DD 2760 2002-2024 free printable template

Show details

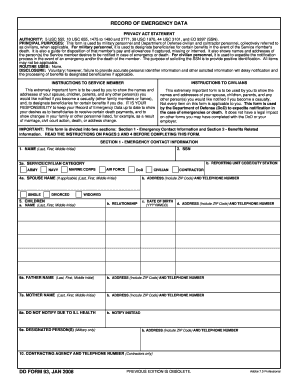

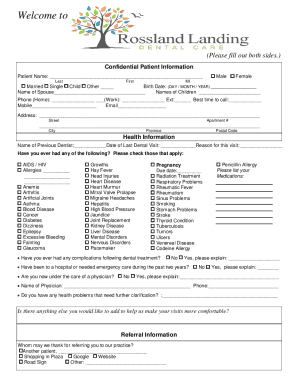

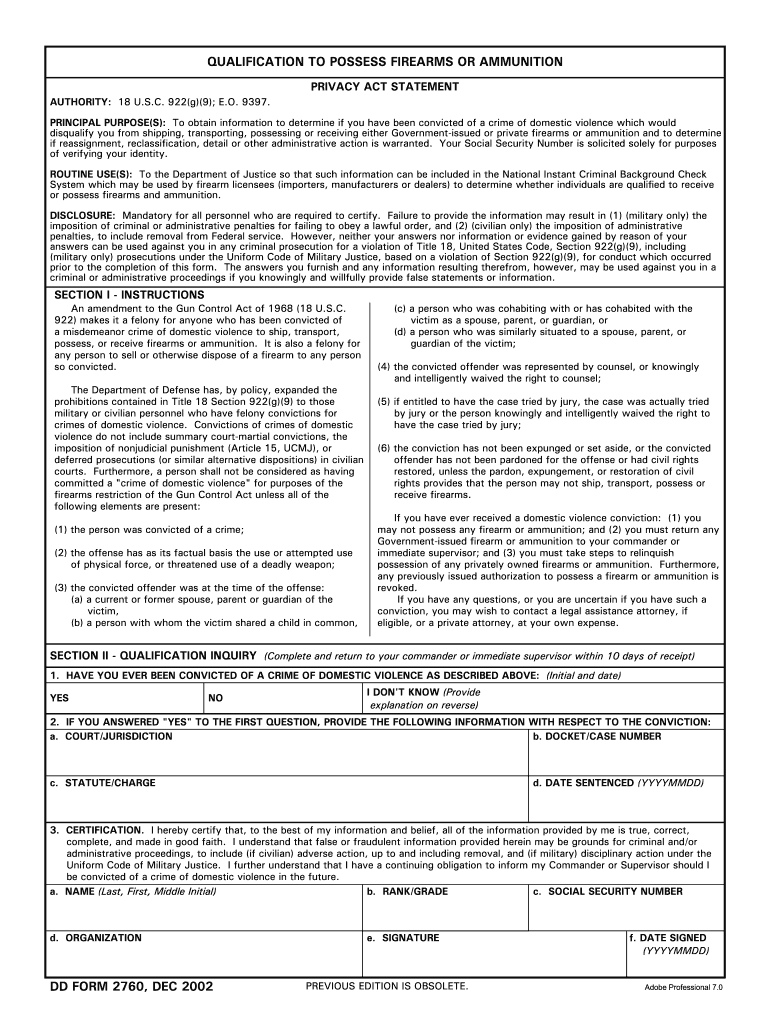

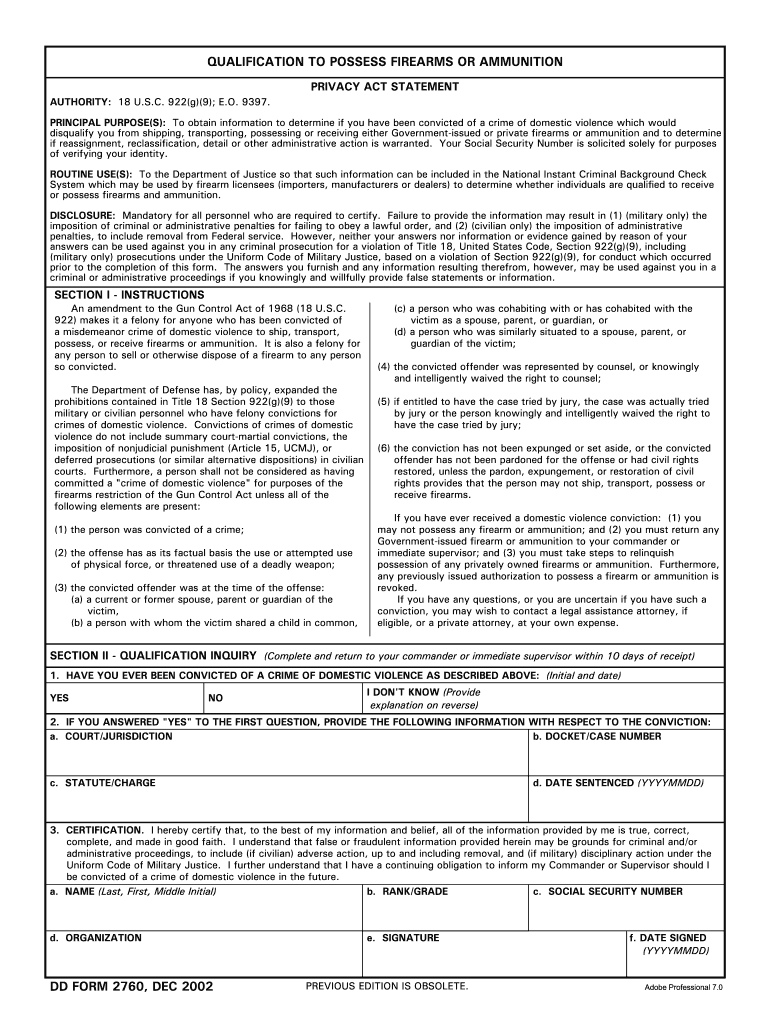

A. NAME Last First Middle Initial b. RANK/GRADE c. SOCIAL SECURITY NUMBER d. ORGANIZATION DD FORM 2760 DEC 2002 e. QUALIFICATION TO POSSESS FIREARMS OR AMMUNITION PRIVACY ACT STATEMENT AUTHORITY 18 U*S*C. 922 g 9 E*O. 9397. PRINCIPAL PURPOSE S To obtain information to determine if you have been convicted of a crime of domestic violence which would disqualify you from shipping transporting possessing or receiving either Government-issued or private firearms or ammunition and to determine if...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form 2760 controlling person form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 2760 controlling person form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 2760 controlling person online

Follow the steps down below to benefit from a competent PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 2760. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

How to fill out form 2760 controlling person

How to fill out form 2760:

01

Start by carefully reading the instructions provided with form 2760.

02

Gather all the necessary information and documents required to complete the form. This may include personal information, financial details, or any supporting documentation.

03

Begin filling out the form by entering your personal information accurately and legibly. This may include your full name, address, contact details, and any other required information.

04

Follow the instructions on the form to provide the requested details. This may include answering specific questions, checking boxes, or providing additional explanations where necessary.

05

Take your time to review the completed form and ensure all the information provided is accurate and complete. Make any necessary corrections or additions before moving forward.

06

If there are any sections or questions that you are unsure about, consult the instructions or seek assistance from a relevant authority or professional.

07

Once you are confident that the form is correctly filled out, sign and date it as required. If there are any additional signatures or authorizations needed, ensure they are obtained before submitting the form.

08

Make a copy of the completed form for your records before submitting it to the designated recipient.

Who needs form 2760:

01

Form 2760 is typically required by individuals or organizations who are involved in a specific process or transaction that necessitates the collection of certain information. The exact requirement for form 2760 varies depending on the specific context and purpose.

02

It is essential to refer to the specific guidelines, regulations, or instructions given by the organization, institution, or authority requesting the form to determine if it is necessary in your particular case.

03

Common examples of situations where form 2760 may be required include applying for a loan, submitting a financial report, requesting certain benefits or assistance, or participating in a specific program. It is advisable to consult the relevant documentation or contact the responsible party to confirm the necessity of form 2760.

Video instructions and help with filling out and completing form 2760 controlling person

Instructions and Help about 2760 fillable form

Fill how to form 2760 : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 2760?

Form 2760 is a form used by the Internal Revenue Service to initiate a taxpayer's installment agreement. It is used when a taxpayer is unable to pay the full amount of the assessed tax liability due. The form is used to request that the IRS agree to an installment payment plan to pay back taxes. The form also includes an authorization from the taxpayer to the IRS to deduct payments from the taxpayer's bank account.

Who is required to file form 2760?

Form 2760 is used to request a determination letter from the Internal Revenue Service (IRS) for a group exemption from federal income tax. It must be filed by any organization that has applied for or is already recognized by the IRS as exempt from federal income tax under section 501(c) of the Internal Revenue Code.

What is the purpose of form 2760?

Form 2760 is used by the IRS to adjust certain tax liabilities of a taxpayer related to an installment agreement. It is used to adjust a taxpayer's liability on a specific tax year, to reconcile the amount due, and to update the installment agreement payment schedule.

What information must be reported on form 2760?

Form 2760 must include the following information:

1. The name of the employer

2. The name of the employee

3. The date the employee was hired

4. The employee’s job title

5. The employee’s hourly rate of pay

6. The employee’s total annual salary or wages

7. The number of hours worked by the employee

8. The type of benefits, if any, provided to the employee

9. The total amount of taxes withheld from the employee’s wages

10. The total amount of deductions made from the employee’s wages

11. The total net amount of wages paid to the employee

12. The total amount of contributions made by the employer to any retirement plan or other plan for the employee

How to fill out form 2760?

To fill out form 2760, you can follow these steps:

1. Obtain the form: You can download form 2760 from the relevant government website or collect a physical copy from the respective office.

2. Read the instructions: Before starting to fill out the form, ensure you carefully read and understand the accompanying instructions. This will help you accurately provide the required information.

3. Provide personal details: The form typically requires you to enter personal information such as your name, address, date of birth, contact details, and any other requested identifying information.

4. Specify the purpose: Indicate the reason for completing the form, such as applying for a specific benefit, requesting a service, or providing information for a particular purpose. Make sure to clearly state the purpose based on the options provided.

5. Provide supporting documents: If needed, attach any necessary supporting documents that are requested. This could include identification documents, proof of address, or any other relevant paperwork. Ensure that you have all the required documents and include copies, not originals.

6. Complete additional sections if applicable: Some forms may have additional sections requesting specific information based on your circumstances. Fill in these sections accurately and completely.

7. Review and sign: Before submitting the form, review all the provided information for accuracy and completeness. Make any necessary corrections, if required. Once done, sign and date the document as indicated.

8. Submit the form: Determine the submission method specified in the instructions. This can vary, but common options may include mailing the form, submitting it online, or hand delivering it to the designated office. Ensure you comply with the submission requirements.

9. Retain a copy for your records: Before submitting the form, make photocopies or scan the filled-out form and all accompanying documents for your personal records. This can serve as proof of your submission and for your reference in the future.

Remember, the specific requirements and procedure can vary based on the purpose and jurisdiction, so it is beneficial to carefully review the provided instructions and consult any available guidance.

What is the penalty for the late filing of form 2760?

Form 2760 is not a recognized form in general taxation or business requirements. Therefore, there is no specific penalty for late filing of Form 2760 since it does not exist. To provide a precise answer, please clarify the exact purpose or jurisdiction related to the form.

How do I modify my form 2760 controlling person in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your form 2760 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send controlling person form 2760 to be eSigned by others?

To distribute your dd2760, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit dd form 2760 fillable pdf straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing dd 2760 form, you can start right away.

Fill out your form 2760 controlling person online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Controlling Person Form 2760 is not the form you're looking for?Search for another form here.

Keywords relevant to form 2760 printable

Related to dd 2760 pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.