USPS PS 7381 2001-2025 free printable template

Show details

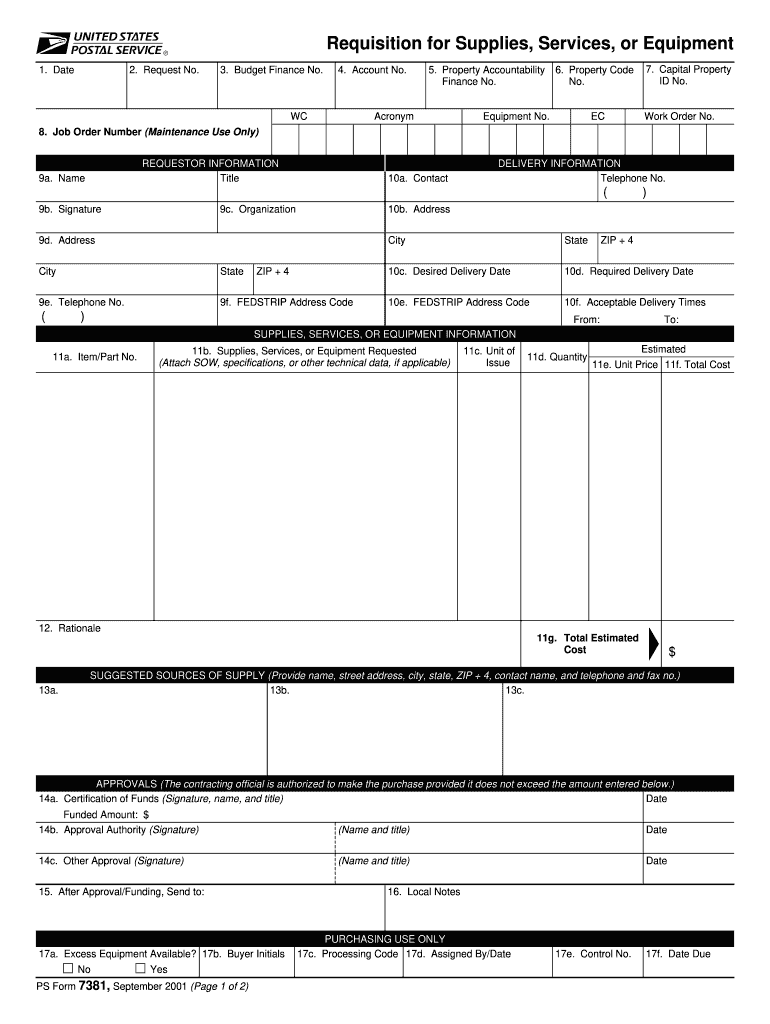

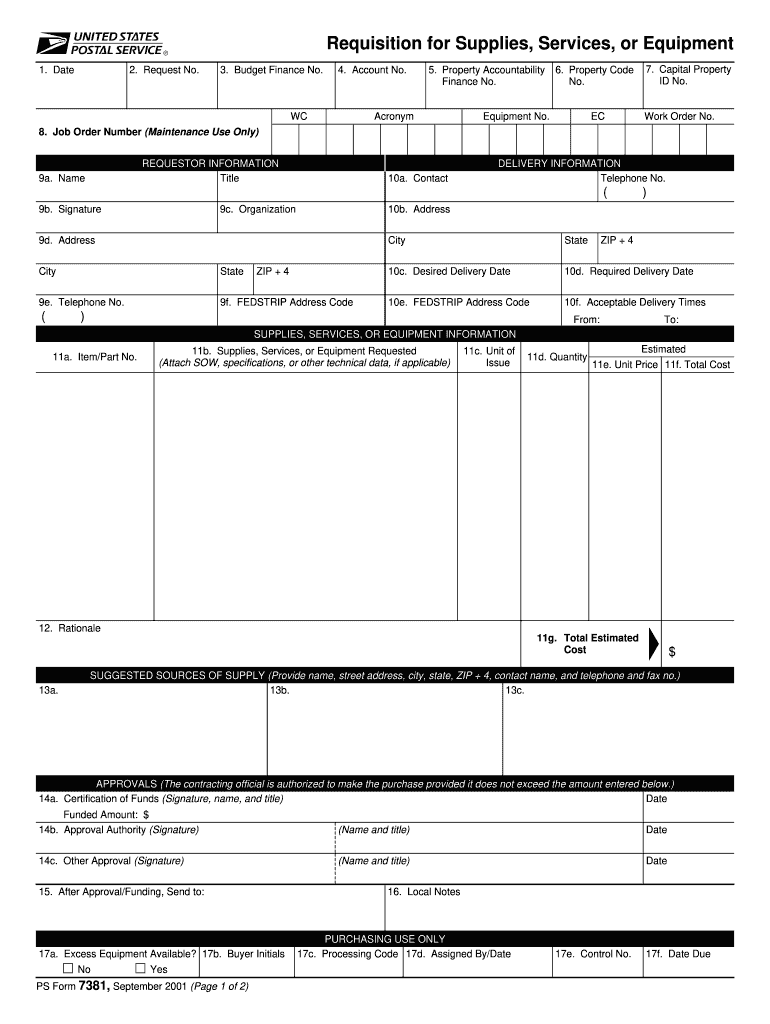

After Approval/Funding Send to 17a. Excess Equipment Available 17b. Buyer Initials No Yes PS Form 7381 September 2001 Page 1 of 2 16. Local Notes PURCHASING USE ONLY 17c. Processing Code 17d. Assigned By/Date 17e. Control No. 17f. Date Due Instructions for Use of PS Form 7381 Requisition for Supplies Services or Equipment Use This form is used to request the purchase of supplies services or equipment.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign USPS PS 7381

Edit your USPS PS 7381 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your USPS PS 7381 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit USPS PS 7381 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit USPS PS 7381. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out USPS PS 7381

How to fill out USPS PS 7381

01

Obtain the USPS PS 7381 form from a USPS location or download it from the USPS website.

02

Begin by filling out the sender's information in the designated section, including name, address, and contact information.

03

Enter the recipient's information, ensuring that the name and address are accurate and complete.

04

Specify the type of service requested (e.g., Priority Mail, First-Class Mail) by checking the appropriate box.

05

If applicable, include details about additional services such as insurance or certified mail.

06

Indicate the weight of the package by using a scale to weigh it accurately.

07

Calculate the postage required based on weight and service type; use the postage calculator if necessary.

08

Sign and date the form at the bottom to certify that all information provided is correct.

09

Make a copy of the completed form for your records before submitting it to USPS.

Who needs USPS PS 7381?

01

Anyone who is shipping a package through USPS.

02

Businesses and individuals needing to request a shipping label or service.

03

Persons mailing valuable items who require specific services like tracking and insurance.

Fill

form

: Try Risk Free

People Also Ask about

What is a corporate accountant?

A corporate accountant helps in basic bookkeeping, extending insights regarding financial analysis, planning budgets, preparing financial reports, management of expenses and account receivables etc.

What is the difference between accountant and corporate accountant?

Public accountants work in firms selling accounting services, while corporate CPAs work at companies selling something other than accounting services (think: the accounting department at Dunder Mifflin).

What does corporate accounting department do?

What are the Key Roles of the Accounting Department? Money out – making payments and keeping the bills paid. Money in – processing incoming payments. Payroll – make sure everyone gets paid (including the government) Reporting – preparing financial reports, e.g. P&L, Balance sheets and budgets.

What is corporate accounting in simple words?

Corporate accounting is an activity that deals with analyzing, classifying, collecting, and presenting a company's financial data.

What is corporate accounting example?

Examples of these include bank transfers, checks, credit-card payments and electronic wire transfers. When handling accounts payable, corporate accountants normally focus on inventory flowing into the firm. However, they can also focus on loan payments, taxes and premise maintenance costs.

Does a corporate accountant need to be a CPA?

To become a qualified corporate accountant, individuals first need to earn a bachelor's degree in accounting. Some companies may also require the Uniform Certified Public Accountant (CPA) credential or Certified Management Accountant (CMA) credential.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit USPS PS 7381 online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your USPS PS 7381 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I edit USPS PS 7381 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign USPS PS 7381 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How can I fill out USPS PS 7381 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your USPS PS 7381 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is USPS PS 7381?

USPS PS 7381 is a form used by the United States Postal Service for reporting certain financial and operational data related to postal services.

Who is required to file USPS PS 7381?

Employees or agents of the USPS who handle specific financials or operational metrics are required to file USPS PS 7381.

How to fill out USPS PS 7381?

To fill out USPS PS 7381, you need to provide the required data in designated fields, ensuring accuracy and completeness before submission.

What is the purpose of USPS PS 7381?

The purpose of USPS PS 7381 is to collect necessary data that aids in monitoring performance and compliance within the USPS operational framework.

What information must be reported on USPS PS 7381?

Information that must be reported on USPS PS 7381 includes operational metrics, financial data, and any other specific details required by the USPS for accurate reporting.

Fill out your USPS PS 7381 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

USPS PS 7381 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.