Get the free Form W-2 and Form 1099 Guide for EmployeesContact Us - ADP

Show details

Widely available software can produce realistic forged ... longer the case. In 1990, the Uniform ..... Q: Some of our employees travel extensively .... 34 Forms W-2 and 1099 let ADP print these payroll

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form w-2 and form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form w-2 and form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form w-2 and form online

Follow the guidelines below to use a professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form w-2 and form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

How to fill out form w-2 and form

How to fill out form w-2 and form:

01

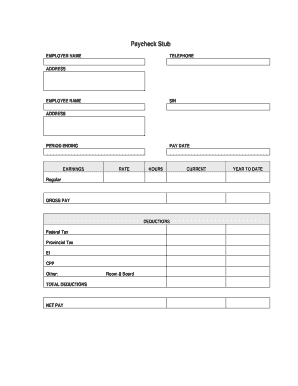

Begin by gathering all necessary information, including your personal details, such as name, address, and Social Security number, as well as details of your employer(s) and income for the tax year.

02

Review the instructions provided with the form to understand the specific requirements and any changes for the current tax year.

03

Start with filling out your personal information, such as your name, address, and Social Security number, in the designated sections on both forms.

04

Move on to the employer information section where you'll provide details about your employer(s), including their name, address, and Employer Identification Number (EIN). You may need to repeat this section if you have more than one employer.

05

Proceed to the income section where you'll report your wages, tips, and other compensation. This information can typically be found on your pay stubs or annual statements provided by your employer(s).

06

If applicable, complete additional sections for specific income types, such as self-employment income, if you have any.

07

Calculate and report any taxes withheld from your income, such as federal income tax, Social Security tax, or Medicare tax. This information is usually provided on your W-2 or on separate statements from your employer(s).

08

Review your completed forms for accuracy and make sure you have signed and dated them before submitting them to the appropriate recipients. Retain copies of both forms for your records.

Who needs form w-2 and form:

01

Employees who receive wages, salaries, or tips from an employer need to fill out Form W-2. This form is used by employers to report the amount of wages and taxes withheld from an employee's earnings.

02

Employers are responsible for providing Form W-2 to their employees by January 31st of the following tax year. Employees then use Form W-2 to report their income and taxes withheld when filing their individual income tax return.

03

Self-employed individuals who receive income from their own businesses or freelance work typically do not receive Form W-2. Instead, they may need to report their income and expenses on other forms like Schedule C or Schedule SE when filing their tax return.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form w-2 and form?

Form W-2 is a tax form used by employers to report wages, tips, and other compensation paid to employees. It also contains information about taxes withheld from employee paychecks. Form W-2 is used to file federal and state income taxes. Form W-2 is required for every employee for whom an employer pays wages, salaries, or other compensation subject to income tax withholding. Form W-2 is a summary of employee earnings and taxes withheld during the year.

Who is required to file form w-2 and form?

Employers are required to file Form W-2 for each employee to whom they pay wages, salaries, or other compensation subject to income tax withholding. Employers must also file Form W-2 for each employee who would have had income tax withheld if they had claimed no more than one withholding allowance or had not claimed exemption from withholding on Form W-4. Self-employed individuals who receive income subject to self-employment tax are also required to file a similar form called Form 1099-MISC.

How to fill out form w-2 and form?

To fill out Form W-2, you will need to provide the following information: employer's identification number (EIN), employer's name, address, and ZIP code, employee's social security number (SSN), employee's name, address, and ZIP code, employee's wages, tips, and other compensation, federal income tax withheld, social security wages, Medicare wages, and any other relevant information such as retirement plan contributions and dependent care benefits. The form should be filled out accurately and completely, following the instructions provided by the Internal Revenue Service (IRS).

What is the purpose of form w-2 and form?

The purpose of Form W-2 is to provide employees with information on their earnings and taxes withheld during the year. It is also used by employers to report this information to the IRS and state tax agencies. Form W-2 is essential for both employees and employers to accurately determine and report their income tax liability. It is also used to verify the accuracy of tax returns and ensure compliance with tax laws.

What information must be reported on form w-2 and form?

Form W-2 must include the employee's wages, tips, and other compensation, as well as federal income tax withheld, social security wages, Medicare wages, and any other relevant information such as retirement plan contributions and dependent care benefits. It should also include the employer's identification number (EIN), name, address, and ZIP code, as well as the employee's social security number (SSN), name, address, and ZIP code. Additionally, it may include details about any fringe benefits provided to the employee.

When is the deadline to file form w-2 and form in 2023?

The deadline to file Form W-2 for the year 2023 is January 31, 2024. This is the deadline for both electronic filing and paper filing. It is important to ensure that the forms are filed on time to avoid penalties or delays in processing the tax returns of both employees and employers.

What is the penalty for the late filing of form w-2 and form?

The penalty for late filing of Form W-2 depends on the size of the employer's business. For small businesses with annual gross receipts of $5 million or less, the penalty is $50 per form if filed within 30 days after the due date, with a maximum penalty of $197,500 per year. If filed more than 30 days after the due date but before August 1, the penalty is $110 per form, with a maximum penalty of $565,000 per year. For larger businesses, the penalty is $270 per form if filed within 30 days after the due date, with a maximum penalty of $3,339,000 per year. If filed more than 30 days after the due date but before August 1, the penalty is $540 per form, with a maximum penalty of $6,750,000 per year.

How do I modify my form w-2 and form in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign form w-2 and form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I execute form w-2 and form online?

pdfFiller makes it easy to finish and sign form w-2 and form online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit form w-2 and form online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your form w-2 and form to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Fill out your form w-2 and form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.