Get the free Gift Letter ENdocx - aim ca

Show details

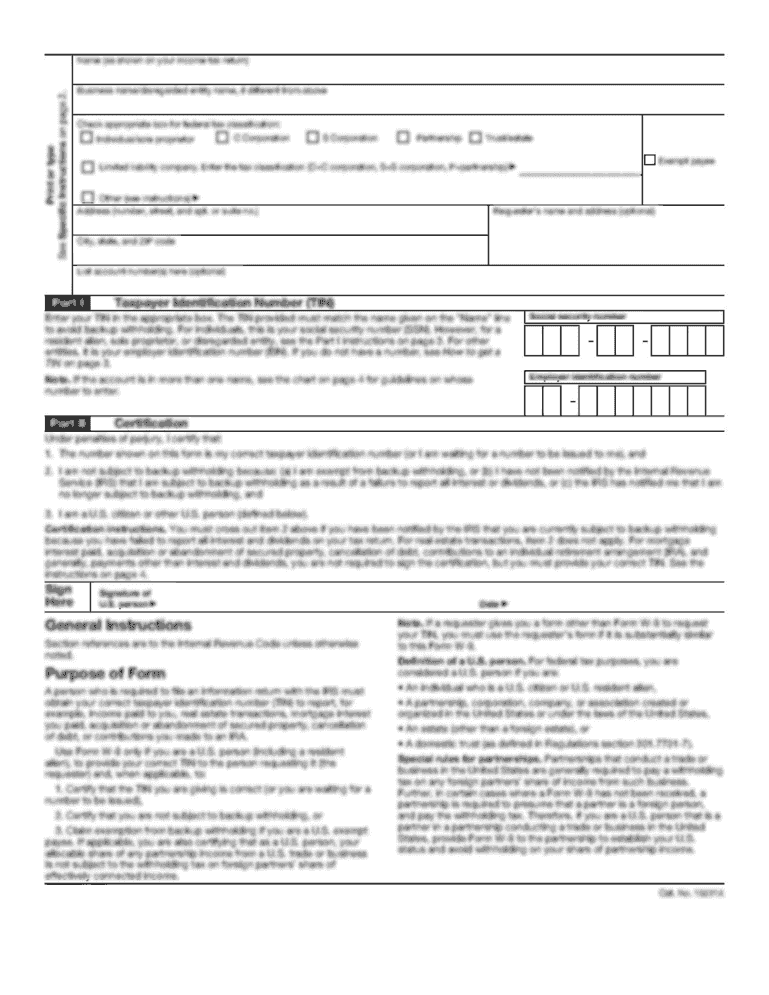

MAP Gift Income Letter EN 01/30/2015. Sample Gift Letter. Today's Date: Medical Access Program. P.O. Box 15559. Sacramento, CA 958520559.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gift letter endocx form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift letter endocx form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gift letter endocx online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gift letter endocx. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

How to fill out gift letter endocx

How to Fill Out a Gift Letter Endocx:

01

Start by opening the gift letter endocx document in the software or program of your choice.

02

Begin filling out the necessary information, such as the recipient's name, address, and contact details. Make sure to provide accurate and up-to-date information.

03

Specify the donor's details, including their name, address, and contact information. Ensure that all information regarding the donor is correct.

04

Indicate the relationship between the donor and the recipient. This is important as it helps establish the legitimacy of the gift.

05

Provide a clear description and value of the gift being given. If it is a monetary gift, state the exact amount. If it is a physical item, describe it in detail and provide an estimated value.

06

Include any additional details relevant to the gift transaction, such as any conditions or restrictions that may apply.

07

Sign and date the gift letter. Both the donor and the recipient should sign the document to acknowledge and confirm their agreement to the terms stated in the letter.

08

Save the completed gift letter endocx document and ensure that it is easily accessible for future reference.

Who Needs a Gift Letter Endocx?

01

Individuals who plan to give or receive a gift of significant value may need a gift letter endocx. This document serves as proof of the gift, its value, and the terms of the transaction.

02

Real estate transactions often require a gift letter endocx when the down payment or a portion of the purchase price is being gifted. Lenders may require this document to verify the legitimacy of the gift and ensure that it won't affect the borrower's ability to repay the loan.

03

Parents or family members who are gifting funds to their children for various purposes, such as education or property purchases, may need to provide a gift letter endocx to demonstrate that the funds are not loans but rather gifts.

04

Non-profit organizations that receive significant donations from individuals or organizations may request a gift letter endocx to acknowledge and document the donor's contribution.

Overall, a gift letter endocx is a crucial document that helps establish the legitimacy and terms of a gift transaction. It is necessary to accurately complete the document and ensure that it is easily accessible for future reference.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gift letter endocx?

Gift letter endocx is a legal document used to prove that a gift was given to someone, usually in the context of a real estate transaction.

Who is required to file gift letter endocx?

The person giving the gift is required to file the gift letter endocx.

How to fill out gift letter endocx?

Gift letter endocx can be filled out by providing details about the gift, including the amount, description of the gift, and the relationship between the giver and receiver.

What is the purpose of gift letter endocx?

The purpose of gift letter endocx is to document the gift and ensure that it was given willingly and without expectation of repayment.

What information must be reported on gift letter endocx?

Information such as the amount of the gift, the date it was given, the names of the giver and receiver, and their relationship must be reported on gift letter endocx.

When is the deadline to file gift letter endocx in 2023?

The deadline to file gift letter endocx in 2023 is typically the same as the tax filing deadline, which is usually April 15th.

What is the penalty for the late filing of gift letter endocx?

The penalty for late filing of gift letter endocx can vary depending on the specific circumstances, but it could result in fines or other consequences.

How can I send gift letter endocx to be eSigned by others?

Once you are ready to share your gift letter endocx, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete gift letter endocx online?

Completing and signing gift letter endocx online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit gift letter endocx on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign gift letter endocx on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your gift letter endocx online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.