Get the free Professional employer organization controlling corporation ...

Show details

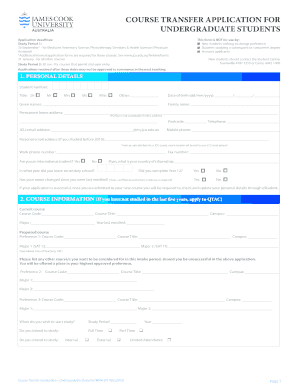

WWW.DLR.Texas.gov cs.PEO DLR.Texas.gov. This form must be completed by each corporation that owns a controlling ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your professional employer organization controlling form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your professional employer organization controlling form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit professional employer organization controlling online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit professional employer organization controlling. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out professional employer organization controlling

How to fill out professional employer organization controlling:

01

Familiarize yourself with the purpose and objectives of professional employer organization controlling. Understand the key components and processes involved.

02

Gather all relevant financial and operational data related to the professional employer organization. This may include financial statements, payroll data, employee demographics, and other relevant information.

03

Review and analyze the data to identify any discrepancies or areas of concern. Pay attention to key performance indicators and benchmarks to assess the organization's performance.

04

Evaluate the effectiveness of internal controls and risk management practices within the professional employer organization. Identify any weaknesses or areas that require improvement.

05

Develop a comprehensive controlling plan that outlines specific actions and strategies to enhance the organization's financial performance and minimize risks.

06

Implement the controlling plan by assigning responsibilities to specific individuals or departments within the organization. Set clear targets and deadlines to track progress.

07

Regularly monitor and track the organization's financial performance against the controlling plan. Review and analyze financial reports and other relevant data to assess the effectiveness of the controlling measures.

08

Make necessary adjustments and improvements to the controlling plan based on the feedback and insights gained from the monitoring process.

09

Communicate the results of the controlling process to relevant stakeholders, such as management, board members, and employees. Provide clear explanations and recommendations for further actions, if needed.

10

Continuously evaluate and update the controlling process to ensure its effectiveness in supporting the professional employer organization's goals and objectives.

Who needs professional employer organization controlling:

01

Small and medium-sized businesses (SMBs) that have engaged a professional employer organization (PEO) for human resource management and payroll administration.

02

Organizations that require assistance in managing employee benefits, risk management, and compliance with legal and regulatory requirements.

03

Companies looking to outsource non-core functions to a specialized service provider, such as payroll processing, employee onboarding, and tax administration.

04

Startups and growing businesses that need professional guidance and expertise in managing their workforce effectively.

05

Industries with complex payroll and HR requirements, such as healthcare, construction, and hospitality, where compliance with regulations is crucial.

Note: It is important to consult with a professional or seek expert advice specific to your organization's needs when filling out professional employer organization controlling.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is professional employer organization controlling?

Professional employer organization controlling involves managing certain employee-related responsibilities such as payroll, benefits, and workers' compensation on behalf of businesses.

Who is required to file professional employer organization controlling?

Professional employer organizations (PEOs) are required to file professional employer organization controlling.

How to fill out professional employer organization controlling?

Professional employer organization controlling can typically be filled out online or through specified forms provided by the relevant regulatory agencies.

What is the purpose of professional employer organization controlling?

The purpose of professional employer organization controlling is to ensure compliance with regulations and provide transparency in the management of employee-related responsibilities.

What information must be reported on professional employer organization controlling?

Information such as the PEO's financial statements, list of client companies, and details of services provided must be reported on professional employer organization controlling.

When is the deadline to file professional employer organization controlling in 2023?

The deadline to file professional employer organization controlling in 2023 is typically on or before March 31st.

What is the penalty for the late filing of professional employer organization controlling?

The penalty for late filing of professional employer organization controlling can vary, but typically includes fines and potential legal consequences.

How can I edit professional employer organization controlling from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your professional employer organization controlling into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit professional employer organization controlling in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your professional employer organization controlling, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I edit professional employer organization controlling on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit professional employer organization controlling.

Fill out your professional employer organization controlling online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.