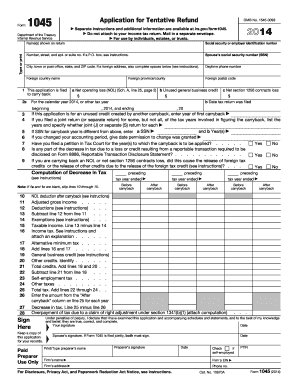

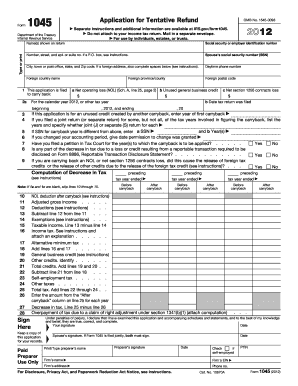

IRS 1045 2013 free printable template

Get, Create, Make and Sign

How to edit 2013 form 1045 online

IRS 1045 Form Versions

How to fill out 2013 form 1045

How to fill out 2013 form 1045:

Who needs 2013 form 1045?

Instructions and Help about 2013 form 1045

Hey it's tax quips time from tax mother come today tax mother yours from Marvin in the tax quips forum who needs clarification on Form 10:45 where can I carry net operating losses back for up to five years and in what order do I do that do I start with the fifth year then the fourth and three to one or do I start with the most recent year and work back to the fifth year and how long is the carry forward period my situation involves goes properties well Marvin yes I am familiar with form 1040 five and by definition it's designed to carry losses back to generate a quick refund you must file it before December 31st of the year after the NOT was created or in this case January 2nd 2012 for 2010 losses depending on the year the loss was created and the relevant tax law related to net operating losses you can use form 1045 to elect to carry the losses back anywhere from two to five years since to use the form 1040 five this year you must be dealing with a 2010 loss the only options you have are to carry it back two years except for go zones farming and qualified disaster losses go zones have a three-year carry back farming and disaster losses have a five-year carry back now the order in which you use the losses the earliest year first in other words of three years ago is 2007 then two years then one and pub 536 shows you an example right here once you've used up the go zone loss in the three years you can then carry them forward to 2011 and then for another 20 years I hope that helps and remember you can find answers to all kinds of questions about net operating losses and other tax issues free where else at tax mother dot-com

Fill form : Try Risk Free

People Also Ask about 2013 form 1045

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 2013 form 1045 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.