. More Address 2: ... more Address 3: ... more.

Zip/Postal Code: Zip: ... more

Phone:

Address

City:

State: (Zip)

Zip Code:

Address Line 2:

City:

State: (Zip)

Zip Code: 0755

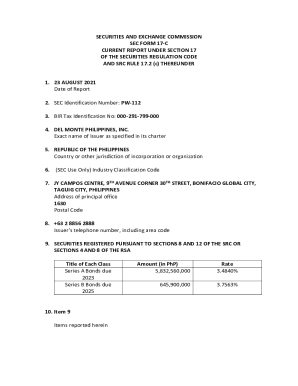

What is our Business Tax Status?

What is the tax treatment of your investment?

What are our operating expenses?

How much capital do we have?

If you're not sure whether you have a partnership and would like to know, please contact us.

We are a federally chartered corporation, but are treated like a sole proprietorship when conducting any business activities. We file regular federal tax returns under the federal tax code, however we also file quarterly business tax returns for each period that begins July 1 of the fiscal year and ends July 31 of the following year under the U.S. Internal Revenue Code. There are no fees or penalties for filing these annual returns. Our business tax returns are not tax returns in any state that report to the state. For example, a partnership will need to file a separate state return when entering into a contract or partnership agreement with a state on the same grounds as it would need to file a tax return. When a partnership enters into a contract with a state such as selling real or corporate properties, the partnership will file a federal tax return when the contract is completed. We file all federal tax returns as required under the federal tax code, while also filing other federal and state returns. To find out how to file a federal tax return on the Form 1040 on our website, click here. ... more

Please keep in mind every partnership must have at least one member that is an independent contractor. We also must have at least one member that is an independent contractor.

You are not allowed to use this site as a vehicle to solicit business.

Get the free Nonresidents Only All Partners 0 9 - NC Department of Revenue

Show details

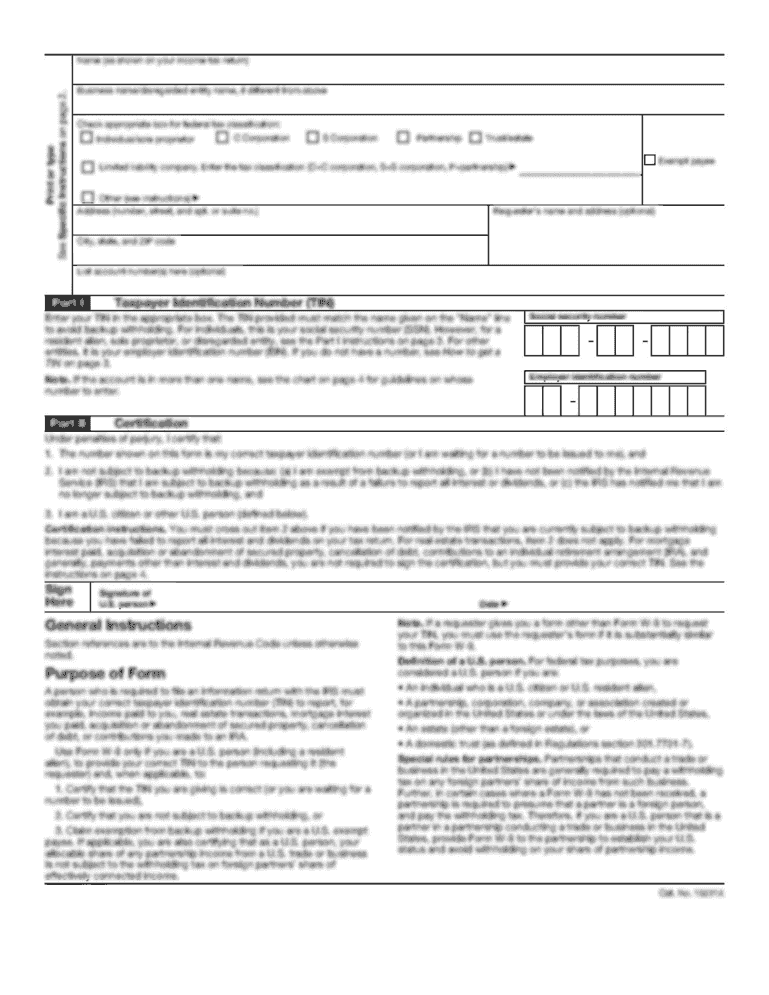

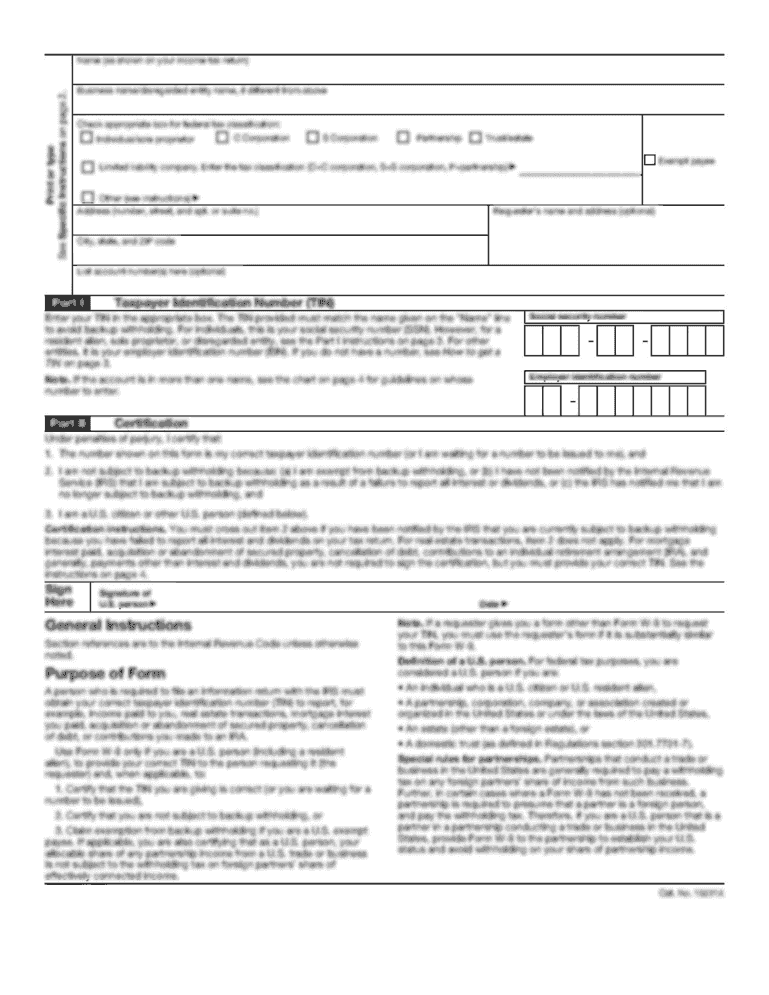

Federal Employer ID Number. Partnership×39’s Name, Address, and Zip Code. For calendar year 2009, or fiscal year beginning and ending (MM-DD-YY). (MM-DD) ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your nonresidents only all partners form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nonresidents only all partners form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nonresidents only all partners online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit nonresidents only all partners. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is nonresidents only all partners?

Nonresidents only all partners refers to a type of filing requirement for partnerships where all partners are nonresidents for tax purposes. In this case, the partnership is not required to file a tax return, and each partner reports their share of partnership income and expenses on their individual tax return.

Who is required to file nonresidents only all partners?

Partnerships that consist entirely of nonresident partners are required to file as nonresidents only all partners. If there is even one partner who is a resident for tax purposes, the partnership would not qualify for this filing status.

How to fill out nonresidents only all partners?

To fill out the nonresidents only all partners filing, each partner must report their share of partnership income and expenses on their individual tax return. They should consult the tax laws and regulations of their jurisdiction to ensure accurate reporting.

What is the purpose of nonresidents only all partners?

The purpose of nonresidents only all partners filing is to simplify the tax reporting process for partnerships with nonresident partners. By allowing each partner to report their share of income and expenses on their individual tax return, it reduces the administrative burden on the partnership.

What information must be reported on nonresidents only all partners?

Each partner must report their share of partnership income, expenses, deductions, and any other relevant tax information on their individual tax return. They should refer to the partnership's tax documents, such as Schedule K-1, for the specific details.

When is the deadline to file nonresidents only all partners in 2023?

The deadline to file nonresidents only all partners in 2023 may vary depending on the tax jurisdiction. Partners should consult their local tax authority or a tax professional to determine the exact deadline for their specific situation.

What is the penalty for the late filing of nonresidents only all partners?

The penalty for the late filing of nonresidents only all partners can also vary depending on the tax jurisdiction. It is advisable to check the local tax laws and regulations or consult a tax professional to understand the specific penalties and consequences for late filing.

How can I edit nonresidents only all partners from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including nonresidents only all partners, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make edits in nonresidents only all partners without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit nonresidents only all partners and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I sign the nonresidents only all partners electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your nonresidents only all partners in minutes.

Fill out your nonresidents only all partners online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.