Get the free Keep for your records

Show details

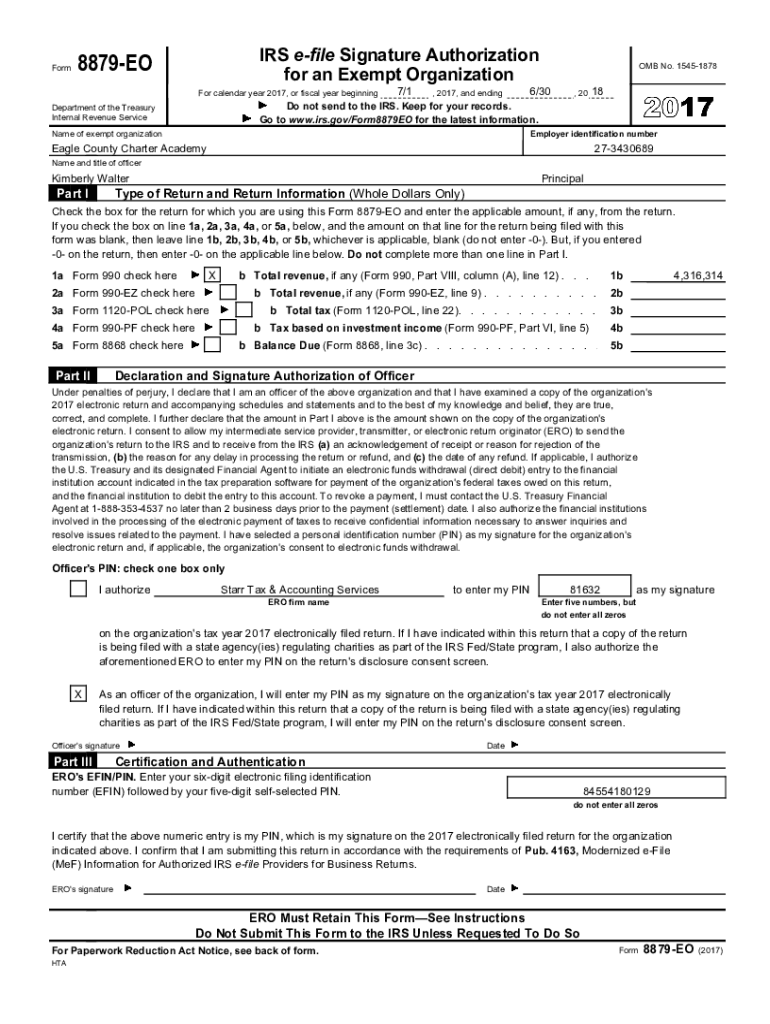

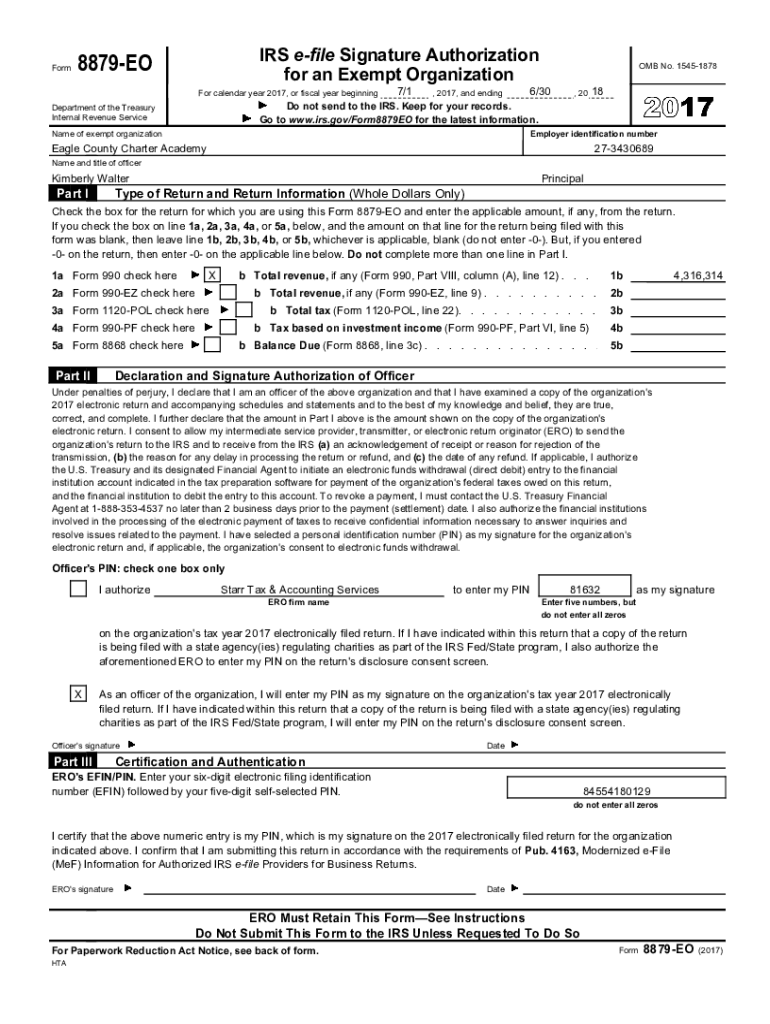

Form IRS file Signature Authorization for an Exempt Organization8879EOFor calendar year 2017, or fiscal year beginning7/1, 2017, and ending OMB No. 154518786/30, 2018Do not send to the IRS. Keep for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign keep for your records

Edit your keep for your records form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your keep for your records form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit keep for your records online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit keep for your records. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out keep for your records

How to fill out keep for your records

01

To fill out keep for your records, follow the steps below:

02

Start by gathering all the necessary documents that you want to keep for your records. These can include receipts, invoices, contracts, bank statements, tax documents, and any other important paperwork.

03

Organize the documents into relevant categories or folders. You can use physical folders or create digital folders on your computer.

04

Label each document with a descriptive name or title. This will make it easier for you to locate specific documents when needed.

05

Create a system for storing the documents. This can be a filing cabinet for physical documents or a dedicated folder on your computer or cloud storage for digital documents.

06

Make sure to keep your records in a safe and secure place to prevent loss or damage. Consider using fireproof safes or encrypted digital storage for added security.

07

Regularly review and update your records to keep them accurate and up to date. This will ensure that you have the most recent information readily available.

08

Finally, consider creating backups of your records. You can make physical copies or use secure cloud services to store your documents in case of any unforeseen events.

Who needs keep for your records?

01

Anyone who wants to keep track of important documents and information can benefit from keeping records. This can include individuals, small business owners, freelancers, students, landlords, and professionals among others.

02

Keeping records is especially important for tax purposes, financial management, legal compliance, audit preparation, budgeting, and planning.

03

By keeping records, you can easily retrieve information when needed, monitor your financial activities, track expenses, provide evidence in case of disputes or audits, and make informed decisions.

04

Overall, keeping records helps to maintain organization, improve efficiency, and provide peace of mind knowing that important information is properly documented and easily accessible.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify keep for your records without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including keep for your records, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit keep for your records online?

The editing procedure is simple with pdfFiller. Open your keep for your records in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How can I edit keep for your records on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing keep for your records right away.

What is keep for your records?

Keep for your records is a document or form where important information is kept and stored for future reference.

Who is required to file keep for your records?

Any individual or organization that needs to keep track of important information and records is required to file keep for your records.

How to fill out keep for your records?

Keep for your records can be filled out by providing relevant information in the designated fields or sections of the document.

What is the purpose of keep for your records?

The purpose of keep for your records is to ensure that important information is easily accessible and organized for future use.

What information must be reported on keep for your records?

Information such as dates, names, descriptions, amounts, and any other relevant details must be reported on keep for your records.

Fill out your keep for your records online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Keep For Your Records is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.