Get the free Liabilities, capital and surplus - dfs ny

Show details

NEW YORK STATE DEPARTMENT OF FINANCIAL SERVICES

REPORT ON FINANCIAL CONDITION EXAMINATION

OF

THE UNITED STATES LIFE INSURANCE COMPANY

IN THE CITY OF NEW PRECONDITION:DECEMBER 31, 2011DATE OF REPORT:JUNE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

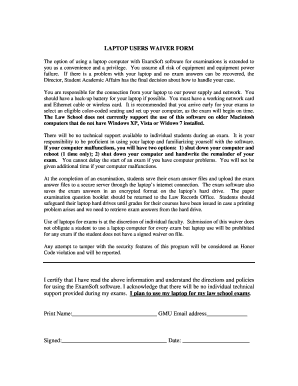

Edit your liabilities capital and surplus form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your liabilities capital and surplus form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing liabilities capital and surplus online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit liabilities capital and surplus. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out liabilities capital and surplus

How to fill out liabilities capital and surplus:

01

Identify the liabilities: Start by identifying all the current and long-term liabilities the company owes. This can include loans, accounts payable, accrued expenses, and other financial obligations.

02

Calculate the capital: Calculate the capital of the company, which includes the amount of money invested by the owners or shareholders, as well as any retained earnings or profits. This can be determined by subtracting total liabilities from total assets.

03

Determine the surplus: The surplus represents the excess of assets over liabilities and capital. It reflects the retained earnings or profits accumulated by the company over time. Calculate the surplus by subtracting the total liabilities and capital from the total assets of the company.

04

Fill out the liabilities section: Enter the specific details of each liability in the appropriate section of the financial statement. Include the name of the creditor, the amount owed, the terms of repayment, and any other relevant information.

05

Fill out the capital section: Record the details of the capital invested by the owners or shareholders. Include the name of the investor, the amount invested, and any relevant terms or conditions.

06

Fill out the surplus section: Include the calculated surplus amount in the relevant section of the financial statement. This represents the accumulated profits or earnings of the company.

Who needs liabilities capital and surplus?

01

Business owners: Business owners need to understand the liabilities, capital, and surplus of their company to assess the financial health and stability of their business. It helps them make informed decisions regarding investments, expansion, or loan repayments.

02

Investors: Potential investors analyze the liabilities and capital structure of a company to evaluate its financial stability and growth potential. The surplus is also a critical factor in assessing the profitability and long-term viability of the company.

03

Creditors: Creditors, such as banks or suppliers, need to assess the liabilities and capital of a company before extending credit or providing loans. This helps them determine the creditworthiness and ability of the company to repay its debts.

04

Financial analysts: Financial analysts rely on the liabilities, capital, and surplus of a company to evaluate its financial performance, profitability, and overall financial standing. This information is used to generate financial reports, ratios, and forecasts for investors, stakeholders, and management.

05

Regulatory authorities: Regulatory authorities and government agencies require companies to report their liabilities, capital, and surplus as part of their financial disclosures. This information helps in ensuring compliance with accounting standards and regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is liabilities capital and surplus?

Liabilities capital and surplus refers to the financial obligations, equity capital, and excess amount of assets over liabilities of a company.

Who is required to file liabilities capital and surplus?

Companies and organizations are required to file liabilities capital and surplus as part of their financial reporting and compliance obligations.

How to fill out liabilities capital and surplus?

Liabilities capital and surplus can be filled out by compiling all financial data related to the company's liabilities, capital, and surplus, and reporting them accurately in the designated forms.

What is the purpose of liabilities capital and surplus?

The purpose of liabilities capital and surplus is to provide a comprehensive overview of a company's financial position, including its debts, equity capital, and overall financial health.

What information must be reported on liabilities capital and surplus?

Information such as total liabilities, total capital, total surplus, and any other relevant financial data must be reported on liabilities capital and surplus.

When is the deadline to file liabilities capital and surplus in 2023?

The deadline to file liabilities capital and surplus in 2023 is typically set by regulatory authorities and may vary depending on the jurisdiction.

What is the penalty for the late filing of liabilities capital and surplus?

The penalty for late filing of liabilities capital and surplus may include fines, sanctions, or other forms of enforcement action by regulatory authorities.

How can I send liabilities capital and surplus for eSignature?

When you're ready to share your liabilities capital and surplus, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I edit liabilities capital and surplus on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing liabilities capital and surplus, you need to install and log in to the app.

How do I edit liabilities capital and surplus on an Android device?

The pdfFiller app for Android allows you to edit PDF files like liabilities capital and surplus. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your liabilities capital and surplus online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.