Get the free 1991 Form 4835. Farm Rental Income and Expenses

Show details

Did you actively participate in the operation of this farm during 1991? (See instructions.) B ... Total cooperative distributions (Form(s) 1099-PATR). 2a. 3a. 3b ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 1991 form 4835 farm form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1991 form 4835 farm form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1991 form 4835 farm online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 1991 form 4835 farm. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out 1991 form 4835 farm

How to fill out 1991 form 4835 farm:

01

Start by gathering all relevant information and documentation related to your farm, such as income and expenses records, depreciation schedules, and any other necessary supporting documents.

02

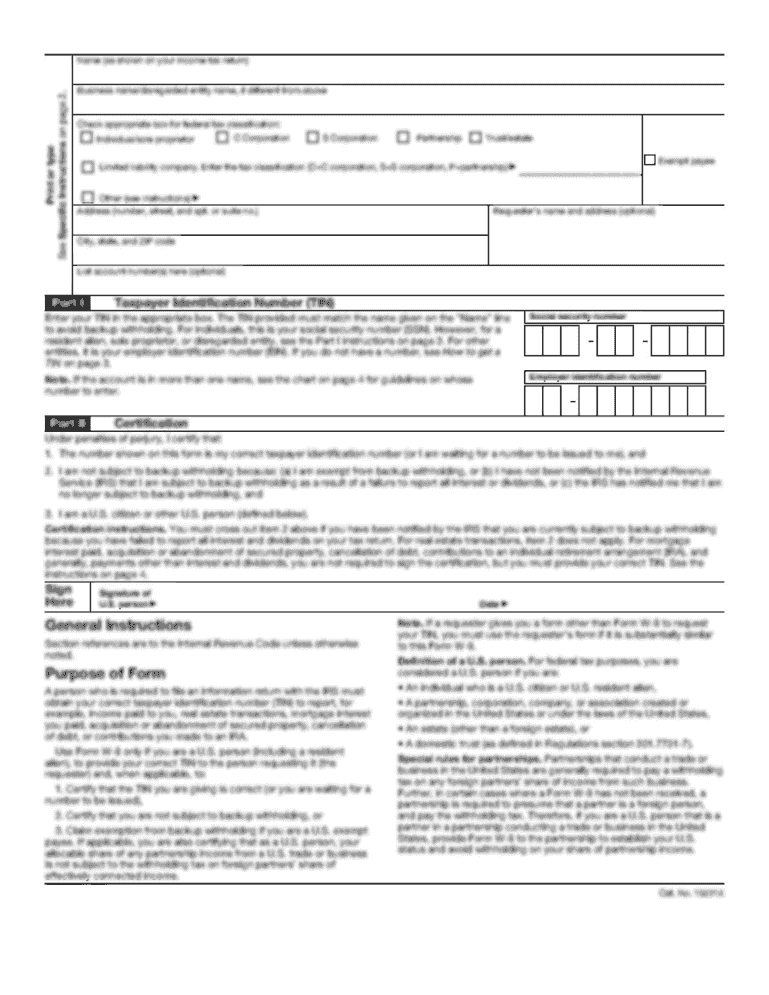

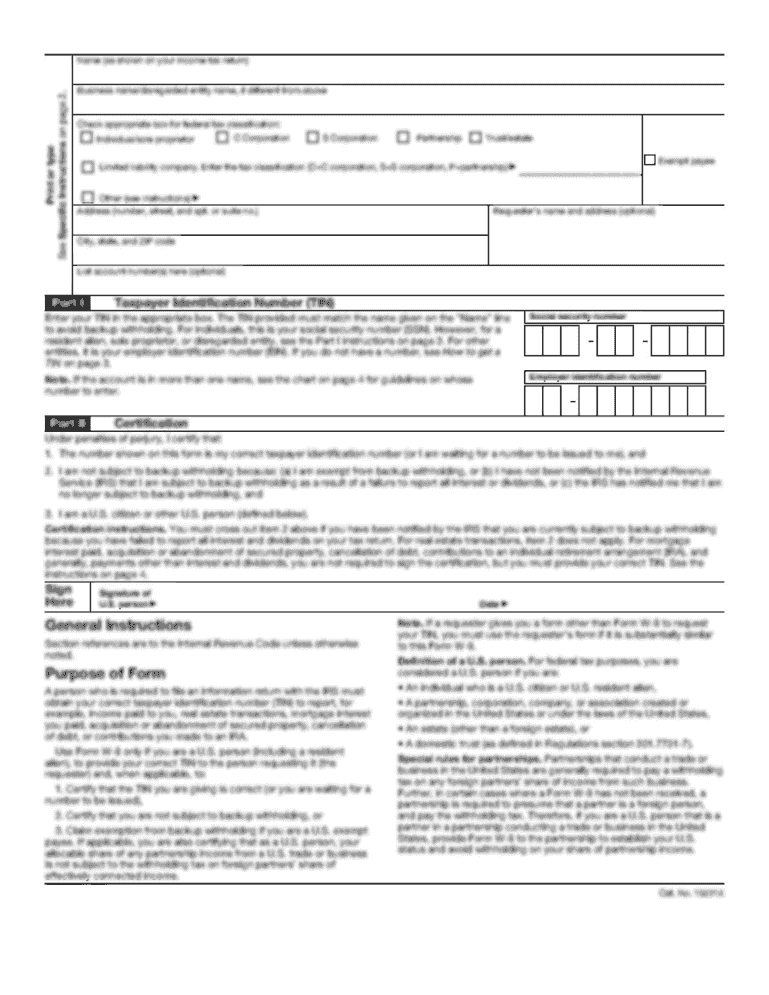

Fill out the general information section of the form, which includes your name, address, and taxpayer identification number.

03

Provide details about your farming activity, including the type of farm and the method used (cash method or accrual method).

04

Report your income from farming, including sales of livestock, produce, and other products. Fill out the specific sections for each category of income.

05

Deduct your allowable farm expenses, such as feed, seed, fertilizer, equipment maintenance, and labor costs. Ensure you provide accurate and detailed information in the appropriate sections.

06

Determine any applicable depreciation deductions for farm property, such as buildings, equipment, and vehicles. You may need to refer to additional forms or instructions for this purpose.

07

Complete the section for calculating your net farm profit or loss. Follow the instructions carefully to ensure accurate calculation.

08

Transfer the totals from various sections to the corresponding lines on the Form 4835.

09

Sign and date the form to certify the accuracy of the information provided.

10

Keep a copy of the completed form for your records.

Who needs 1991 form 4835 farm:

01

Individuals who are engaged in the farming business as a sole proprietor or as a partner in a partnership need to fill out the 1991 Form 4835 farm.

02

This form is specifically used to report income and expenses related to farming activities.

03

If you received income from operating a farm or owning rental property related to farming, you may need to file this form.

04

It is important to consult the IRS guidelines and instructions or seek professional advice to determine if you meet the criteria for filing the 1991 Form 4835 farm.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 4835 farm rental?

Form 4835 farm rental is a form used by individuals or partnerships who are engaged in farming or renting agricultural property to report their income and expenses related to farming activities.

Who is required to file form 4835 farm rental?

Individuals or partnerships who receive income from farming or renting agricultural property are required to file form 4835 farm rental.

How to fill out form 4835 farm rental?

To fill out form 4835 farm rental, you need to provide information about your farming activities, such as your income, expenses, and depreciation. This information should be reported accurately and in accordance with the instructions provided by the IRS.

What is the purpose of form 4835 farm rental?

The purpose of form 4835 farm rental is to calculate your net farm rental income or loss, which will be reported on your individual or partnership tax return.

What information must be reported on form 4835 farm rental?

On form 4835 farm rental, you must report your gross farm rental income, deductions for farming expenses, and any depreciation or amortization deductions.

When is the deadline to file form 4835 farm rental in 2023?

The deadline to file form 4835 farm rental in 2023 is typically April 15th, but it is always recommended to check the latest IRS guidelines or consult with a tax professional for the exact deadline.

What is the penalty for the late filing of form 4835 farm rental?

The penalty for the late filing of form 4835 farm rental is typically a percentage of the unpaid tax amount, with the exact penalty rate depending on the length of the delay. It is advisable to refer to the latest IRS guidelines or consult with a tax professional for accurate penalty information.

How can I modify 1991 form 4835 farm without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including 1991 form 4835 farm. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make changes in 1991 form 4835 farm?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your 1991 form 4835 farm to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit 1991 form 4835 farm straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing 1991 form 4835 farm right away.

Fill out your 1991 form 4835 farm online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.