CEFCU Totten Trust Designation 2012-2024 free printable template

Show details

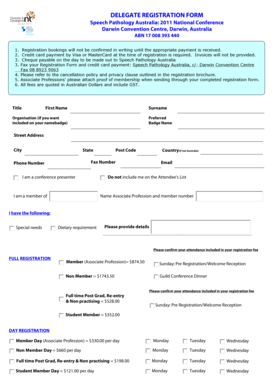

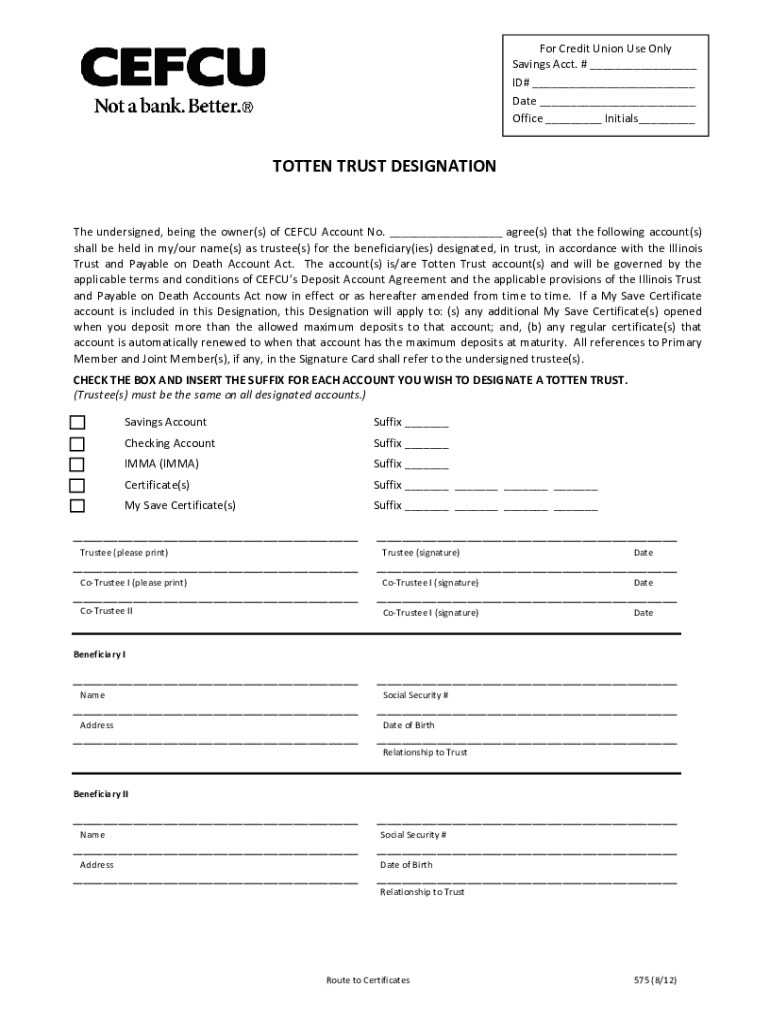

GOTTEN TRUST DESIGNATION Use this form to add beneficiaries to your Gotten Trust account. To change beneficiaries to an existing Gotten Trust account, you must (1) first complete a Gotten Trust Revocation

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your totten trust form pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your totten trust form pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing totten trust form pdf online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit totten trust form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

How to fill out totten trust form pdf

How to fill out totten trust form?

01

Start by obtaining a copy of the totten trust form. You can usually find this form online or obtain it from your financial institution.

02

Read the form carefully to understand the requirements and instructions. Make sure you have all the necessary information and documentation before proceeding.

03

Begin by filling out your personal information, including your name, address, and contact details. Provide any other requested information, such as your social security number or date of birth.

04

Next, designate the beneficiary or beneficiaries of the trust. Include their full names, addresses, and any other required details. If you have multiple beneficiaries, indicate the specific portion or percentage each will receive.

05

Determine the type of account you wish to create with the totten trust. This could be a savings account, money market account, or any other type offered by your financial institution. Specify the account number or type in the appropriate section.

06

Consider whether you want to add any special instructions or conditions to the trust. For example, you may want to specify that the funds should only be distributed to the beneficiary once they reach a certain age or achieve a specific milestone.

07

Review all the information you have entered on the totten trust form for accuracy. Double-check spellings, addresses, and other details to ensure there are no errors.

08

Sign and date the form in the designated sections. If required, have the form notarized by a certified notary public.

09

Make copies of the completed totten trust form for your records and submit the original form to your financial institution as instructed.

Who needs totten trust form?

01

Individuals who want to set up a simple and straightforward way to transfer assets upon their death may need a totten trust form.

02

Parents or guardians who want to provide for their minor children or ensure funds are set aside for their education can benefit from the use of a totten trust.

03

Those who want to avoid probate and ensure a smooth transfer of assets to their designated beneficiaries may choose to establish a totten trust.

04

Individuals who wish to retain control over their assets during their lifetime but want to plan for their distribution after death may also utilize a totten trust.

Fill form : Try Risk Free

People Also Ask about totten trust form pdf

What is the difference between a beneficiary and a Totten trust?

Is it better to have a beneficiary or a trust?

What are the disadvantages of Totten trust?

What is a Totten trust form?

What is the difference between a pod and a Totten trust?

What is the disadvantage of a Totten trust?

Who is the beneficiary of a Totten trust?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is totten trust form?

A Totten Trust, also known as a Payable-on-Death (POD) account or a Totten trust account, is a type of informal revocable trust that is set up at a bank. It allows an individual to designate a beneficiary who will receive the funds in the account upon the depositor's death, without having to go through probate. The depositor retains full control and ownership of the funds during their lifetime, and can make withdrawals or close the account any time. The designated beneficiary only gains access to the funds after the depositor's death by providing necessary documentation. Totten trusts are simple and inexpensive to set up, making them a popular choice for individuals who want a simple way to transfer funds upon their death.

Who is required to file totten trust form?

The account owner or the grantor is required to file a Totten Trust form. The form is typically filed with the financial institution where the Totten Trust account is established.

How to fill out totten trust form?

To fill out a Totten Trust form, follow these steps:

1. Obtain the Totten Trust form: You can usually find this form at your local bank or financial institution. You may also be able to download it from their website.

2. Understand the requirements: Read through the form carefully to understand what information is required. Make sure you have all the necessary documentation and details ready before you start filling it out.

3. Provide personal information: Fill in your full legal name, address, date of birth, and any other personal identification details requested on the form.

4. Appoint the beneficiary: Designate the person or organization who will receive the trust assets upon your death. Provide their full name, address, and relationship to you.

5. Specify the trust assets: Indicate what assets you are placing in the trust. This can include cash, securities, real estate, or any other eligible property.

6. Sign the form: Put your signature and date on the relevant sections of the form. Some forms may require witnesses or notarization, so follow the instructions accordingly.

7. Keep a copy for yourself: Make sure to retain a copy of the completed form for your records.

8. Submit the form: Return the completed form to the bank or financial institution that provided it. They will process the form and set up the Totten Trust account for you.

Note: It is advisable to consult with an attorney or financial advisor while setting up a Totten Trust to ensure it aligns with your specific needs and circumstances.

What is the purpose of totten trust form?

The purpose of a Totten Trust form, also known as a Pay-on-Death (POD) or Transfer-on-Death (TOD) account, is to allow an individual to designate a beneficiary who will receive the assets held in the account upon the account holder's death. This type of trust form is commonly used for bank accounts, certificates of deposit (CDs), and investment accounts.

The main goal of a Totten Trust is to avoid the probate process. Probate is the legal process through which a deceased person's assets are distributed to their beneficiaries. By designating a beneficiary in a Totten Trust form, the assets held in the account pass directly to the beneficiary upon the account holder's death, bypassing probate.

Totten Trusts provide a simple and efficient way to transfer assets upon death, as the account holder can change or revoke the designation at any time during their lifetime. They are often used when an individual wants to ensure a specific person or organization receives the assets without the need for a will or going through probate.

What information must be reported on totten trust form?

When creating a totten trust, the following information needs to be reported on the form:

1. The name and contact information of the settlor (the person creating the trust).

2. The name and contact information of the beneficiary (the individual who will receive the trust assets upon the settlor's death).

3. The type of assets being placed in the totten trust (e.g., cash, stocks, bonds).

4. The value of the assets being placed in the trust.

5. The name and contact information of the financial institution where the totten trust account will be held.

6. Any specific instructions or conditions regarding the distribution of the assets upon the settlor's death.

7. The date the totten trust is being created.

It is important to note that the specific reporting requirements may vary depending on the jurisdiction and the financial institution involved. It is advisable to consult with a legal or financial professional to ensure compliance with all applicable regulations.

How do I make edits in totten trust form pdf without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your totten trust form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I sign the totten trust form bank electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I edit totten trust on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute cefcu totten trust from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your totten trust form pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Totten Trust Form Bank is not the form you're looking for?Search for another form here.

Keywords relevant to totten trust cefcu form

Related to printable totten trust forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.