Get the free Transfer of Ownership/Change Beneficiary/ Change Annuitant

Show details

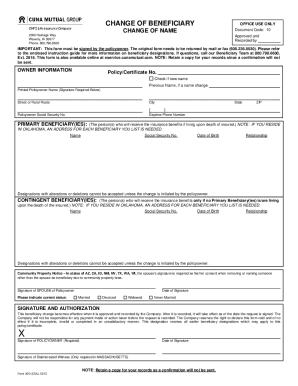

Transfer of Ownership/Change Beneficiary/ Change Annuitant INSURER: FIDELITY & GUARANTY LIFE INSURANCE COMPANY Contract No. Insured / Annuitant Part A: Transfer of Ownership The undersigned hereby

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your transfer of ownershipchange beneficiary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transfer of ownershipchange beneficiary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing transfer of ownershipchange beneficiary online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit transfer of ownershipchange beneficiary. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

How to fill out transfer of ownershipchange beneficiary

To fill out a transfer of ownershipchange beneficiary, follow these steps:

01

Obtain the necessary forms: Contact the relevant institution or organization to obtain the transfer of ownershipchange beneficiary forms. These forms may vary based on the specific situation or asset involved.

02

Review the instructions: Read the instructions carefully to understand the requirements and procedures for filling out the forms correctly. Pay attention to any supporting documents or additional information that may be needed.

03

Gather the required information: Collect all the necessary information related to the transfer of ownershipchange beneficiary. This may include personal details of the current owner, details of the new beneficiary, and any supporting documentation such as identification proofs or legal documents.

04

Fill out the forms accurately: Complete the transfer of ownershipchange beneficiary forms accurately and legibly. Provide the requested information in the appropriate sections, ensuring that all necessary fields are filled out.

05

Double-check for accuracy: Before submitting the forms, review them thoroughly to ensure that all the information provided is correct and complete. Pay attention to any specific instructions or special requirements mentioned in the forms.

06

Attach supporting documents: If any supporting documents are required, make sure to attach them securely to the completed forms. These may include identification proofs, proof of relationship, or any other relevant documentation.

07

Submit the forms: Once you are confident that the forms are correctly filled out and all necessary attachments are included, submit the transfer of ownershipchange beneficiary forms as instructed. This may involve mailing them, submitting them online, or personally delivering them to the designated office or authority.

Who needs transfer of ownershipchange beneficiary?

01

Individuals: People who wish to transfer ownership of their assets, such as property, bank accounts, or investments, may need to fill out a transfer of ownershipchange beneficiary form. This allows them to designate a new beneficiary or change the existing one.

02

Companies or organizations: Businesses or organizations that need to transfer ownership of their assets or change the beneficiary may also require a transfer of ownershipchange beneficiary form. This can include transferring shares, changing partnership or ownership structures, or reassigning assets.

03

Trusts or estates: In the case of trusts or estates, a transfer of ownershipchange beneficiary form may be necessary to update beneficiary designations, distribute assets, or modify the terms of a trust agreement.

In summary, anyone who needs to transfer ownership of assets or change the designated beneficiary may require a transfer of ownershipchange beneficiary form. This applies to individuals, companies, organizations, trusts, or estates.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is transfer of ownershipchange beneficiary?

Transfer of ownershipchange beneficiary refers to the process of transferring ownership of an asset or property to a new beneficiary.

Who is required to file transfer of ownershipchange beneficiary?

The current owner or executor of the asset or property is typically required to file transfer of ownershipchange beneficiary.

How to fill out transfer of ownershipchange beneficiary?

To fill out a transfer of ownershipchange beneficiary, you will need to provide information about the current owner, the new beneficiary, and details of the asset or property being transferred. You may also need to attach supporting documents or forms as required by the governing authority.

What is the purpose of transfer of ownershipchange beneficiary?

The purpose of transfer of ownershipchange beneficiary is to legally transfer the rights and ownership of an asset or property from one individual or entity to another.

What information must be reported on transfer of ownershipchange beneficiary?

The transfer of ownershipchange beneficiary form typically requires the reporting of information such as names and contact details of the current owner and new beneficiary, description of the asset or property being transferred, and any relevant identifying numbers or documentation.

When is the deadline to file transfer of ownershipchange beneficiary in 2023?

The deadline to file transfer of ownershipchange beneficiary in 2023 may vary depending on the jurisdiction and specific circumstances. It is advisable to consult with the relevant governing authority or seek professional advice to determine the specific deadline for your situation.

What is the penalty for the late filing of transfer of ownershipchange beneficiary?

The penalty for the late filing of transfer of ownershipchange beneficiary may vary depending on the governing authority and applicable regulations. It is advisable to consult with the relevant authority or seek professional advice to understand the specific penalties or consequences for late filing.

How can I get transfer of ownershipchange beneficiary?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the transfer of ownershipchange beneficiary in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I sign the transfer of ownershipchange beneficiary electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your transfer of ownershipchange beneficiary in seconds.

How do I edit transfer of ownershipchange beneficiary straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing transfer of ownershipchange beneficiary.

Fill out your transfer of ownershipchange beneficiary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.