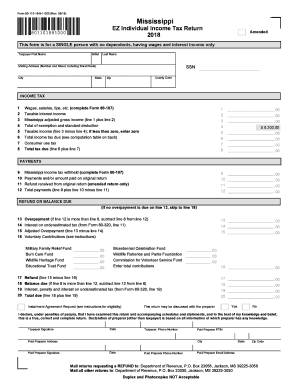

MS DoR Form 80-110 2014 free printable template

Get, Create, Make and Sign MS DoR Form 80-110

Editing MS DoR Form 80-110 online

Uncompromising security for your PDF editing and eSignature needs

MS DoR Form 80-110 Form Versions

How to fill out MS DoR Form 80-110

How to fill out MS DoR Form 80-110

Who needs MS DoR Form 80-110?

Instructions and Help about MS DoR Form 80-110

Hi IN#39’m mark for you tax calm the state of Mississippi has three rates at which it taxes income for single taxpayers the first five thousand dollars of income is taxable at 3% from $5,001 to ten thousand dollars four percent and above ten thousand one dollar five percent married couples who file a joint return have the option of determining their tax liabilities separately and then adding the results the state of Mississippi does not tax Social Security benefits your retirement income may be exempt from state taxes if you receive an early distribution from any of these plans ITIS not considered retirement income Andes subject to taxation if you earn income on interest from obligations of Mississippi or any of its political subdivisions you are exempt from state taxes on that income if any of the following are true you should file Mississippi state tax return mississippiwithheld income taxes from your wagesyou'’ve been taxed by Mississippi and area non-resident or part-year resident you were employed in a foreign country on temporary or transition basis and area resident of Mississippi than you are subject to state tax you are resident Mississippi working out of state then you must file a resident return and report your total gross income regardless of source you are single and have a gross income above eighty-three hundred dollars plus $1,500 per dependent you are married, and you have combined income of more than sixteen thousand dollars plus fifteen hundred dollars per dependent with your spouse for more information visit attacksdot-com

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute MS DoR Form 80-110 online?

Can I create an electronic signature for the MS DoR Form 80-110 in Chrome?

How do I complete MS DoR Form 80-110 on an iOS device?

What is MS DoR Form 80-110?

Who is required to file MS DoR Form 80-110?

How to fill out MS DoR Form 80-110?

What is the purpose of MS DoR Form 80-110?

What information must be reported on MS DoR Form 80-110?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.