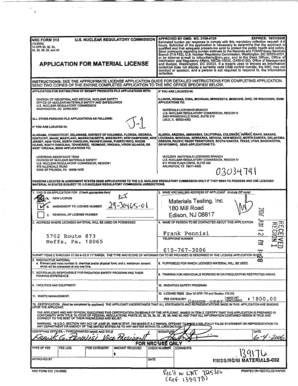

For Retirement Part A includes one page only, and must be signed in ink. If you fail to read and sign the Application. For Retirement Part A and fail to sign in ink on any part, or if your signature is illegible because of loss of or damage to your signature, or if you fail to answer the questions, or if the application is void on any question, or if the application has become lost or stolen, you shall forfeit the 250 application fee and be returned all the Application. For Retirement Part A. You will be contacted or called if any portion of this application is to be used to apply for any other benefit, including any pension benefits, other than the Pension Benefits Program. APPLICATION FOR RETIREMENT PART A is to establish for the International Brotherhood of Teamsters a trust or other instrument in the name of the International Brotherhood of Teamsters (International Brotherhood of Teamsters) by which we may pay your share of the pension benefits payable to you by the Employee Retirement Income Security Act of 1974 (ERICA), the Industry Pension Investment Board (PIPE), or any other program for which an equivalent amount of contributions is provided by you. You shall be entitled to the funds from the trust or other instrument in the proportion which the following percentages apply to your benefit package (see Appendix A) at the time of death: (1) In the case of the pension amounts set forth in Appendix A, the greatest of (i) your service as a Teamster in a covered, covered company as of the first day of the first calendar year of the four-year period ending with the month in which the application for the trust or other instrument is filed, and (ii) the number of calendar years of service in a covered, covered company, less service as a Teamster in a covered, covered company as of the first day of the first calendar year of the four-year period ending with the month in which the application for the trust or other instrument is filed. For purposes of determining your service as a Teamster in a covered, covered company, it must be inferred that you served the equivalent of one year active service as a Teamster in a non-covered, non-covered company, provided that you did not serve two years of active service in a covered, covered company (after the date of your retirement due to the death of a previous member) and you had not less than three years of active service in a covered, covered company.

Get the free gcc ibt national pension fund form

Show details

Gccibt-npf.org or by calling the Fund Office. Be advised that pursuant to the Fund s original Rehabilitation Plan the Long-Term Disability Benefit was eliminated effective May 1 2008 for anyone whose disability commenced after September 12 2007.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gcc ibt national pension form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gcc ibt national pension form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gcc ibt national pension fund online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit gcc ibt npf form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gcc ibt national pension?

GCC IBT National Pension is a pension scheme administered by the Gulf Cooperation Council (GCC) Industrial Bank and Trust (IBT). It is a retirement plan available to individuals who are citizens of the member countries of the Gulf Cooperation Council (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates). The scheme aims to provide financial security and retirement benefits to eligible individuals, typically through contributions made by both the employee and employer during the individual's working years. The specific details and benefits of the GCC IBT National Pension scheme may vary depending on the country and individual circumstances.

Who is required to file gcc ibt national pension?

Individuals who are employed and have a salary income in the Kingdom of Saudi Arabia are required to file the GCC-IBT National Pension. This includes both Saudi nationals and non-Saudi employees.

How to fill out gcc ibt national pension?

To fill out the National Pension form (GCC IBT), you need to follow these steps:

1. Obtain the form: You can collect the GCC IBT National Pension form from your employer or the local pension office.

2. Personal information: Fill in your personal details such as your full name, date of birth, gender, nationality, and contact information.

3. Social security number: Provide your social security number or any other identification numbers as required.

4. Employer details: Enter your employer's name, address, and contact details.

5. Employment details: Fill in the dates of your employment, including the start and end date, and the nature of your work. Also, provide your job position, salary, and any other relevant employment information.

6. Declaration: Read and understand the declaration section carefully. Sign and date the declaration to confirm the accuracy and authenticity of the information provided.

7. Submitting the form: After completing the form, submit it to your employer or the local pension office as per the instructions provided.

Note: The specific instructions and requirements for filling out the GCC IBT National Pension form may vary depending on the country or region. It is recommended to refer to the guidance provided by your employer or the local pension office to ensure accurate completion of the form.

What is the purpose of gcc ibt national pension?

The purpose of the GCC IBT National Pension is to provide retirement benefits to employees in the Gulf Cooperation Council (GCC) countries. It is a mandatory pension scheme that ensures financial security for individuals after retirement. The GCC IBT National Pension aims to support individuals in maintaining a decent standard of living and meeting their basic needs during their retirement years. It helps employees accumulate a pension fund throughout their working life, which is then disbursed as regular income during their retirement.

What information must be reported on gcc ibt national pension?

The information that must be reported on GCC IBT National Pension includes:

1. Employee details: This includes the personal information of the employee such as name, date of birth, gender, nationality, and civil ID.

2. Employment details: This includes information about the employer, such as the company name, address, and contact details.

3. Salary details: This includes the employee's salary information, such as the monthly or annual salary, allowances, bonuses, and any other income received.

4. Contributions: This includes the amount of contributions made by both the employee and the employer towards the national pension scheme.

5. Date of joining and leaving: The dates of when the employee joined the company and when they left or will leave the employment should be reported.

6. Leaves and absences: Any leaves taken by the employee should be reported, including the reason for the leave and the duration.

7. Termination or resignation details: If the employee has left the company, the reason for termination or resignation should be reported, along with the last working day.

8. Other relevant information: Any other relevant information related to the pension scheme, such as changes in the contribution rates, changes in employment status, or any updates to the employee's personal information, should also be reported.

What is the penalty for the late filing of gcc ibt national pension?

The late filing penalty for the GCC-IBT (General Confederation of Trade Unions - International Brotherhood of Teamsters) National Pension varies depending on the specific circumstances and regulations of the pension plan. It is best to consult with the pension plan administrator or refer to the plan's official documents for accurate information on late filing penalties.

How do I modify my gcc ibt national pension fund in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your gcc ibt npf form as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make changes in gccibt npf pension?

The editing procedure is simple with pdfFiller. Open your gcc ibt national pension fund in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit gcc ibt npf form in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your gccibt npf pension, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Fill out your gcc ibt national pension online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gccibt Npf Pension is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.