Get the free Uniform Budgeting and Accounting Act - legislature mi

Show details

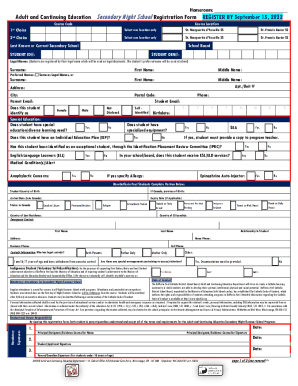

Act to provide for the formulation and establishment of uniform charts of accounts and reports in local units of government; to define local units of government; to provide for examination of books

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign uniform budgeting and accounting

Edit your uniform budgeting and accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uniform budgeting and accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit uniform budgeting and accounting online

Follow the steps down below to use a professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit uniform budgeting and accounting. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out uniform budgeting and accounting

How to fill out Uniform Budgeting and Accounting Act

01

Gather all financial records and data needed to prepare the budget.

02

Understand the guidelines set by the Uniform Budgeting and Accounting Act.

03

Create a budget proposal that details revenue sources and planned expenditures.

04

Ensure that all revenue estimates are based on realistic projections.

05

Allocate funds to various departments and programs according to priority and need.

06

Review the budget for compliance with state regulations and standards.

07

Submit the budget proposal for approval by the relevant governing body.

08

After approval, implement the budget and track expenditures against it.

09

Prepare periodic reports to assess budget performance and make adjustments as necessary.

Who needs Uniform Budgeting and Accounting Act?

01

Local governments and municipalities that are required to comply with state budgeting laws.

02

Public agencies and departments responsible for managing public funds.

03

Taxpayers who benefit from transparent and accountable financial management.

04

Financial auditors and accountants who need to ensure compliance with legal standards.

05

State governments that require standardized budgeting practices among local entities.

Fill

form

: Try Risk Free

People Also Ask about

What did the budget and Accounting Act do?

The Budget and Accounting Act of 1921 gave the President overall responsibility for budget planning by requiring him to submit an annual, comprehensive budget proposal to the Congress; that act also expanded the President's control over budgetary information by establishing the Bureau of the Budget (renamed the Office

What is the Budget and Accounting Act?

The Budget and Accounting Act of 1921 established a requirement for the President to submit a budget request for the upcoming fiscal year near the beginning of each calendar year.

What is the budget and Accounting Act of 1950?

This act provides a firm foundation for modernizing the Government's accounting along efficient lines to serve management purposes, safeguard the public funds, and inform the Congress and the taxpayers clearly of what happens to the funds provided for Government activities.

How did the Budget and Accounting Act of 1921 change the budget?

The Budget and Accounting Act of 1921 established a requirement for the President to submit a budget request for the upcoming fiscal year near the beginning of each calendar year.

What did the Budget and Accounting Act do?

In the 20th century, the Budget and Accounting Act of 1921 created a statutory role for the President by requiring agencies to submit their budget requests to him and, in turn, for him to submit a consolidated request to Congress.

What is the Accounting and Auditing Act of 1950?

The Budget and Accounting Act of 1921 established a requirement for the President to submit a budget request for the upcoming fiscal year near the beginning of each calendar year.

How did the Budget and Accounting Act of 1921 change the federal budget?

The Budget and Accounting Act of 1921 centralized many functions of the executive budget process within the institutional presidency. It established an explicit role for the President by requiring that he or she prepare and submit a comprehensive federal budget to Congress each year.

Why is the Budget and Accounting Act of 1921 important?

In the 20th century, the Budget and Accounting Act of 1921 created a statutory role for the President by requiring agencies to submit their budget requests to him and, in turn, for him to submit a consolidated request to Congress.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Uniform Budgeting and Accounting Act?

The Uniform Budgeting and Accounting Act is legislation that establishes standardized financial practices and procedures for governmental entities to ensure transparency, accountability, and consistency in budgeting and accounting.

Who is required to file Uniform Budgeting and Accounting Act?

Entities such as state and local governments, schools, and certain nonprofit organizations that are receiving public funds are required to file under the Uniform Budgeting and Accounting Act.

How to fill out Uniform Budgeting and Accounting Act?

To fill out the Uniform Budgeting and Accounting Act, entities must follow the prescribed forms and guidelines set forth by the governing authority, providing detailed information on budget estimates, revenues, expenditures, and a comparison of prior year data.

What is the purpose of Uniform Budgeting and Accounting Act?

The purpose of the Uniform Budgeting and Accounting Act is to promote effective financial management, foster public trust by ensuring accountability, and streamline reporting processes among governmental units.

What information must be reported on Uniform Budgeting and Accounting Act?

Information that must be reported includes budget estimates, actual revenues and expenditures, comparative financial statements, and any significant amendments or changes to the budget during the fiscal year.

Fill out your uniform budgeting and accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Uniform Budgeting And Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.