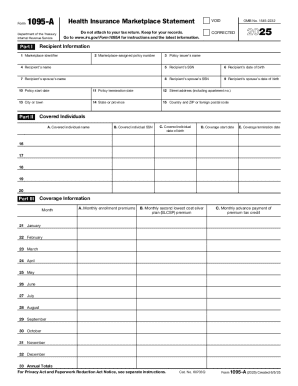

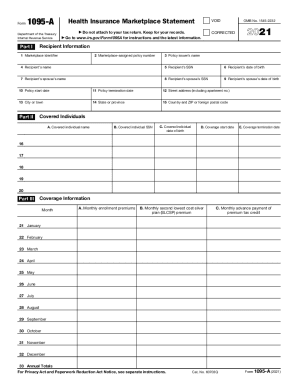

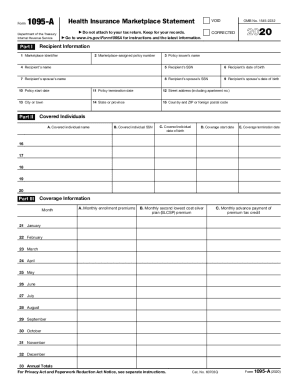

IRS 1095-A 2022 free printable template

Instructions and Help about IRS 1095-A

How to edit IRS 1095-A

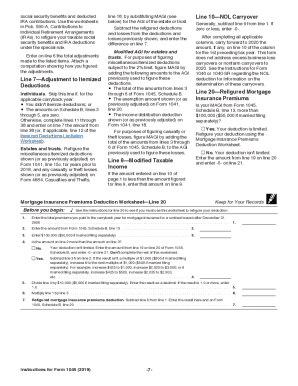

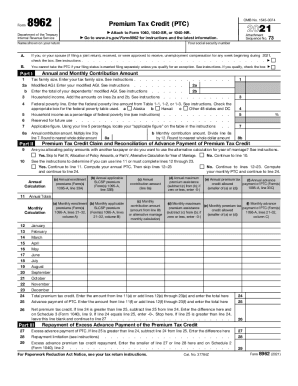

How to fill out IRS 1095-A

About IRS 1095-A 2022 previous version

What is IRS 1095-A?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1095-A

What should I do if I need to correct my IRS 1095-A after filing?

If you find an error on your IRS 1095-A after submission, you can submit a corrected return. It typically involves filling out a new 1095-A form with the correct information and marking it as corrected. Be sure to notify the IRS and provide any necessary documentation to support the changes.

How can I verify the status of my IRS 1095-A filing?

To verify the status of your IRS 1095-A, you can use the IRS's online tools or contact their support. They may provide updates on whether your form has been processed. Common e-file rejection codes may also assist in understanding any issues with your submission.

What are common errors to avoid with IRS 1095-A?

Common errors when filing IRS 1095-A include mismatched information, incorrect identification numbers, and failure to report all relevant healthcare coverage details. Double-check all entries for accuracy to avoid rejected filings or delays in processing.

What should I do if I receive a notice regarding my IRS 1095-A?

If you receive a notice about your IRS 1095-A, read it carefully to understand the issue or request. Depending on the content, you may need to provide additional documentation or respond within the specified timeframe to avoid penalties and ensure compliance.

See what our users say