Get the free ABC PLAN - dol

Show details

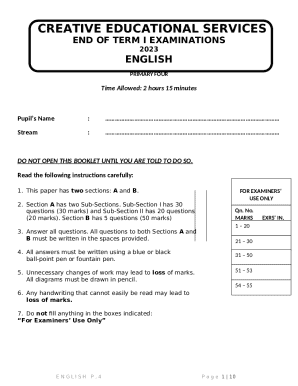

ABC PLAN

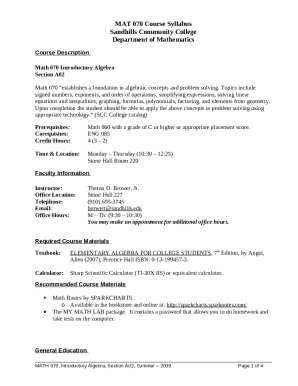

401(k) PLAN FEE DISCLOSURE FORM

For Services Provided by XYZ Company1

Overview

The Employee Retirement Income Security Act of 1974, as amended (ERICA) requires employee benefit

plan fiduciaries

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign abc plan - dol

Edit your abc plan - dol form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your abc plan - dol form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing abc plan - dol online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit abc plan - dol. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out abc plan - dol

How to fill out an ABC plan:

01

Start by gathering all the necessary information and documentation required for the ABC plan. This can include financial statements, budget projections, and any other relevant data.

02

Analyze the current situation and identify the goals and objectives of the ABC plan. This step is crucial in determining what needs to be included in the plan and how it should be structured.

03

Create a detailed outline or template for the ABC plan, including sections such as an executive summary, background information, strategies, action steps, and implementation timeline. This will help ensure that all important aspects are covered in the plan.

04

Begin filling out each section of the ABC plan, providing clear and concise information. Be sure to include specific details and examples, as well as any supporting data or research that may be relevant.

05

Review and revise the ABC plan to ensure it is comprehensive, logical, and aligned with the goals and objectives. This step is important to catch any errors or inconsistencies and make necessary adjustments.

06

Seek feedback and input from relevant stakeholders, such as management, employees, or external consultants. Their perspectives can bring valuable insights and help improve the quality of the plan.

07

Finalize the ABC plan by incorporating any feedback received and making any necessary revisions. Make sure the plan is well-organized, easy to understand, and addresses all relevant aspects.

Who needs an ABC plan:

01

Small businesses: An ABC plan can be beneficial for small businesses as it helps them manage their finances more effectively. It allows them to identify cost-saving opportunities and make informed decisions regarding resource allocation.

02

Startups: Startups often operate with limited resources and need to carefully manage their finances. An ABC plan can help them prioritize spending and allocate resources based on their business needs and objectives.

03

Non-profit organizations: Non-profit organizations also need to be mindful of their finances, as they rely on donations and fundraising efforts. An ABC plan can assist them in tracking expenses, managing budgets, and demonstrating transparency to donors.

04

Individuals or families: While typically associated with businesses, an ABC plan can also be useful for individuals or families to track their expenses, manage savings, and plan for future financial needs. It helps in understanding where the money is being spent and finding areas for potential savings or investments.

In conclusion, filling out an ABC plan requires gathering information, analyzing the situation, creating a template, detailing each section, reviewing and revising, seeking feedback, and finalizing the plan. The plan is beneficial for small businesses, startups, non-profit organizations, and individuals or families to effectively manage their finances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send abc plan - dol to be eSigned by others?

When your abc plan - dol is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit abc plan - dol online?

The editing procedure is simple with pdfFiller. Open your abc plan - dol in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit abc plan - dol in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your abc plan - dol, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is abc plan?

ABC plan is a strategic business plan that outlines the steps needed to achieve a specific goal or objective.

Who is required to file abc plan?

ABC plan is typically required to be filed by businesses or organizations as part of their strategic planning process.

How to fill out abc plan?

ABC plan can be filled out by conducting a thorough analysis of the current situation, setting specific goals, outlining strategies to achieve those goals, and monitoring progress.

What is the purpose of abc plan?

The purpose of ABC plan is to provide a roadmap for achieving a specific goal or objective in a strategic and organized manner.

What information must be reported on abc plan?

ABC plan typically includes information such as goals, objectives, strategies, timelines, resources needed, and progress indicators.

Fill out your abc plan - dol online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Abc Plan - Dol is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.