Get the free GST-QST New Housing Rebate Application: Owner of a ...

Show details

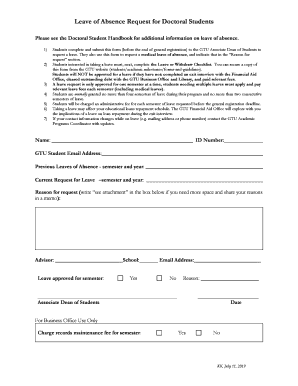

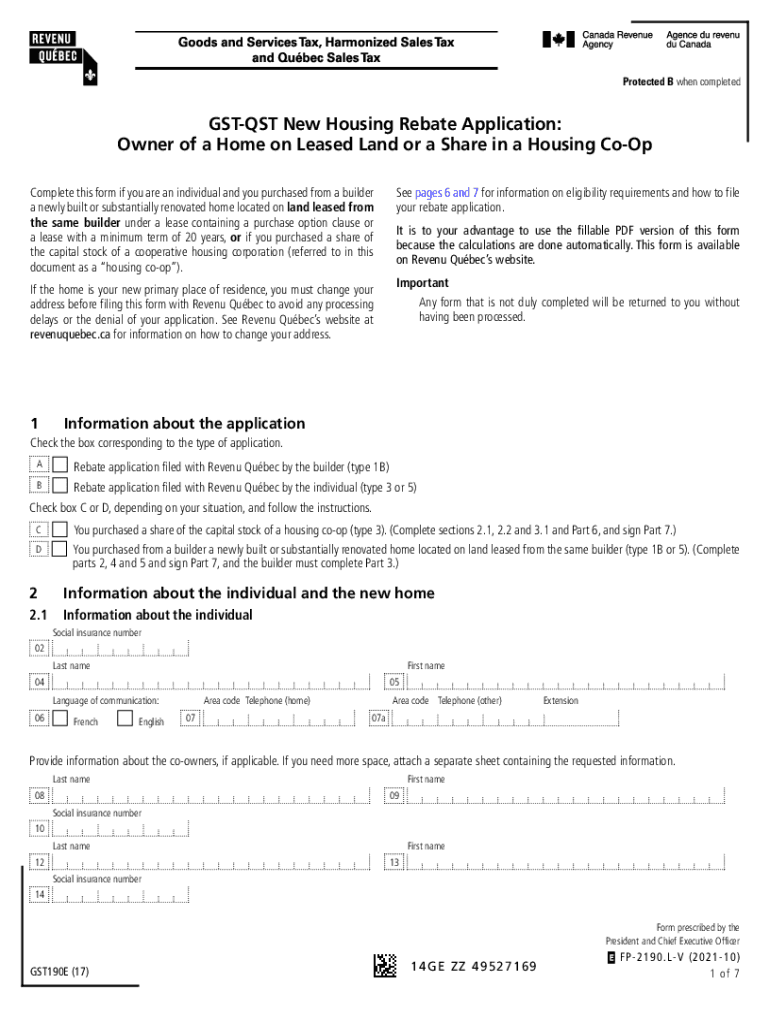

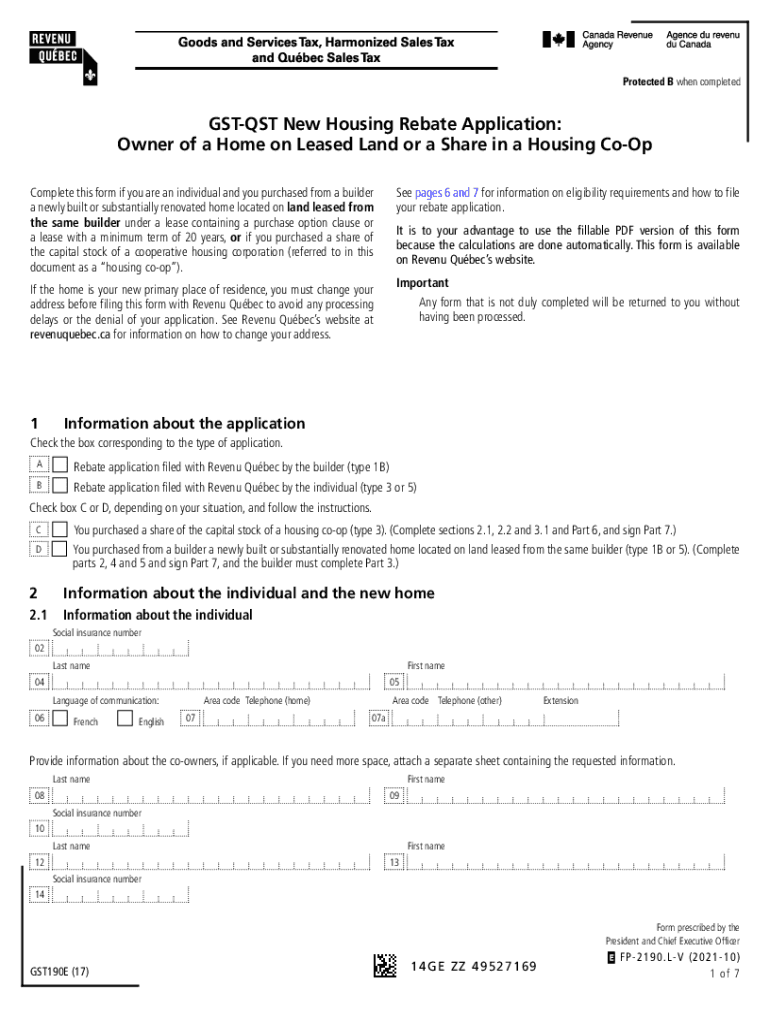

Navigation pointersProtected B when completedNoticeGSTQST New Housing Rebate Application: Owner of a Home on Leased Land or a Share in a Housing Coop Complete this form if you are an individual, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gst-qst new housing rebate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gst-qst new housing rebate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gst-qst new housing rebate online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit gst-qst new housing rebate. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out gst-qst new housing rebate

How to fill out gst-qst new housing rebate

01

Make sure you meet the eligibility criteria for the GST-QST new housing rebate.

02

Complete the GST190 - GST/HST New Housing Rebate Application for Houses Purchased from a Builder form.

03

Include all required supporting documents such as purchase agreement, occupancy permit, and proof of payment.

04

Submit the completed application and supporting documents to the Canada Revenue Agency (CRA) within the specified time frame.

05

Wait for a response from the CRA regarding the status of your rebate application.

Who needs gst-qst new housing rebate?

01

Individuals who have purchased a new or substantially renovated home in Canada may be eligible for the GST-QST new housing rebate.

02

Builders or vendors of new homes may also need to apply for the rebate on behalf of their clients.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find gst-qst new housing rebate?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific gst-qst new housing rebate and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in gst-qst new housing rebate?

The editing procedure is simple with pdfFiller. Open your gst-qst new housing rebate in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an eSignature for the gst-qst new housing rebate in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your gst-qst new housing rebate right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Fill out your gst-qst new housing rebate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.