Get the free These requirements are applicable to Amicus Attorney Premium Edition 2014 SP1 with o...

Show details

Hardware & Software Requirements These requirements are applicable to Amicus Attorney Premium Edition 2014 SP1 with or without Amicus Premium Billing. Amicus Application ServerWorkstation with Offline

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your formse requirements are applicable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your formse requirements are applicable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing formse requirements are applicable online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit formse requirements are applicable. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

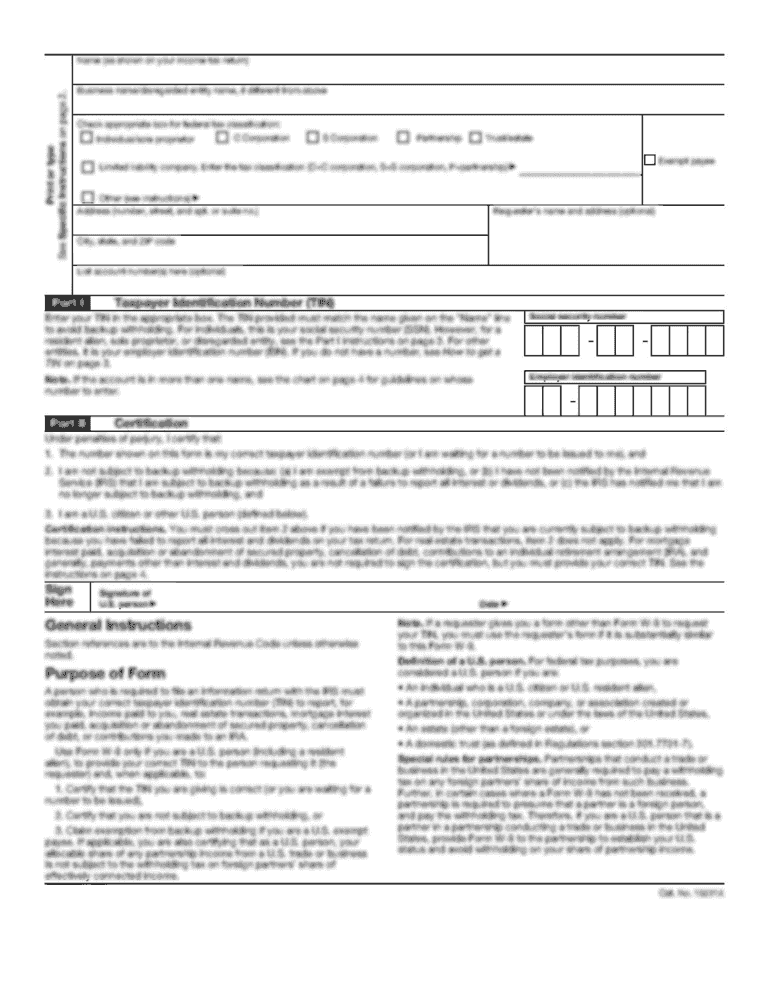

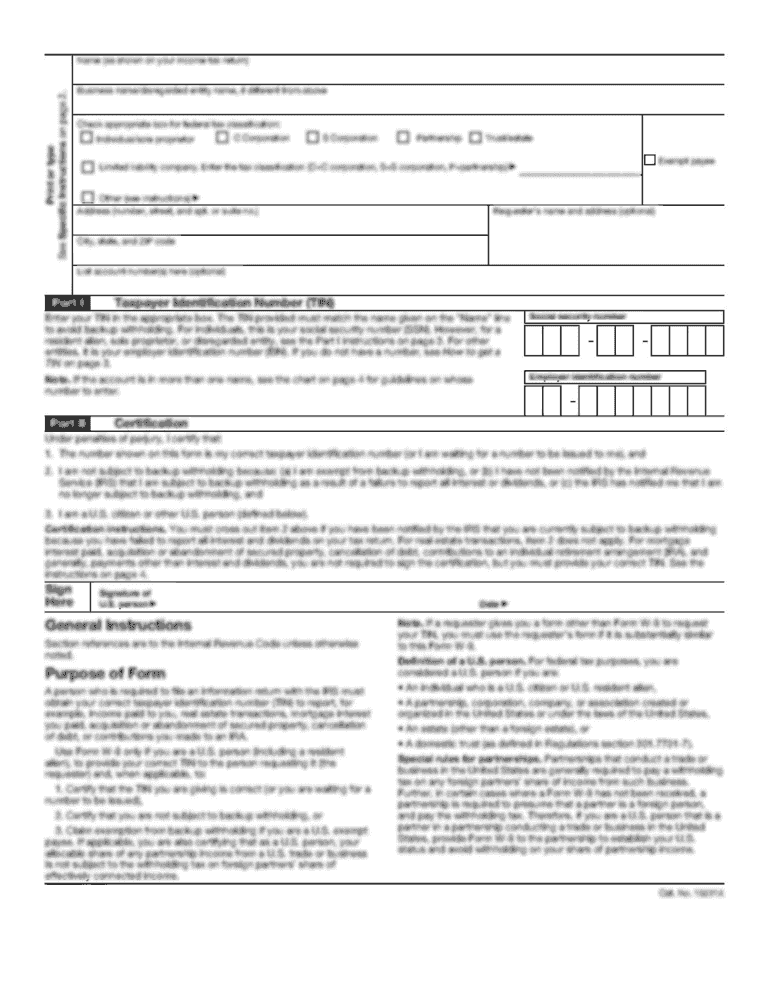

How to fill out formse requirements are applicable

How to fill out formse requirements are applicable:

01

Start by carefully reading the instructions provided with the formse. Make sure you understand the purpose of the formse and the specific requirements that need to be fulfilled.

02

Gather all the necessary information and documents that are required to complete the formse. This may include personal identification, financial records, or any other supporting documentation that is requested.

03

Fill out the formse accurately and clearly. Pay attention to details such as spelling, dates, and numbers to ensure accuracy. Use black or blue ink and write legibly to avoid any confusion.

04

Follow any specific formatting or layout instructions provided with the formse. This may include organizing information in a specific order, using specific sections or headings, or complying with any specific formatting guidelines.

05

Double-check your answers before submitting the formse. Review all the information you have provided to ensure its accuracy and completeness. Make sure you have answered all applicable questions and provided all required information.

Who needs formse requirements are applicable:

01

Individuals who are required to fill out the specific formse. This could include individuals applying for licenses, permits, or certifications, individuals filing for certain benefits or assistance programs, or individuals involved in legal proceedings.

02

Institutions or organizations that require individuals to complete the formse. This could include government agencies, educational institutions, healthcare providers, or employers.

03

Any party involved in a transaction or process that requires the completion of the formse. This could include buyers, sellers, landlords, tenants, contractors, or employees.

Overall, anyone who needs to provide specific information or fulfill certain requirements in a standardized manner may need to fill out formse requirements that are applicable to their situation. It is important to carefully follow the instructions and accurately complete the formse to ensure proper processing and evaluation of the information provided.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is formse requirements are applicable?

Form SE requirements are applicable to self-employed individuals who have a net earnings of $400 or more in a year, or who meet other specific criteria set by the IRS.

Who is required to file formse requirements are applicable?

Self-employed individuals who meet the income threshold set by the IRS are required to file form SE requirements.

How to fill out formse requirements are applicable?

Form SE can be filled out online through the IRS website or by mail. It requires information about the individual's income, deductions, and self-employment tax.

What is the purpose of formse requirements are applicable?

The purpose of form SE is to calculate and report the self-employment tax that self-employed individuals owe to the IRS.

What information must be reported on formse requirements are applicable?

Form SE requires information about the individual's net earnings from self-employment, deductions related to self-employment income, and the calculated self-employment tax.

When is the deadline to file formse requirements are applicable in 2023?

The deadline to file form SE requirements for the tax year 2023 is April 15, 2024.

What is the penalty for the late filing of formse requirements are applicable?

The penalty for late filing of form SE requirements is 5% of the unpaid tax amount for each month the return is late, up to a maximum of 25%.

How do I modify my formse requirements are applicable in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your formse requirements are applicable as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I edit formse requirements are applicable on an iOS device?

You certainly can. You can quickly edit, distribute, and sign formse requirements are applicable on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete formse requirements are applicable on an Android device?

Use the pdfFiller mobile app to complete your formse requirements are applicable on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your formse requirements are applicable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.