Get the free Form W-10 - IRS.gov - bcbsal

Show details

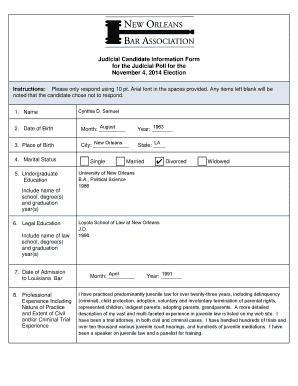

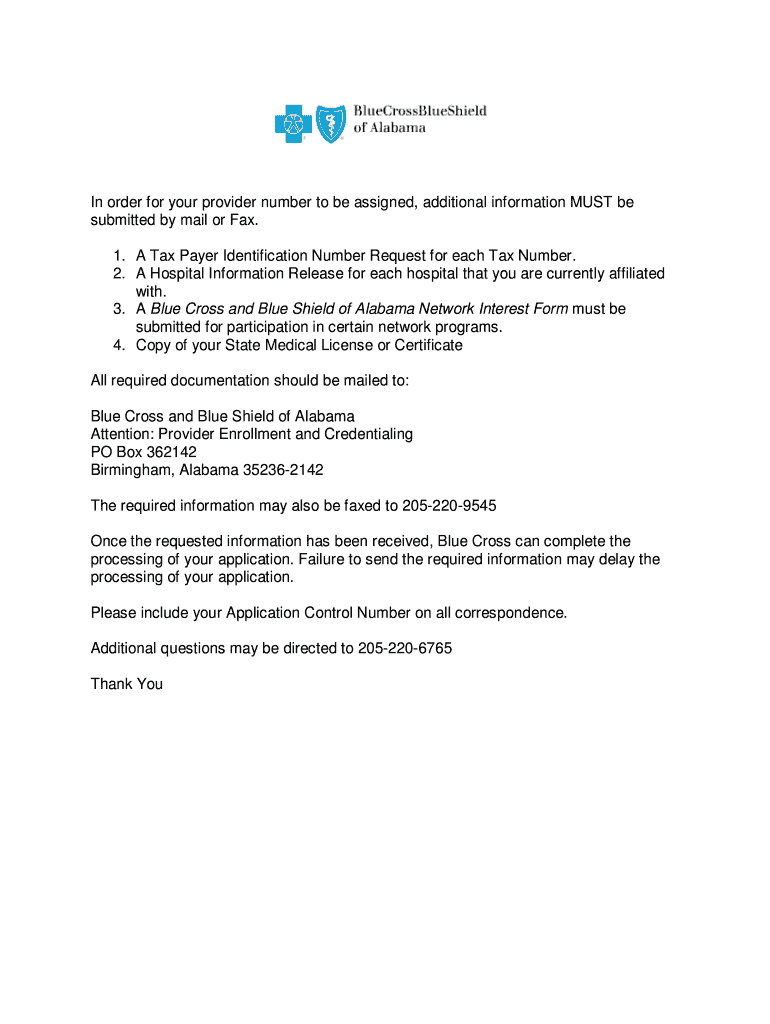

A Blue Cross and Blue Shield of Alabama Network Interest Form must be submitted for ... 07/2010). Part 1: Tax Status. Name as it appears on Internal. Revenue Service (IRS) Records (Required) ... If

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form w-10 - irsgov form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form w-10 - irsgov form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form w-10 - irsgov online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form w-10 - irsgov. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

How to fill out form w-10 - irsgov

Instructions on how to fill out form W-10 - IRSgov:

01

Start by accessing the official IRS website at irs.gov.

02

Navigate to the "Forms & Instructions" section.

03

Locate form W-10 in the alphabetical list and click on it to open the form.

04

Review the instructions provided on the form to understand its purpose and eligibility requirements.

05

Begin by entering your personal information in the designated sections of the form, such as your name, address, and social security number.

06

If applicable, provide the information of your spouse or dependent(s) according to the instructions.

07

Next, fill in the details of the individual or entity requesting your taxpayer identification number (TIN). Include their name, address, and relationship to you.

08

If you are providing a TIN for a trust or estate, ensure you correctly complete all the required information specific to this type of entity.

09

Sign and date the form in the designated area, certifying that the information provided is true and accurate to the best of your knowledge.

10

If required, attach any supporting documents or additional statements as specified in the instructions.

Who needs form W-10 - IRSgov:

01

Individuals who are requested to provide their taxpayer identification number (TIN) to an individual or entity.

02

Respective individuals or entities who need to collect a TIN from another party for proper tax reporting.

03

The form may be required for different purposes, such as obtaining a TIN for reporting income, claiming tax treaty benefits, or complying with certain federal regulations. It is essential to review the specific instructions and circumstances to determine the necessity of form W-10.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form w-10 - irsgov?

The form W-10, also known as the Dependent Care Provider's Identification and Certification, is a document used by individuals who provide dependent care services to request the taxpayer identification number (TIN) of the person or organization for whom they provide care. This form is used by both the caretaker and the person/entity receiving the care.

Who is required to file form w-10 - irsgov?

Individuals who provide dependent care services are required to file form W-10 - irsgov if they need to request the taxpayer identification number (TIN) of the person or organization they are providing care for. This form is used to certify that the dependent care provider is eligible to claim certain tax benefits related to the care provided.

How to fill out form w-10 - irsgov?

To fill out form W-10 - irsgov, the dependent care provider must provide their personal information such as name, address, and social security number (SSN). They must also provide the name, address, contact information, and taxpayer identification number (TIN) of the person or organization they provide care for. The form must be signed and certified by both the dependent care provider and the care recipient.

What is the purpose of form w-10 - irsgov?

The purpose of form W-10 - irsgov is to allow individuals who provide dependent care services to request the taxpayer identification number (TIN) of the person or organization they are providing care for. This form is used to establish eligibility for certain tax benefits related to dependent care expenses, such as the Child and Dependent Care Credit.

What information must be reported on form w-10 - irsgov?

On form W-10 - irsgov, the dependent care provider must report their personal information such as name, address, and social security number (SSN). They must also report the name, address, contact information, and taxpayer identification number (TIN) of the person or organization they provide care for. Additionally, the form requires the dependent care provider and care recipient to certify the accuracy of the information provided.

When is the deadline to file form w-10 - irsgov in 2023?

The deadline to file form W-10 - irsgov in 2023 is usually April 15th, which is the same as the deadline for filing individual income tax returns. However, it is important to note that tax deadlines may vary from year to year, so it is best to consult the official IRS website or a tax professional for the most up-to-date information.

How do I make changes in form w-10 - irsgov?

The editing procedure is simple with pdfFiller. Open your form w-10 - irsgov in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I sign the form w-10 - irsgov electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your form w-10 - irsgov and you'll be done in minutes.

How do I edit form w-10 - irsgov on an Android device?

You can make any changes to PDF files, such as form w-10 - irsgov, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your form w-10 - irsgov online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.