Get the free US Office 6120 Decena Drive #112, San Diego,CA92120, United States

Show details

The Ken crest Corp. JP Office 1803-5 One, Semi City, Gift Pref, Japan ZIP 501-3265 US Office 6120 Decent Drive #112, San Diego,CA92120, United States Order Form Order List 1 6 2 7 3 8 4 9 5 10 Flat

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your us office 6120 decena form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us office 6120 decena form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing us office 6120 decena online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit us office 6120 decena. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

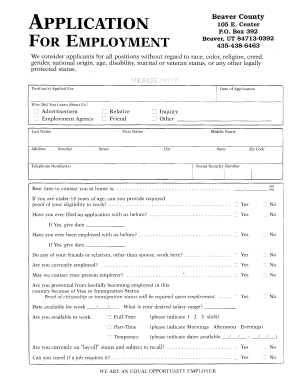

How to fill out us office 6120 decena

How to fill out US Office 6120 Decena:

01

Start by gathering all the necessary information and documents required to complete the form.

02

Carefully read the instructions provided with the form to ensure you understand the requirements and any specific details you need to provide.

03

Begin by filling out the personal information section, including your name, address, and contact details. Double-check for accuracy and make sure to write legibly.

04

Move on to the section that requires you to provide details about your employment, such as your job title, company name, and address. If applicable, include any additional information requested, such as previous employment history.

05

If the form requires you to state your income or financial information, make sure to accurately provide the requested details. Be prepared to attach additional supporting documents if necessary.

06

Continue to fill out any remaining sections of the form, such as those related to your eligibility or requests for any specific permissions or authorizations.

07

Carefully review your completed form for any errors or omissions. Make any necessary corrections before proceeding.

08

Once you are confident that the form is correctly filled out, sign and date it as required.

09

Make copies or take pictures of the completed form for your records before submitting it.

10

Submit the filled-out form to the designated recipient, following any additional instructions provided.

Who needs US Office 6120 Decena?

01

US citizens who are employed and need to provide specific employment-related information to relevant authorities.

02

Individuals applying for certain licenses or permits that require disclosure of employment details.

03

Employers or human resources personnel responsible for collecting and submitting employee information to government agencies or other entities.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

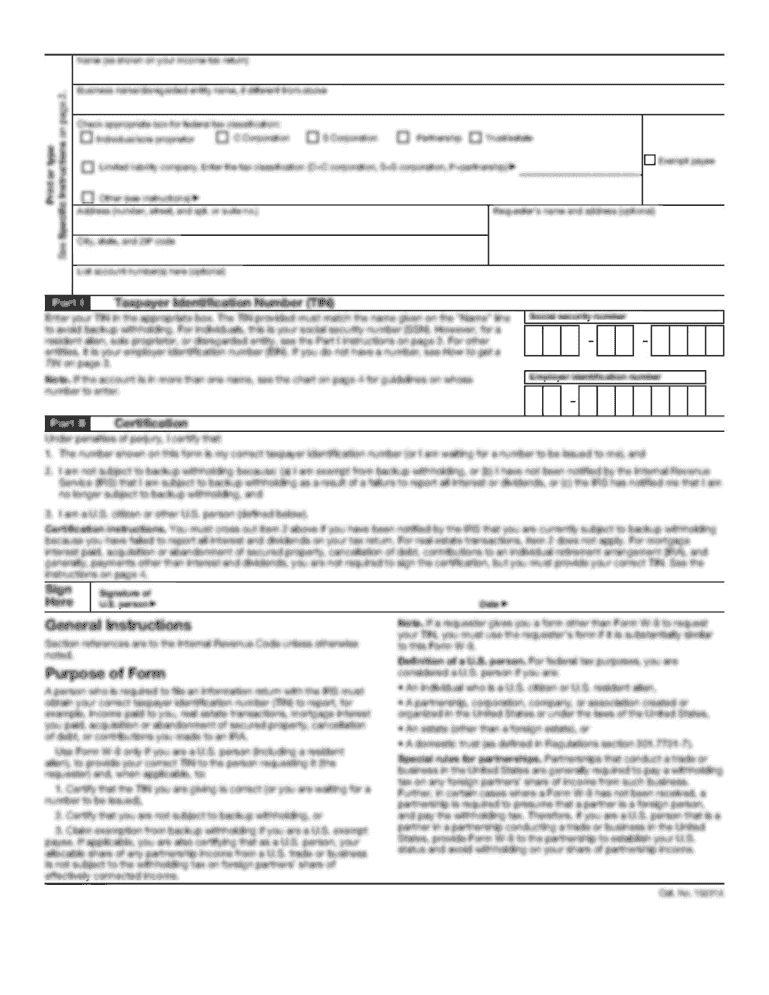

What is us office 6120 decena?

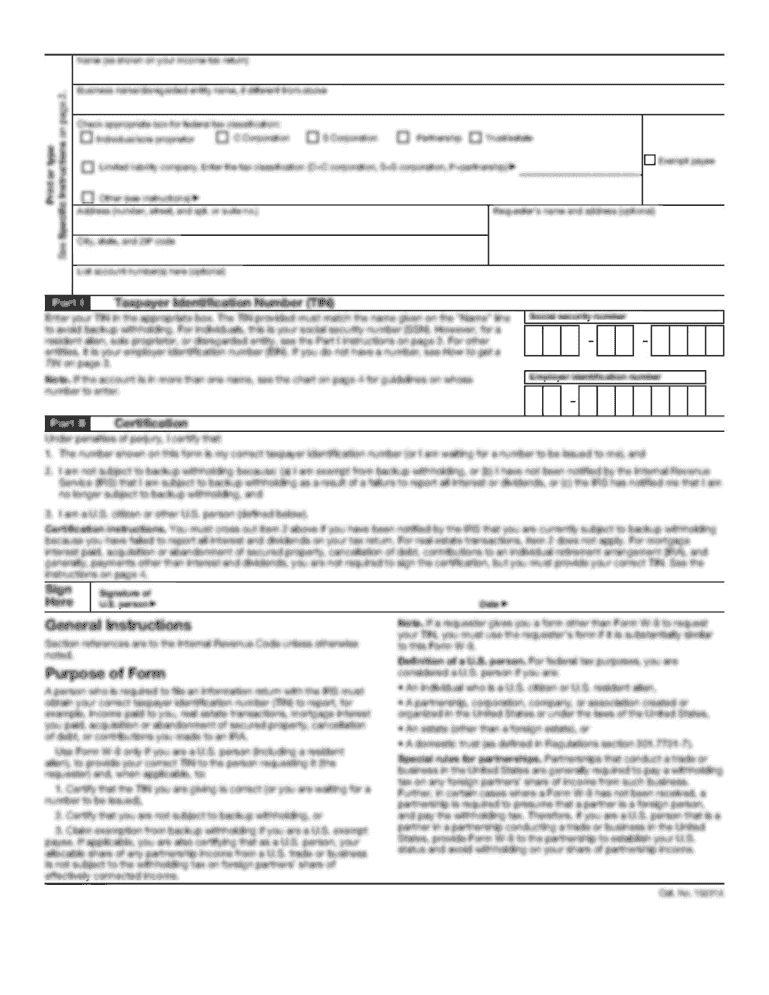

US Office 6120 Decena is a form required by the Internal Revenue Service (IRS) for reporting foreign financial accounts.

Who is required to file us office 6120 decena?

US persons who have a financial interest in or signature authority over foreign financial accounts exceeding certain thresholds are required to file US Office 6120 Decena.

How to fill out us office 6120 decena?

US Office 6120 Decena can be filled out online or by mail. It requires information about the foreign financial accounts, including the maximum value during the year.

What is the purpose of us office 6120 decena?

The purpose of US Office 6120 Decena is to report foreign financial accounts to the IRS to help prevent tax evasion.

What information must be reported on us office 6120 decena?

Information about the foreign financial accounts must be reported, including the account number, financial institution, and maximum value during the year.

When is the deadline to file us office 6120 decena in 2023?

The deadline to file US Office 6120 Decena in 2023 is April 15th.

What is the penalty for the late filing of us office 6120 decena?

The penalty for the late filing of US Office 6120 Decena can be up to $10,000 per violation.

How do I make edits in us office 6120 decena without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit us office 6120 decena and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit us office 6120 decena on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign us office 6120 decena. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How can I fill out us office 6120 decena on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your us office 6120 decena. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your us office 6120 decena online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.