time to make sure everything is accurate and consistent. Ensure that you have signed and dated the form where required.

07

Finally, submit the completed u s bank add according to the instructions given, whether by mailing it to the designated address, submitting it online, or hand-delivering it to a local branch.

Who needs u s bank add:

01

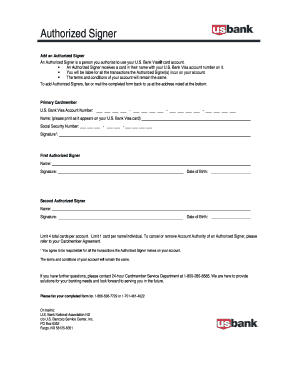

Individuals who want to add a new account to their u s bank profile, such as a checking account, savings account, or credit card account.

02

Existing u s bank customers who wish to add additional services or features to their current accounts, like adding an overdraft protection service or a new credit card.

03

Individuals who have recently moved and need to update their contact information or address with u s bank.

04

Business owners and entrepreneurs who want to open a business account or add new business services through u s bank.

05

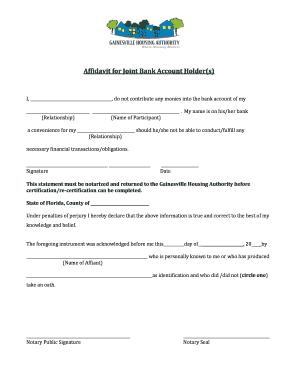

Customers who want to add a joint account holder or benefici

ary to an existing account.

Fill us bank adding someone to your account : Try Risk Free

People Also Ask about how to add someone to us bank account

Can I make my US bank account a joint account?

Can you add someone to an existing bank account?

Can you add a joint owner to a bank account online?

How do I add a joint owner to my US bank account?

Can you add a joint owner to an existing bank account?

Can you add someone to an existing checking account?

How do I add a joint owner to my bank account?

Can a bank account have two owners?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is u s bank add?

U.S. Bank's main address is:

U.S. Bank

800 Nicollet Mall

Minneapolis, MN 55402

Who is required to file u s bank add?

U.S. banks are required to file Form FR 2900, a Consolidated Report of Condition and Income, with the Federal Reserve Board on a quarterly basis.

How to fill out u s bank add?

1. Start by filling out the bank's address. This can usually be found on the bank's website.

2. Enter your name, address, and phone number.

3. Provide the bank with your Social Security Number or Tax Identification Number.

4. Choose the type of account you would like to open.

5. Indicate the amount of money you would like to deposit.

6. Sign and date the form.

7. Submit the form to the bank.

What is the penalty for the late filing of u s bank add?

The penalty for late filing of a U.S. Bank Add can vary depending on the specific regulations of the bank and the type of filing. Generally, a bank might charge a fee for late filing, or it could impose a penalty such as a reduction in the interest rate or an increase in the minimum balance requirement.

What is the purpose of u s bank add?

The purpose of a U.S. Bank ad is to promote and market the various products and services offered by U.S. Bank. These advertisements are designed to capture the attention of potential customers and create brand awareness. The ads typically highlight the bank's features, benefits, competitive rates, convenience, and customer satisfaction. The ultimate goal is to attract new customers and build customer loyalty by communicating the value and reliability of U.S. Bank's offerings.

What information must be reported on u s bank add?

The specific information that must be reported on a U.S. bank ad may vary, but generally, some key information that should be included is:

1. Name and logo of the bank: The advertisement should clearly identify the name and logo of the bank to avoid any confusion.

2. Interest rates: If the advertisement is promoting savings accounts, certificates of deposit (CDs), loans, or credit cards, it should disclose the relevant interest rates or Annual Percentage Rates (APRs) associated with those products.

3. Fees and charges: Any significant fees or charges associated with banking products or services being advertised should be clearly disclosed. For example, if there are monthly maintenance fees for a checking account or penalty fees for early CD withdrawals, these should be mentioned.

4. Terms and conditions: Any important terms and conditions related to the products or services being advertised, such as minimum balance requirements or promotional periods, should be clearly stated.

5. Eligibility requirements: If there are any specific eligibility criteria that customers must meet to qualify for the advertised offer, such as credit score requirements for loans or specific age requirements for certain accounts, this information should be provided.

6. Clear and prominent disclaimers: Banks usually include disclaimers for legal and regulatory purposes. These disclaimers should be clear and prominent, ensuring that customers fully understand any limitations or restrictions associated with the advertised offer.

7. Contact information: The advertisement should provide contact details of the bank, such as phone number, website, or branch location, so that customers can easily reach out for further information or to initiate the desired services.

It's important to note that these are general guidelines, and specific regulations may apply based on the laws and regulations of each jurisdiction and the type of product being advertised.

Can I create an eSignature for the how to add someone to us bank account in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your u s bank add joint owner to checking account form right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out the us bank add authorized user form on my smartphone?

Use the pdfFiller mobile app to complete and sign us bank add joint owner on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete us bank joint credit card on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your u s bank joint credit card form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your how to add someone online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Bank Add Authorized User is not the form you're looking for?Search for another form here.

Keywords relevant to us bank add spouse to account form

Related to add person to us bank checking account

If you believe that this page should be taken down, please follow our DMCA take down process

here

.