OR DoR 41 2014 free printable template

Show details

Oregon 2014 Fiduciary Income Tax Form 41 and Instructions This publication is a guide not a complete statement of Oregon Revised Statutes ORS or Oregon Department of Revenue Administrative Rules OAR. No credit is allowed if the tax has been claimed as a deduction. If a deduction for the other state s tax was claimed on Form 1041 it must be added to income on Oregon Form 41 Schedule 2 line 40. See the 2014 individual return instructions for Oregon Form 40 line 38 for how to figure the credit....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OR DoR 41

Edit your OR DoR 41 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OR DoR 41 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OR DoR 41 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit OR DoR 41. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OR DoR 41 Form Versions

Version

Form Popularity

Fillable & printabley

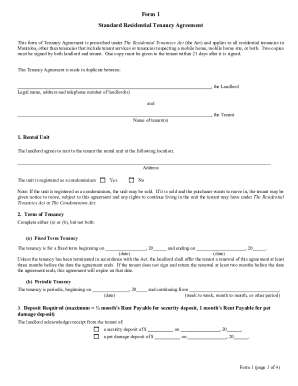

How to fill out OR DoR 41

How to fill out OR DoR 41

01

Start by obtaining the OR DoR 41 form from the appropriate authority or their website.

02

Read the instructions provided with the form carefully.

03

Fill in your personal information such as name, address, and contact details in the designated fields.

04

Provide any required identification numbers or accounts related to the form.

05

Complete all sections related to the purpose of the form, ensuring all relevant information is provided.

06

Review the form for accuracy and completeness before submitting.

07

Submit the form as per the instructions, whether online or via mail.

Who needs OR DoR 41?

01

Individuals or businesses required to report specific information to tax authorities.

02

People seeking refunds or credits related to tax overpayments.

03

Anyone needing to fulfill compliance obligations as set by relevant government regulations.

Fill

form

: Try Risk Free

People Also Ask about

Do beneficiaries pay taxes on estate distributions in Oregon?

Oregon has no inheritance tax. When state residents and individuals who own property in the state begin their estate planning process, they may need to take Oregon's estate tax into consideration.

Does oregon require e file authorization form?

To electronically sign a federal tax return, taxpayers must use federal Form 8879, IRS e-file Signature Authorization, and generate a federal personal identification number (PIN). Oregon accepts the use of a federal PIN signature as signing the Oregon return. Don't use Form OR-EF if using a federal PIN signature.

What is a 10/40 form used for?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Does Oregon have an eFile authorization form?

Federal Form 8879 - IRS e-file Signature Authorization If a return is not signed electronically, the taxpayer must use Oregon Form EF - Oregon Individual Income Tax Declaration for Electronic Filing. Oregon Form EF is to be signed and retained by the taxpayer and tax preparer.

Does everyone have to fill out a 10/40 form?

While people with more complicated tax situations may need more forms and schedules, everyone filing taxes will need to fill out Form 1040 in order to file their taxes.

What is e-file authorization?

The taxpayer authorizes the ERO to enter or generate the taxpayer's personal identification number (PIN) on his or her e-filed individual income tax return.

Who must file a 1041 tax return?

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes.

What assets are subject to Oregon estate tax?

The Oregon Estate Tax The estate tax applies if the total value of all assets comes to at least $1 million or more. An estate may be subject to the estate tax even if the decedent was not a resident of Oregon.

Is Oregon accepting eFile returns now?

Oregon State Income Taxes for Tax Year 2022 (January 1 - Dec. 31, 2022) can be prepared and e-Filed now along with an IRS or Federal Income Tax Return (or you can learn how to only prepare and file a OR state return). The Oregon tax filing and tax payment deadline is April 18, 2023.

How much can you inherit in Oregon without paying taxes?

Oregon Estate Tax Exemption The Oregon estate tax threshold is $1 million. Any estate exceeding that amount that is taxable, but the first $1 million is still not taxed.

How do I avoid oregon estate tax?

There are many options to avoid paying Oregon death taxes, including bypass trusts, lifetime giving, charitable giving, and Irrevocable Life Insurance Trusts, but you should get on top of it now so that your estate, and your loved ones who you would like to inherit from you, don't have an unwelcome bill from the Oregon

Who must file a Pennsylvania partnership tax return?

A partnership must file a PA-20S/PA-65 Information Return to report the income, deductions, gains, losses etc. from their operations. The partnership passes through any profits (losses) to the resident and nonresident partners.

Who must file a PA nonresident return?

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when they received total PA gross taxable income more than $33, even if no PA tax is due.

What are two methods of avoiding the estate tax?

How to Avoid the Estate Tax Give gifts to family. Set up an irrevocable life insurance trust. Make charitable donations. Establish a family limited partnership. Fund a qualified personal residence trust.

Do I need to file 1041 if no income?

Form 1041 is not needed if there is less than $600 of gross income, there is no taxable income and there aren't any nonresident alien beneficiaries.

Who must file a fiduciary tax return?

The IRS requires the filing of an income tax return for trusts and estates on Form 1041—formerly known as the fiduciary income tax return. This is because trusts and estates must pay income tax on their income just like you report your own income on a personal tax return each year.

What is a 10 41 form?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

What is PA-41 used for?

Use PA-41 Schedule A to report interest income and gambling and lottery winnings of estates and trusts. Enter the complete name of the estate or trust as shown on the PA-41, Fiduciary Income Tax Return.

Who must file a PA 41?

The fiduciary of an estate or trust is required under Pennsylvania law to file a PA-41 Fiduciary Income Tax Return, and pay the tax on the taxable income of such estate or trust. If two or more fiduciaries are acting jointly, the return may be filed by any one of them.

What is the Oregon filing requirement?

You must file an Oregon income tax return if: Your filing status isAnd your Oregon gross income is more thanCan be claimed on another's return$1,100*Single$2,350Married filing jointly$4,700Married filing separately If spouse claims standard deduction. If spouse itemizes deductions. $2,350 -0-4 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify OR DoR 41 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your OR DoR 41 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I complete OR DoR 41 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your OR DoR 41, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Can I edit OR DoR 41 on an Android device?

You can make any changes to PDF files, like OR DoR 41, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

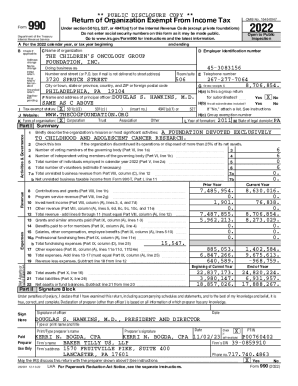

What is OR DoR 41?

OR DoR 41 is a tax form used in the state of Oregon for reporting personal income taxes and certain business taxes to the Department of Revenue.

Who is required to file OR DoR 41?

Individuals and businesses in Oregon with taxable income or those who meet specific filing thresholds are required to file OR DoR 41.

How to fill out OR DoR 41?

To fill out OR DoR 41, taxpayers should provide their personal and financial information, calculate their total income, deductions, and credits, and report the final tax amount owed or refund due.

What is the purpose of OR DoR 41?

The purpose of OR DoR 41 is to ensure proper reporting of income and payment of taxes owed to the state of Oregon, enabling the state to collect necessary revenue for public services.

What information must be reported on OR DoR 41?

ON OR DoR 41, taxpayers must report information such as their total income, adjustments, deductions, credits, and any taxes paid or refundable amounts.

Fill out your OR DoR 41 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OR DoR 41 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.