Get the free Understanding Property Taxes - Idaho State Tax Commission

Show details

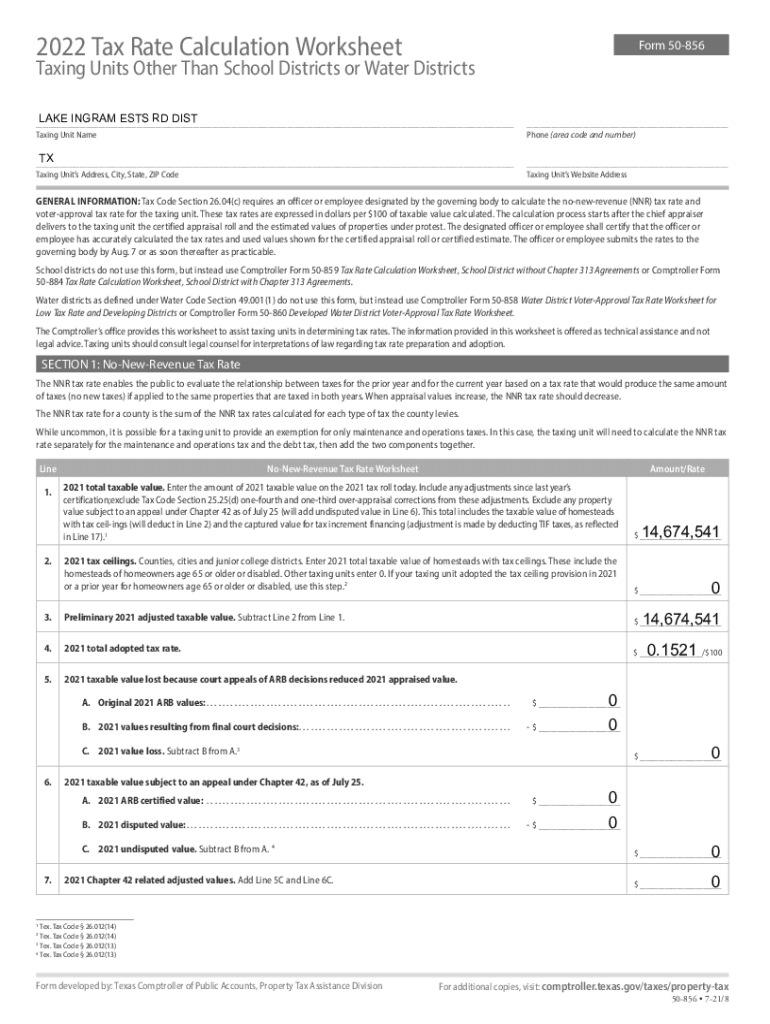

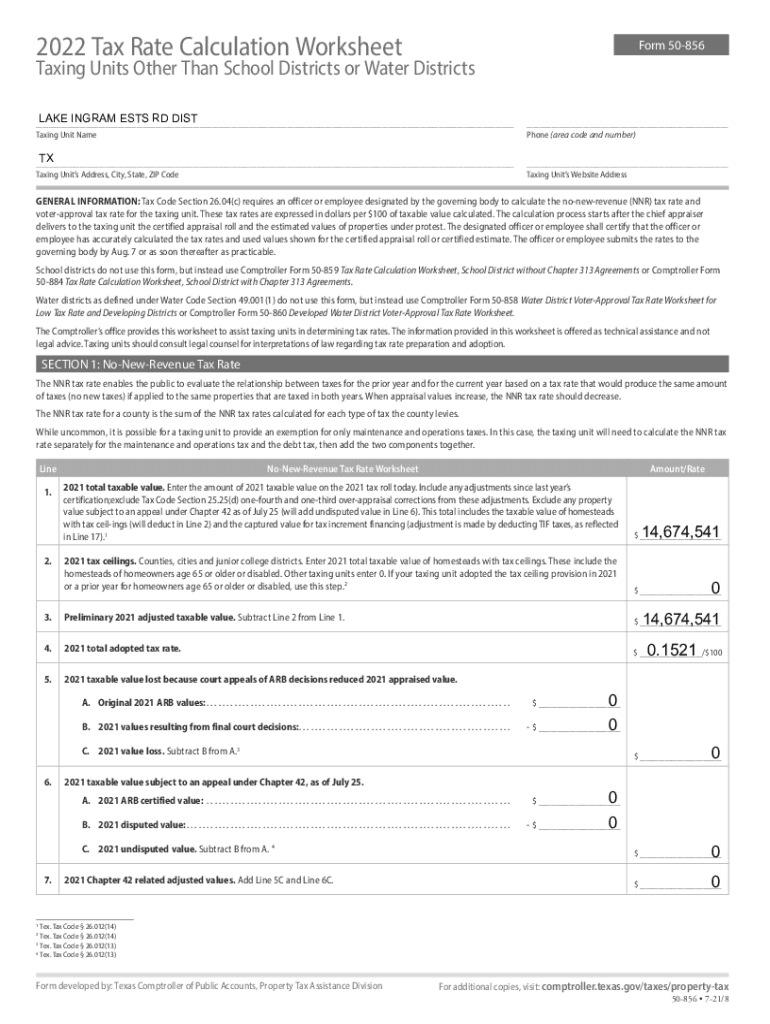

2022 Tax Rate Calculation WorksheetForm 50856Taxing Units Other Than School Districts or Water Districts LAKE INGRAM TESTS RD DIST ___ ___ Taxing Unit Telephone (area code and number)TX ___ ___ Taxing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your understanding property taxes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding property taxes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit understanding property taxes online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit understanding property taxes. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out understanding property taxes

How to fill out understanding property taxes

01

Start by determining the assessment value of your property.

02

Understand the millage rate in your area.

03

Calculate your property taxes by multiplying the assessment value by the millage rate.

04

Consider any exemptions or credits that may apply to reduce your property tax liability.

05

Make sure to pay your property taxes on time to avoid any penalties or interest.

Who needs understanding property taxes?

01

Homeowners

02

Property owners

03

Real estate investors

04

Anyone looking to buy or sell property

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send understanding property taxes for eSignature?

Once your understanding property taxes is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I get understanding property taxes?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific understanding property taxes and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out the understanding property taxes form on my smartphone?

Use the pdfFiller mobile app to fill out and sign understanding property taxes on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your understanding property taxes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.