Get the free DOLP Your Debt Out of Existence

Show details

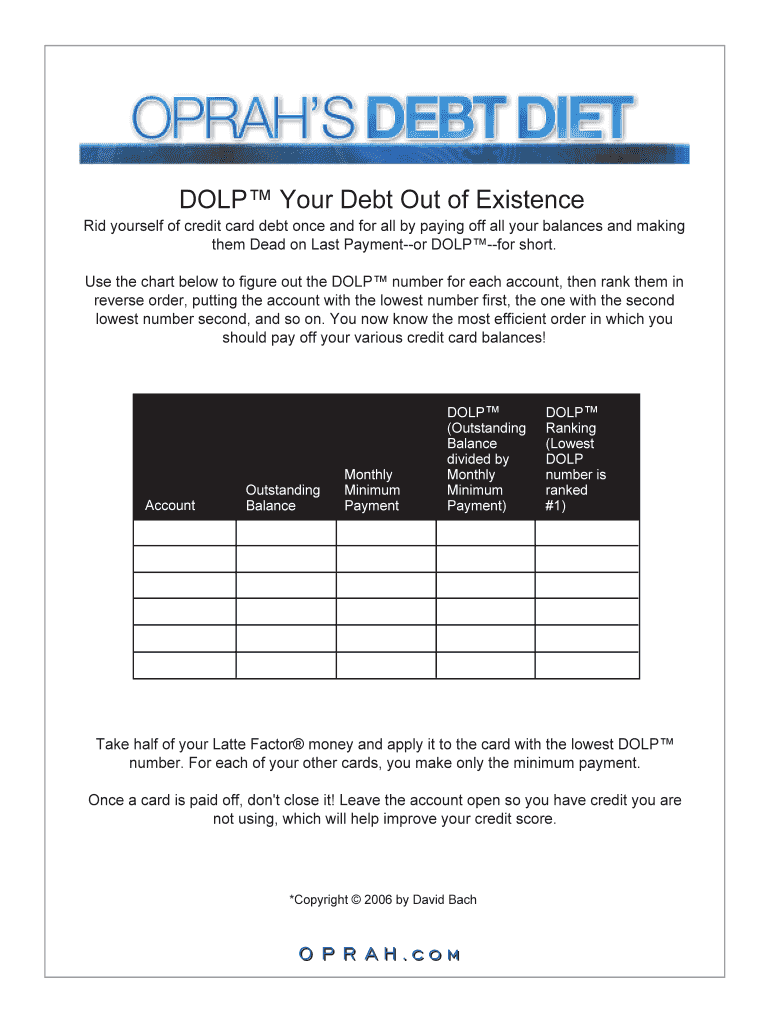

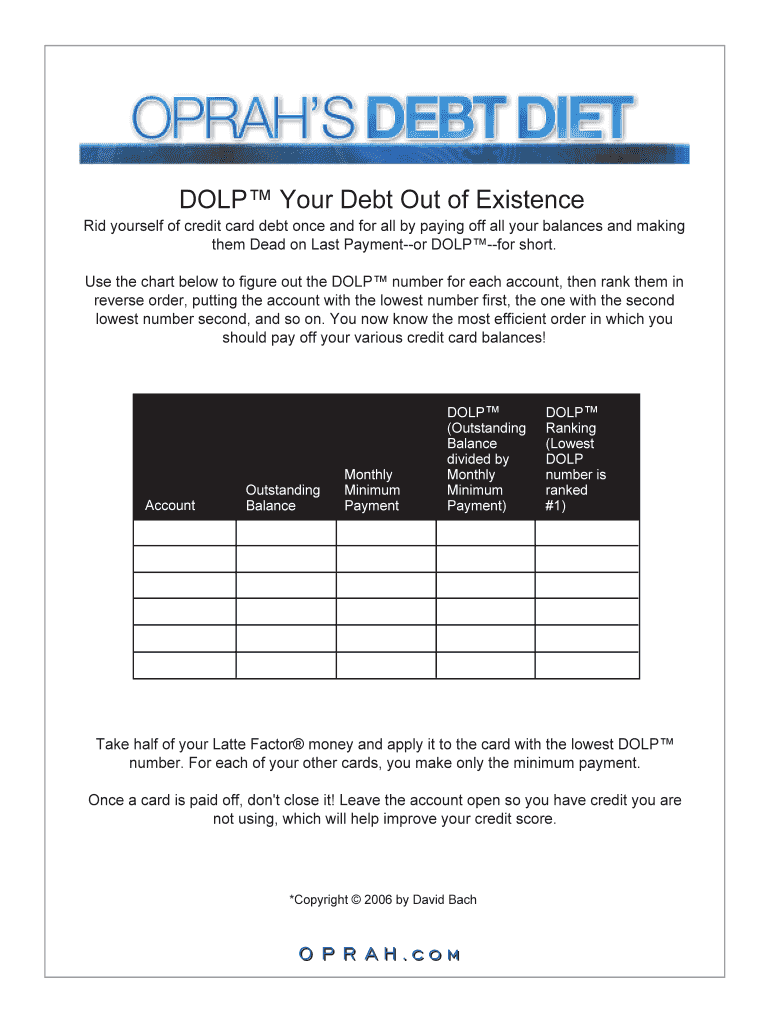

DOLL Your Debt Out of Existence

Rid yourself of credit card debt once and for all by paying off all your balances and making

them Dead on Last Pay mentor Dolor short.

Use the chart below to figure

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your dolp your debt out form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dolp your debt out form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dolp your debt out online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit dolp your debt out. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out dolp your debt out

How to fill out dolp your debt out?

01

Start by gathering all of your financial information, including your debts, income, and expenses.

02

Create a budget to understand your current financial situation and identify areas where you can cut back on expenses to pay off your debt faster.

03

Prioritize your debts based on interest rates or the amount owed. Consider using the snowball or avalanche method to pay off your debts strategically.

04

Contact your creditors to negotiate lower interest rates or payment plans. This can help you pay off your debt more efficiently.

05

Consider consolidating your debts into a single loan with a lower interest rate, such as a personal loan or a balance transfer credit card.

06

Track your progress and stay motivated by setting small achievable goals. Celebrate each milestone as you pay off your debts.

07

Seek professional help if you're overwhelmed or struggling to manage your debt. Credit counseling agencies or financial advisors can provide guidance and support.

Who needs dolp your debt out?

01

Individuals who are facing overwhelming amounts of debt and want to regain control of their financial situation.

02

People who want to save money on interest payments and fees associated with their debts.

03

Individuals who want to improve their credit score by reducing their debt-to-income ratio.

04

Anyone who wants to achieve financial freedom and reduce financial stress in their lives.

05

Individuals who want to establish a healthy financial habit of managing and paying off their debts responsibly.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is dolp your debt out?

Dolp your debt out is a form used to report any debts that have been paid off or settled.

Who is required to file dolp your debt out?

Anyone who has paid off or settled a debt during the tax year is required to file dolp your debt out.

How to fill out dolp your debt out?

To fill out dolp your debt out, you will need to provide information about the debt that was paid off or settled, including the amount, creditor, and date of payment.

What is the purpose of dolp your debt out?

The purpose of dolp your debt out is to report any debts that have been paid off or settled to ensure accurate financial records.

What information must be reported on dolp your debt out?

Information such as the amount of the debt, creditor name, date of payment, and any relevant account numbers must be reported on dolp your debt out.

When is the deadline to file dolp your debt out in 2023?

The deadline to file dolp your debt out in 2023 is typically April 15th, but it is always recommended to check with the IRS for any updates or changes.

What is the penalty for the late filing of dolp your debt out?

The penalty for the late filing of dolp your debt out can vary, but it may result in fines or interest charges on the unpaid amount.

How can I send dolp your debt out to be eSigned by others?

When your dolp your debt out is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I get dolp your debt out?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the dolp your debt out in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit dolp your debt out straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit dolp your debt out.

Fill out your dolp your debt out online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.