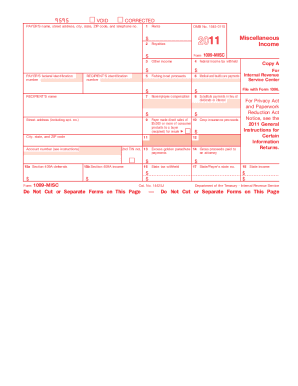

Get the free 2011 Instruction 1099-S. Instructions for Form 1099-S, Proceeds From Real Estate Tra...

Show details

2011 What's New Instructions for Form 1099-S Section references are to the Internal Revenue Code unless otherwise noted. Department of the Treasury Internal Revenue Service Pilot program for truncating

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2011 instruction 1099-s instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 instruction 1099-s instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2011 instruction 1099-s instructions online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2011 instruction 1099-s instructions. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out 2011 instruction 1099-s instructions

How to fill out 2011 instruction 1099-s instructions:

01

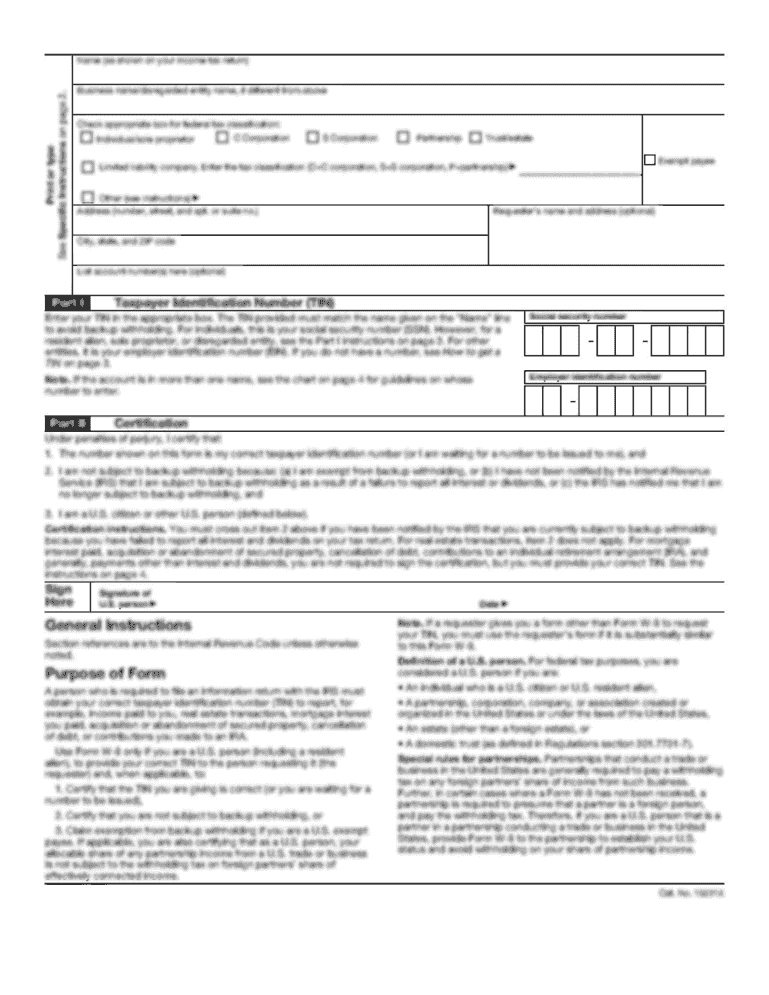

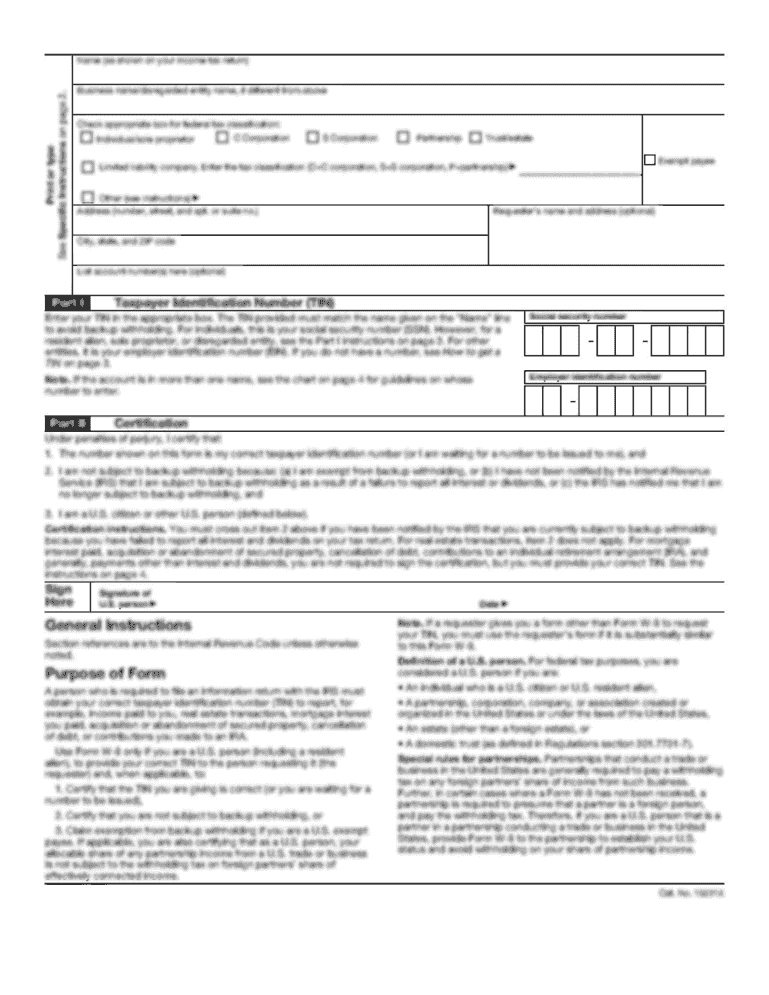

Gather all necessary information, including the seller's name, address, and taxpayer identification number (TIN), as well as the property's address and sales price.

02

Fill out the top section of the form, providing your name, address, and TIN as the person filing the form.

03

Enter the seller's name, address, and TIN in the appropriate fields on the form.

04

Fill out the property information section, including the property's address, sales price, and the date of the closing or transfer.

05

Determine the transaction type and check the corresponding box on the form. The options include cash, installment, or property acquired in a foreclosure or abandonment.

06

If applicable, enter any allocated sales price for multiple properties involved in the transaction.

07

Complete the boxes for the gross proceeds, the account number if applicable, and the property type.

08

Review the completed form for accuracy and ensure all relevant sections are filled out.

09

Sign and date the form, certifying that the information provided is true and accurate.

10

File the completed form with the IRS before the deadline.

Who needs 2011 instruction 1099-s instructions?

01

Individuals who sold real estate property during the tax year 2011.

02

Tax professionals and accountants who prepare tax returns for clients who sold real estate property in 2011.

03

Anyone who received a completed 2011 instruction 1099-S form and needs to understand how to report it on their tax return.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is instruction 1099-s instructions for?

Instruction 1099-S provides guidance on reporting the sale or exchange of real estate property on Form 1099-S. It explains how to report the details of the transaction, such as the gross proceeds, name of the transferor and transferee, and property information.

Who is required to file instruction 1099-s instructions for?

Any person or organization that receives gross proceeds from the sale or exchange of real estate property must file Form 1099-S and follow the instructions provided in Instruction 1099-S. This includes individuals, businesses, estates, and trusts.

How to fill out instruction 1099-s instructions for?

To fill out Form 1099-S and follow the instructions in Instruction 1099-S, you need to provide the required information about the real estate transaction. This includes the name, address, and taxpayer identification number of the transferor and transferee, details of the property sold, and the gross proceeds from the sale or exchange. The form must be filled out accurately and submitted to the IRS.

What is the purpose of instruction 1099-s instructions for?

The purpose of Instruction 1099-S is to provide clear guidance on how to report the sale or exchange of real estate property and fulfill the reporting requirements set by the IRS. It ensures accurate and consistent reporting of these transactions for tax purposes.

What information must be reported on instruction 1099-s instructions for?

On Form 1099-S, you must report the name, address, and taxpayer identification number of both the transferor and transferee, details of the property sold or exchanged (including its address and legal description), and the gross proceeds from the transaction. Additionally, you may need to report any adjustments or escrow amounts related to the sale.

When is the deadline to file instruction 1099-s instructions for in 2023?

The deadline for filing Form 1099-S, along with the accompanying instructions, for the tax year 2023 is generally January 31, 2024. However, specific deadlines may vary depending on certain factors, such as whether you file electronically or by mail. It is important to consult the IRS guidelines or a tax professional for the most accurate and up-to-date deadline information.

What is the penalty for the late filing of instruction 1099-s instructions for?

The penalty for late filing of Form 1099-S, along with the accompanying instructions, can vary depending on the length of the delay and the number of forms filed incorrectly. Generally, the penalty ranges from $50 to $270 per form, with higher penalties applying to intentional disregard of the filing requirement. The penalty amount can accumulate over time if the late filing persists. It is important to file the form by the deadline to avoid penalties.

How can I send 2011 instruction 1099-s instructions to be eSigned by others?

When you're ready to share your 2011 instruction 1099-s instructions, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I edit 2011 instruction 1099-s instructions on an Android device?

You can make any changes to PDF files, like 2011 instruction 1099-s instructions, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I fill out 2011 instruction 1099-s instructions on an Android device?

Complete your 2011 instruction 1099-s instructions and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your 2011 instruction 1099-s instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.