Get the free GST payable on entire billing amount inclusive of EPF & ESI etc.

Show details

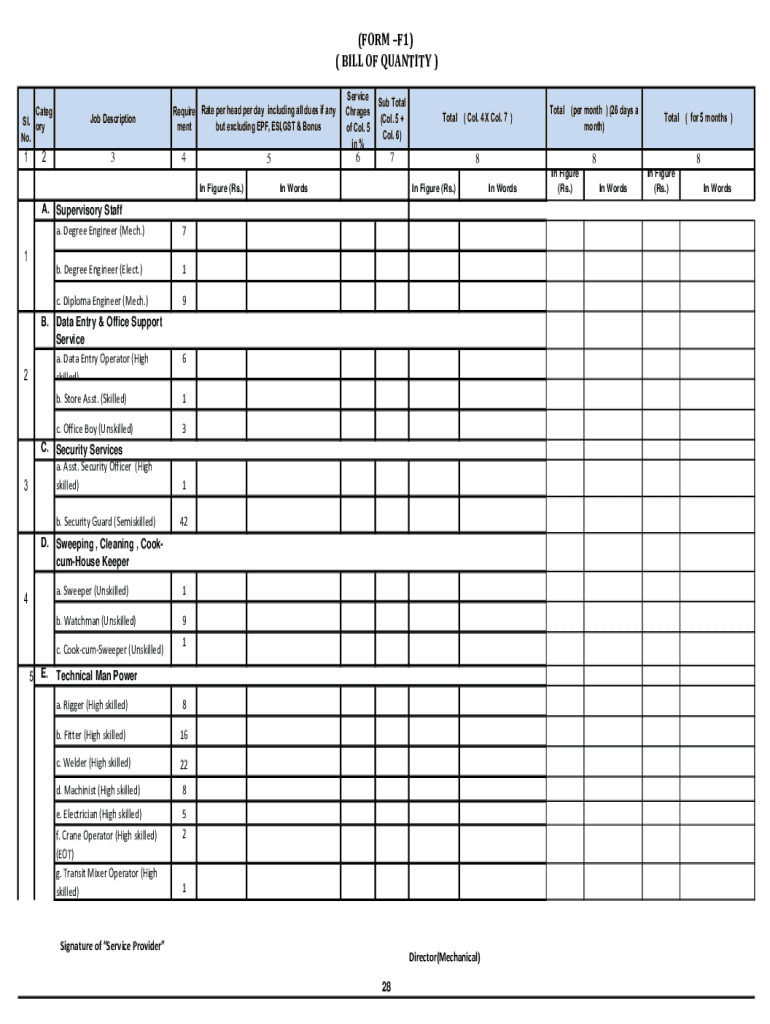

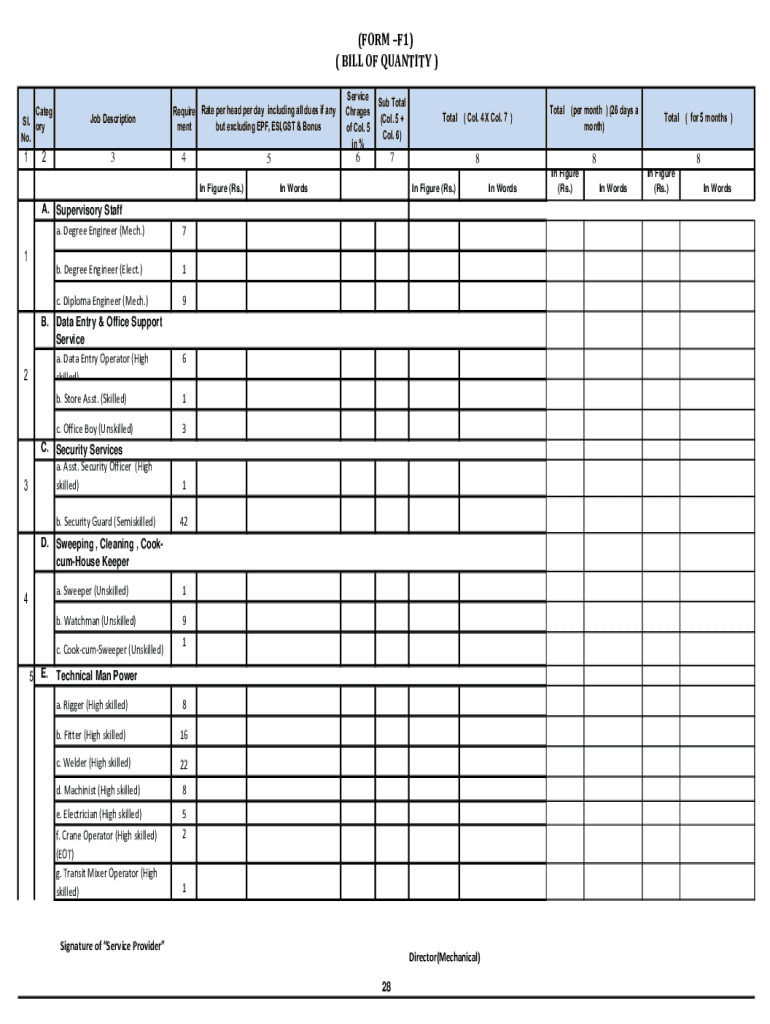

(FORM F1) (BILL OF QUANTITY) Cater SL. ORY No.12Job Description3Require Rate per head per day including all dues if any but excluding EPF, ESI, GST & Bonus ment45 In Figure (Rs.)12A. Supervisory Staff

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gst payable on entire form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gst payable on entire form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gst payable on entire online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gst payable on entire. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out gst payable on entire

How to fill out gst payable on entire

01

Determine the total amount of sales or services subject to GST.

02

Calculate the GST rate applicable to the sales or services.

03

Multiply the total amount by the GST rate to determine the GST payable on the entire amount.

Who needs gst payable on entire?

01

Any individual or business entity that sells goods or services and is registered for GST needs to fill out GST payable on entire.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit gst payable on entire from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including gst payable on entire, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I sign the gst payable on entire electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your gst payable on entire in seconds.

How can I edit gst payable on entire on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing gst payable on entire.

Fill out your gst payable on entire online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.