Get the free FORM 990EZ - Washington State PTA - wastatepta

Show details

C. Name, address -- Insert the legal corporate name of the PTA and use the following address: 2003 ... However, if your PTA has amended the name of your corporation, follow the .... PTA to file IRS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 990ez - washington form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 990ez - washington form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 990ez - washington online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 990ez - washington. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out form 990ez - washington

How to fill out form 990ez - Washington?

01

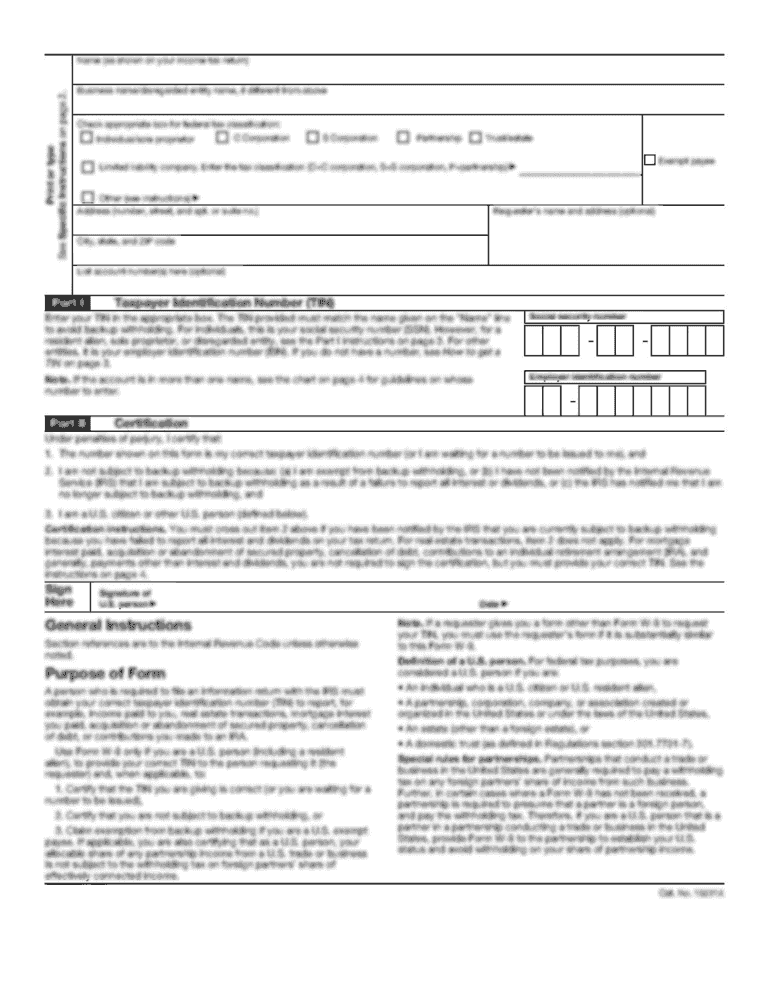

Enter the organization's name, address, and EIN (Employer Identification Number).

02

Provide a brief description of the organization's mission and activities.

03

Report any changes in the organization's address or name.

04

Provide information about the organization's officers, directors, and key employees.

05

Answer questions about the organization's governance, including whether or not it has a written conflict of interest policy.

06

Report the organization's total revenue, expenses, and net assets for the year.

07

Provide details on any significant changes in the organization's finances compared to the previous year.

08

Indicate whether the organization engaged in political campaign activities.

09

Answer questions about the organization's compliance with various tax regulations.

10

Sign and date the form to certify its accuracy.

Who needs form 990ez - Washington?

01

Tax-exempt organizations with annual gross receipts less than $50,000 can file Form 990EZ in Washington.

02

Organizations that qualify for tax-exempt status under section 501(c)(3) or other eligible sections of the Internal Revenue Code.

03

Organizations that want to maintain their tax-exempt status and fulfill their reporting requirements.

04

Organizations that want to provide transparency to the public about their finances, activities, and governance.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 990ez - washington?

Form 990EZ-Washington is a tax form used by tax-exempt organizations in the state of Washington to provide financial information to the Internal Revenue Service (IRS). It is specifically designed for organizations with gross receipts less than $200,000 and total assets less than $500,000.

Who is required to file form 990ez - washington?

Nonprofit organizations in Washington that have tax-exempt status under section 501(c)(3) of the Internal Revenue Code and meet the specific criteria mentioned in the previous answer are required to file form 990EZ - Washington.

How to fill out form 990ez - washington?

To fill out form 990EZ-Washington, organizations need to provide detailed financial information, including income, expenses, assets, and liabilities. They must also answer specific questions related to their activities and governance. The completed form should be submitted to the IRS along with any required schedules or attachments.

What is the purpose of form 990ez - washington?

The purpose of form 990EZ-Washington is to provide transparency and accountability for tax-exempt organizations in Washington. By requiring organizations to report financial information and other relevant details, the form helps the IRS and the public evaluate the organization's operations, governance, and compliance with tax laws.

What information must be reported on form 990ez - washington?

Form 990EZ-Washington requires organizations to report their financial information, including revenue, expenses, assets, liabilities, and net assets. They must also disclose information about their activities, governance, and key employees. Additionally, organizations may be required to attach certain schedules, such as Schedule A for public charities.

When is the deadline to file form 990ez - washington in 2023?

The deadline to file form 990EZ-Washington in 2023 is the 15th day of the 5th month following the end of the organization's fiscal year. For example, if the fiscal year ends on December 31, 2022, the deadline to file would be May 15, 2023.

What is the penalty for the late filing of form 990ez - washington?

The penalty for the late filing of form 990EZ-Washington is generally $20 per day for each day the return is late, up to a maximum of $10,000 or 5% of the organization's gross receipts, whichever is less. However, certain reasonable causes or circumstances may qualify for penalty relief.

How can I edit form 990ez - washington from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including form 990ez - washington, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make edits in form 990ez - washington without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit form 990ez - washington and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How can I fill out form 990ez - washington on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your form 990ez - washington. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your form 990ez - washington online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.