Get the free Full Credit - raic

Show details

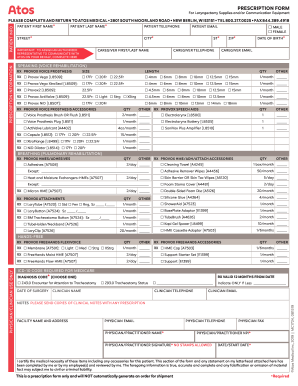

2012 National Urban Design Awards Participant Identification Form Category (Check only one box for each project) $ Urban Design Plans Urban Architecture Civic Design Projects Urban Fragments Community

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign full credit - raic

Edit your full credit - raic form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your full credit - raic form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing full credit - raic online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit full credit - raic. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out full credit - raic

How to fill out full credit - raic?

01

Gather all necessary information and documents required for filling out the full credit - raic form.

02

Start by filling out personal information such as your name, address, contact details, and social security number.

03

Provide details about your employment history, including your current job position, employer's name, duration of employment, and salary information.

04

Mention any other sources of income or assets that can be considered for the credit.

05

Fill out information related to your debts and liabilities, including outstanding loans, mortgages, credit card balances, and any other financial obligations.

06

Provide details about your rent or housing expenses, including the landlord's name and contact information.

07

Include information about any previous bankruptcy or foreclosure, if applicable.

08

Review the form thoroughly to ensure all information is accurate and complete.

09

Sign and date the form before submitting it to the appropriate authority.

Who needs full credit - raic?

01

Individuals who are seeking financial assistance or credit from a lending institution may need to fill out the full credit - raic form.

02

Anyone who wants to apply for a loan, mortgage, or credit card may be required to provide a comprehensive credit report, which can be obtained by filling out the full credit - raic form.

03

Individuals who want to monitor their creditworthiness or check for any errors or discrepancies in their credit report can also benefit from filling out the full credit - raic form.

04

Financial institutions, such as banks or credit unions, may use the information provided in the full credit - raic form to assess an applicant's creditworthiness and determine the terms and conditions of the credit being offered.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify full credit - raic without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your full credit - raic into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send full credit - raic to be eSigned by others?

When you're ready to share your full credit - raic, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I get full credit - raic?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific full credit - raic and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

What is full credit - raic?

Full Credit - RAIC stands for Full Credit Risk Assessment and Internal Capital Adequacy Assessment Process. It is a regulatory requirement for financial institutions to assess and manage credit risk.

Who is required to file full credit - raic?

Financial institutions such as banks, credit unions, and other regulated entities are required to file Full Credit - RAIC.

How to fill out full credit - raic?

Financial institutions must conduct a thorough assessment of credit risk using standardized methods and report the findings to regulatory authorities.

What is the purpose of full credit - raic?

The purpose of Full Credit - RAIC is to ensure that financial institutions have adequate capital reserves to cover potential credit losses.

What information must be reported on full credit - raic?

Information such as portfolio composition, risk exposures, and capital adequacy ratios must be reported on Full Credit - RAIC.

Fill out your full credit - raic online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Full Credit - Raic is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.