OK OTC 994 2013 free printable template

Show details

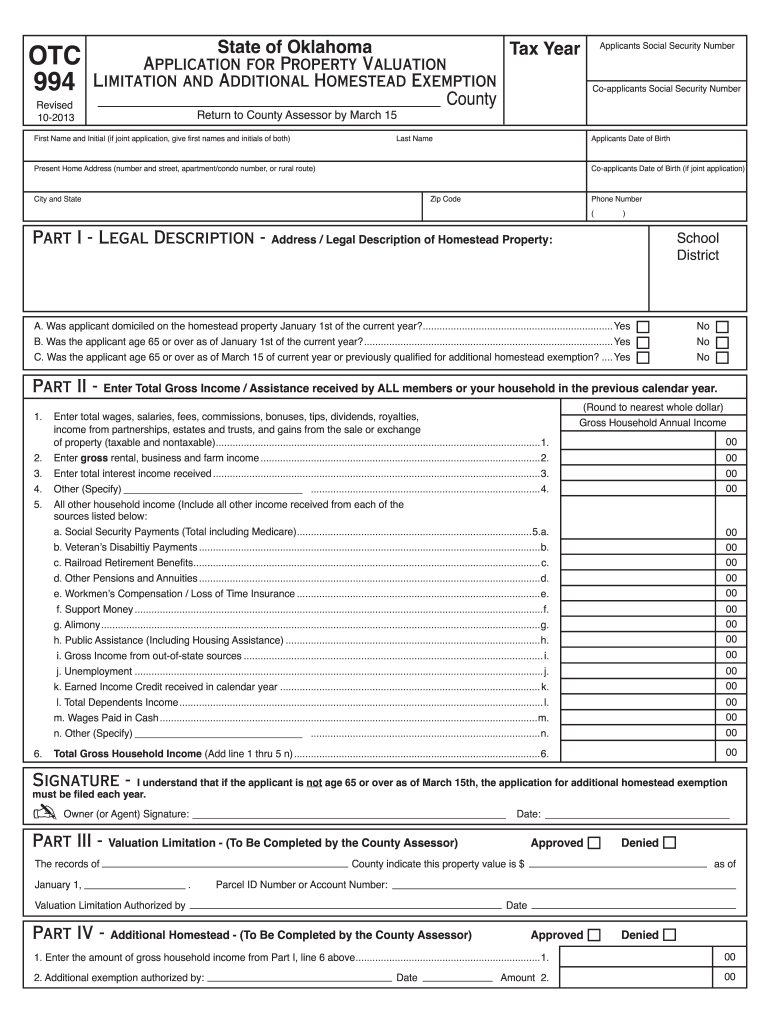

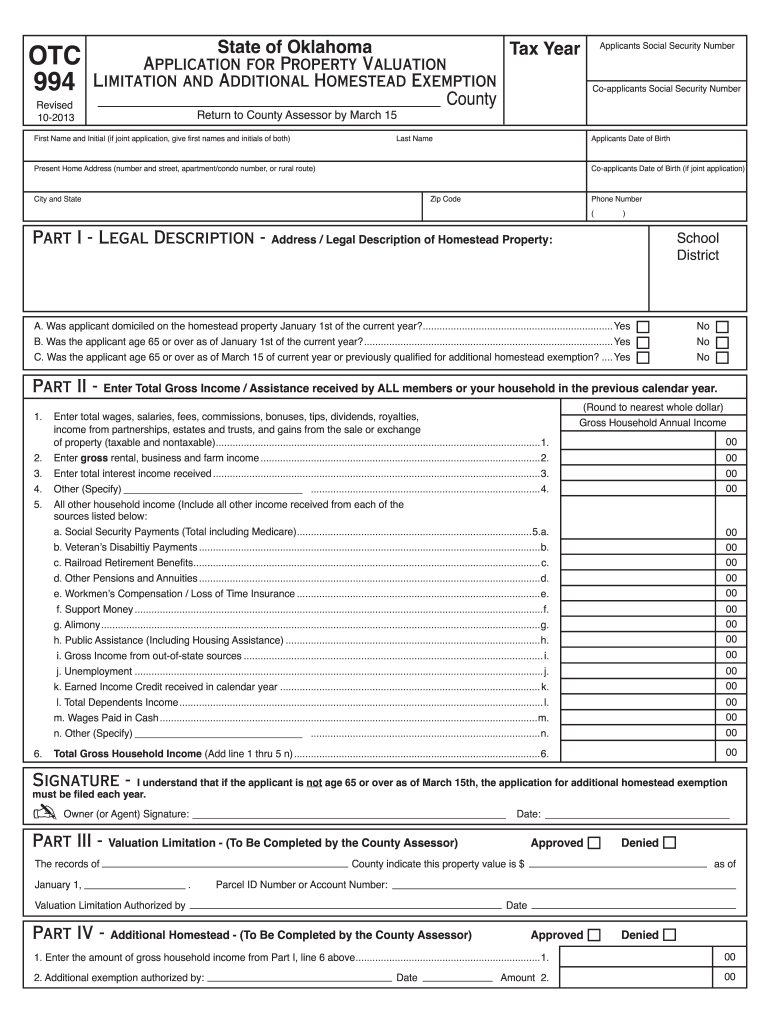

OTC

994

Revised

10-2013

State of Oklahoma

Tax Year

Application for Property Valuation

Limitation and Additional Homestead Exemption

___ County

Applicants Social Security Number

Co-applicants

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign otc 994 2013 form

Edit your otc 994 2013 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your otc 994 2013 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK OTC 994 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out otc 994 2013 form

How to fill out OK OTC 994

01

Start by gathering all necessary information related to the transaction or the assets being reported.

02

Open the OK OTC 994 form and begin filling in your details at the top, including name, address, and any relevant identification numbers.

03

Move on to section A and carefully fill out the applicable details about the transaction, including date, amounts, and any other specifics required.

04

Proceed to section B, where you will provide information about the entities involved in the transaction.

05

Review each section for accuracy, making sure all figures and information match your supporting documentation.

06

Once all sections are completed, sign and date the form at the designated area.

07

Submit the form as per the instructions provided, either electronically or via mail, making sure to keep a copy for your records.

Who needs OK OTC 994?

01

Individuals or entities involved in over-the-counter transactions that are subject to regulatory reporting requirements.

02

Businesses needing to report financial transactions to comply with OK tax laws or regulations.

03

Tax professionals and accountants managing clients' reporting obligations related to OTC transactions.

Instructions and Help about otc 994 2013 form

Fill

form

: Try Risk Free

People Also Ask about

What is the homestead exemption for seniors in Oklahoma?

(4) Maximum household income qualification for the Additional Homestead Exemption is $25,000.00 for all counties. (5) If age 65 or over and have been granted an Additional Homestead Exemption no application is required unless your gross household income exceeded $25,000.00.

How do you qualify for homestead exemption in Oklahoma?

Anyone who is 65 or older or totally disabled, who is head of household, and a resident of the state of Oklahoma during the previous year and whose gross household income does not exceed 12,000 is qualified for this program.

Do you have to file for homestead exemption in Oklahoma?

Any purchaser or new owner of real property must file an application for homestead exemption as herein provided. E. The application for homestead exemption shall be filed with the county assessor of the county in which the homestead is located.

Who is exempt from paying property taxes in Oklahoma?

You may qualify for a real and personal property tax exemption. You must be an Oklahoma resident and eligible for homestead exemption. An exemption from property tax on homesteads is available for 100% disabled veterans. The exemption would apply to 100% disability rated veterans and their surviving spouses.

Do I need to file a homestead exemption every year in Oklahoma?

Any taxpayer who has been granted a Homestead Exemption and who continues to occupy the homestead property, shall not be required to re-apply for Homestead Exemption unless the deed is changed for some reason such as sale, divorce, death, etc; and provided that all personal property taxes appearing on the lien docket

Does Oklahoma have a senior property tax exemption?

Senior citizens (65 and Older) earning $85,300 or less are eligible for the Senior Valuation Freeze which can reduce your property tax bill over time. This will freeze the taxable, or assessed value, of your residential property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is OK OTC 994?

OK OTC 994 is a form used for reporting certain types of transactions in the state of Oklahoma, specifically related to the sale of over-the-counter (OTC) medications.

Who is required to file OK OTC 994?

Individuals or businesses engaged in the sale of over-the-counter medications in Oklahoma are required to file OK OTC 994.

How to fill out OK OTC 994?

To fill out OK OTC 994, provide details including the name and address of the seller, the type of OTC medication sold, quantities, and any other required transaction details as specified by the form instructions.

What is the purpose of OK OTC 994?

The purpose of OK OTC 994 is to monitor and regulate the sale of over-the-counter medications in Oklahoma to ensure compliance with health and safety regulations.

What information must be reported on OK OTC 994?

The information that must be reported on OK OTC 994 includes the seller's name and address, the names and quantities of the OTC medications sold, the dates of the transactions, and any other relevant details as required.

Fill out your otc 994 2013 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Otc 994 2013 Form is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.