Get the free Form 990-PF Return of Private Foundation Treated as a Private ...

Show details

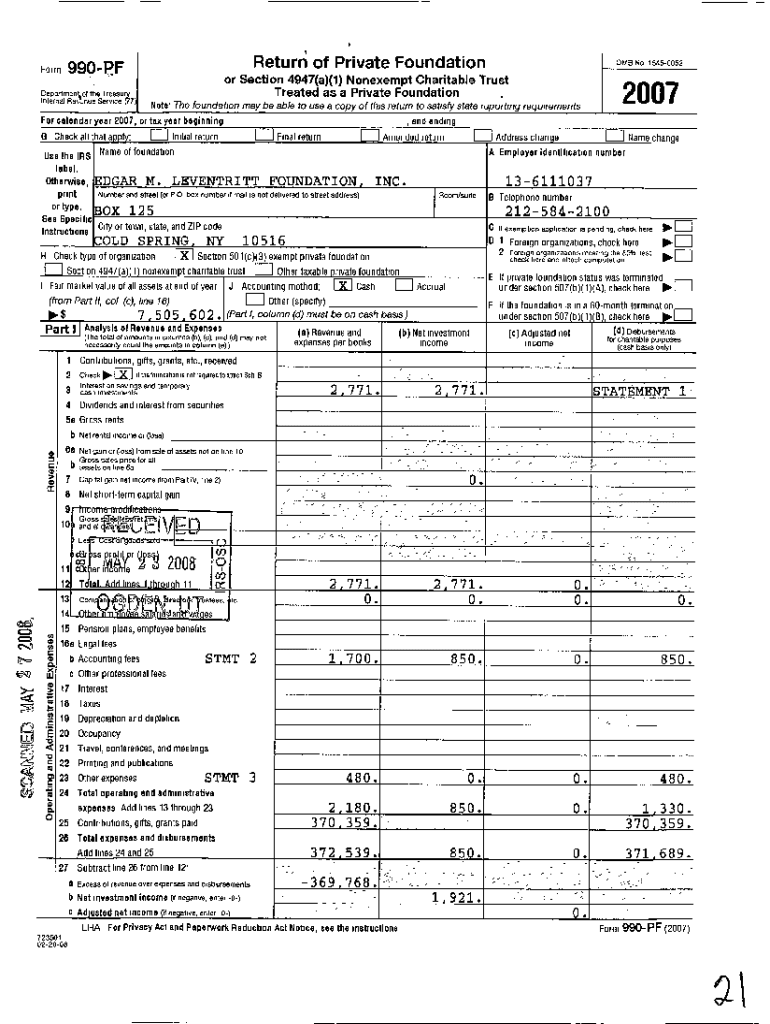

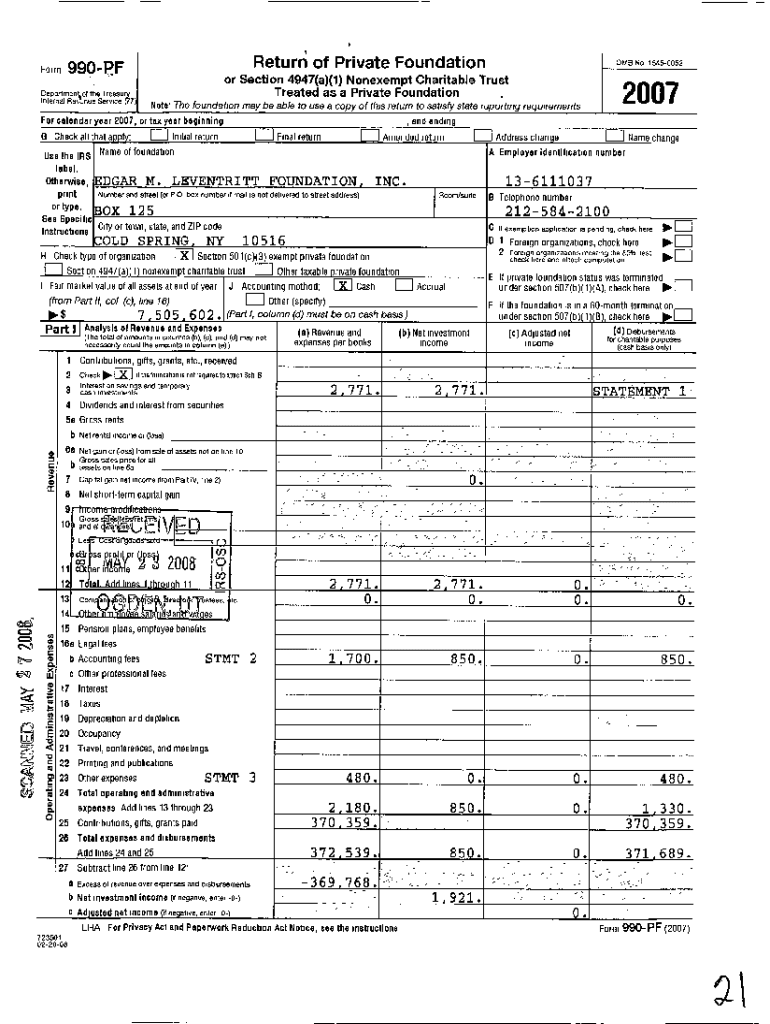

Return of Private Foundation990PTFormor Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private FoundationDepartment^of the Treasury Internal Revenue Service (770 Check all that wooly :and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 990-pf return of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 990-pf return of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 990-pf return of online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 990-pf return of. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

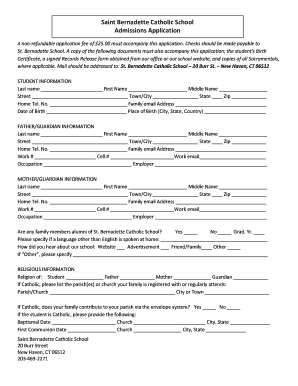

How to fill out form 990-pf return of

How to fill out form 990-pf return of

01

Gather all necessary information and documents such as financial records, grant information, and list of board members.

02

Complete the form by providing all required information including foundation details, financial information, and grant-making activities.

03

Review the completed form for accuracy and consistency.

04

Submit the form to the IRS by the deadline, which is usually the 15th day of the 5th month after the close of the fiscal year.

Who needs form 990-pf return of?

01

Private foundations organized and operated exclusively for charitable, educational, religious, scientific, literary, testing for public safety, fostering national or international amateur sports competition, or prevention of cruelty to children or animals purposes.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form 990-pf return of?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your form 990-pf return of to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I make edits in form 990-pf return of without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing form 990-pf return of and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an eSignature for the form 990-pf return of in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your form 990-pf return of and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your form 990-pf return of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.