Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What information must be reported on 1095c?

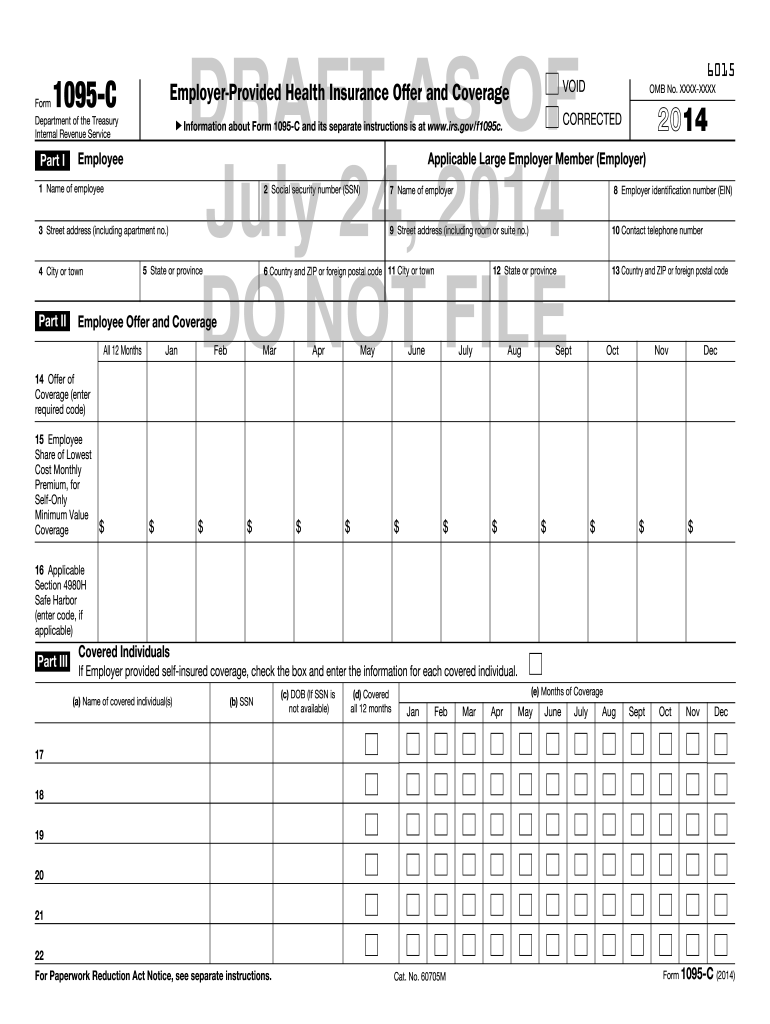

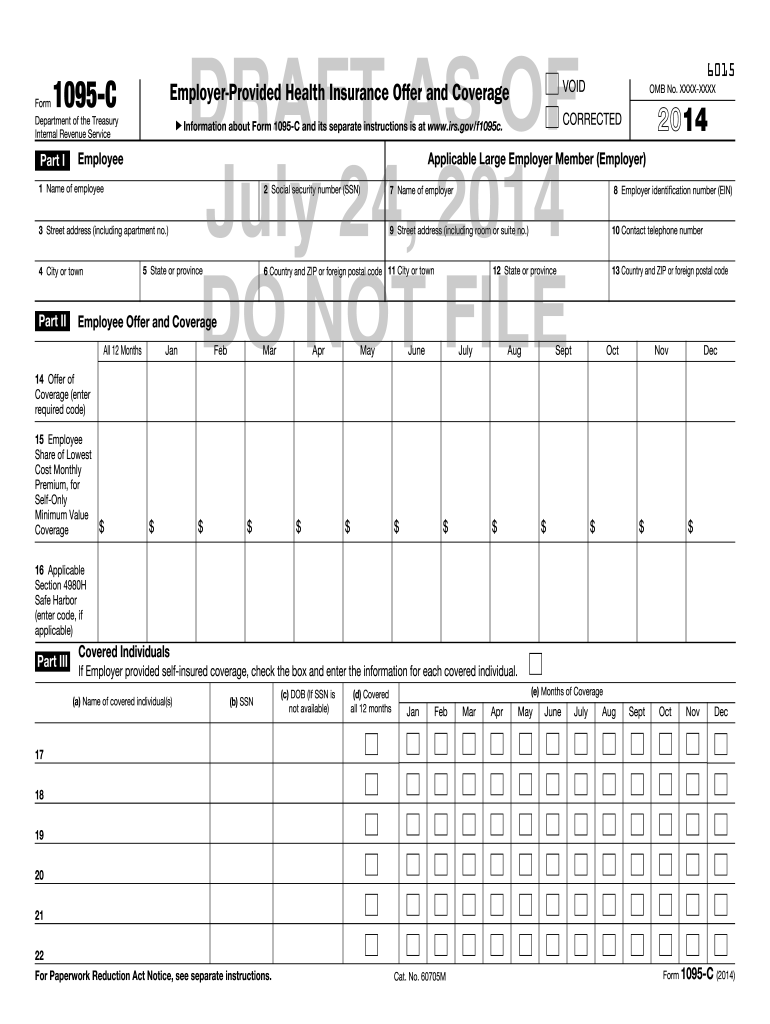

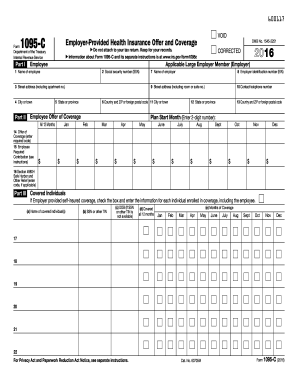

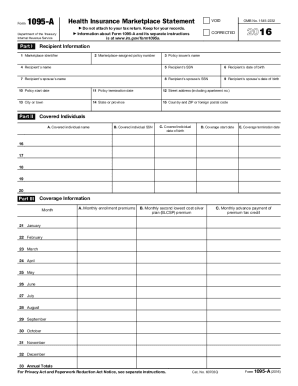

The 1095-C form must include the employer's name, employer identification number (EIN), and contact information; the employee's name, address, and Social Security number; the number of months the employee was covered by a qualified health plan; and the amount of the lowest cost monthly premium for self-only coverage.

When is the deadline to file 1095c in 2023?

The deadline to file 1095-C in 2023 is March 31, 2024.

What is the penalty for the late filing of 1095c?

The Internal Revenue Service (IRS) can impose a penalty of up to $270 per form for the late filing of 1095C forms. The penalty is based on the number of forms filed late, the length of time they are late, and whether the late filing was intentional or unintentional.

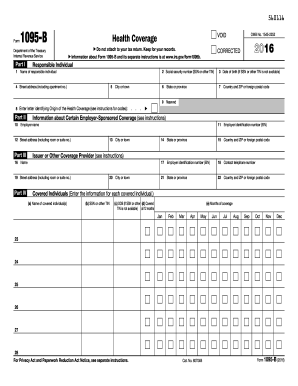

Form 1095-C is a tax form used by employers to report information about the health insurance coverage they offered to their employees. The form is mandated by the Affordable Care Act (ACA), also known as Obamacare. It provides details about the coverage offered by the employer, including the number of months the coverage was available, the employee's share of the monthly premium, and whether the coverage met the minimum essential coverage requirements under the ACA. The purpose of the form is to assist individuals in determining their eligibility for premium tax credits and to verify that individuals and their dependents had minimum essential coverage for each month of the year.

Who is required to file 1095c?

Employers that are subject to the Affordable Care Act (ACA) employer mandate are required to file Form 1095-C. This form is used to report information about the health insurance coverage offered to their full-time employees.

Filling out Form 1095-C can be a bit complex, but here are the general steps:

1. Obtain a blank copy of Form 1095-C from the IRS website, or use a tax software that supports this form.

2. In Part I, provide your personal information such as name, employer identification number (EIN), and address.

3. In Part II, you'll need to report the information for each month of the calendar year. Check the boxes that apply to indicate the type of coverage offered, if any, and whether you offered coverage to the employee's spouse and dependents.

4. In Part III, provide employee information such as the Social Security number, name, and the offer of coverage for each month.

5. If you have any specific codes to report, use Part IV. This section helps provide additional information about the coverage offered to the employee or any details related to affordability and eligibility.

6. Review the completed form for accuracy and ensure all the necessary information is included.

7. Provide copies of Form 1095-C to your employees by the deadline (typically January 31st of the subsequent year), and ensure you keep a copy for your records. If filing electronically, you'll need to submit Form 1095-C to the IRS by the given due date.

It's worth noting that filling out Form 1095-C can be complex, so it's advisable to refer to the instructions provided by the IRS or consult a tax professional if you're unsure about any aspect of the form.

What is the purpose of 1095c?

Form 1095-C is used by employers to report information about offers of health coverage to their employees, as required by the Affordable Care Act (ACA). The purpose of this form is to ensure that employers are offering affordable and minimum essential health coverage to their employees, as well as to determine if individuals are eligible for premium tax credits or other ACA provisions. It provides important information to the IRS and helps individuals understand their eligibility for health coverage and potential tax credits.

Can I create an electronic signature for signing my fillable 1095c in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your 1095 c fillable form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out 1095c mergeable form using my mobile device?

Use the pdfFiller mobile app to fill out and sign fillable 1095 c on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete fillable 1095 c forms on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your fillable forms 1095c 2018 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.