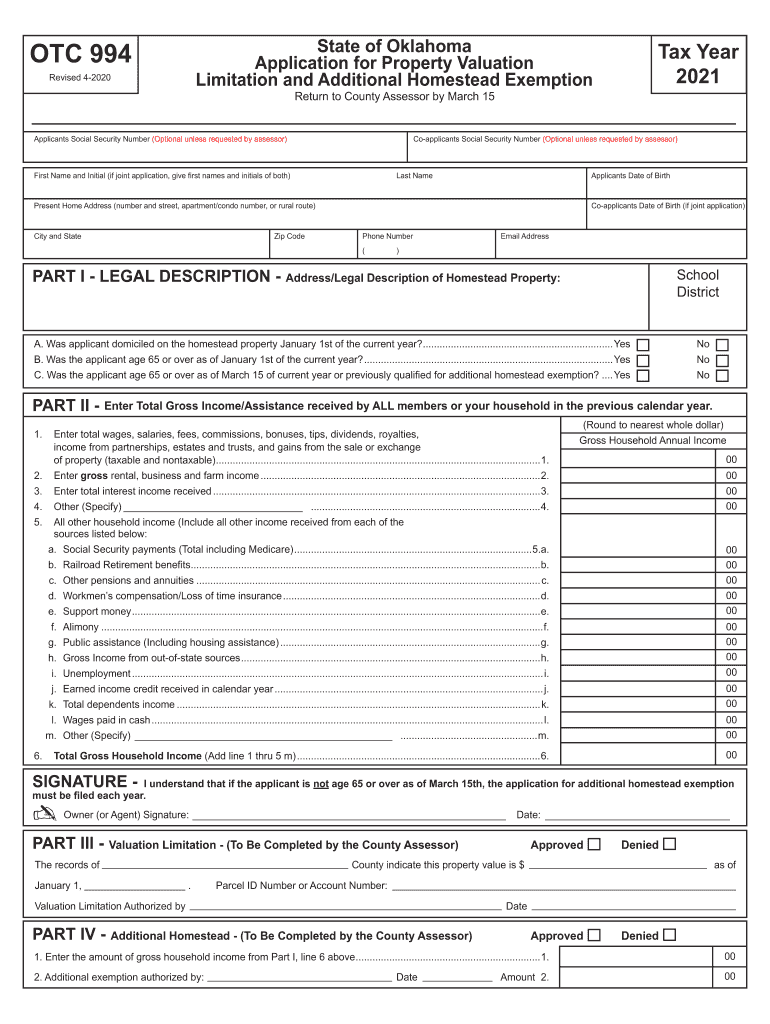

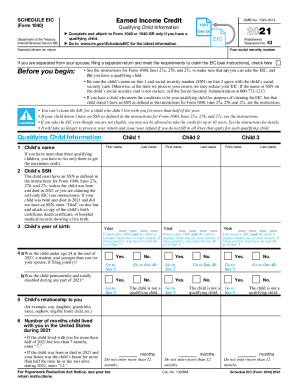

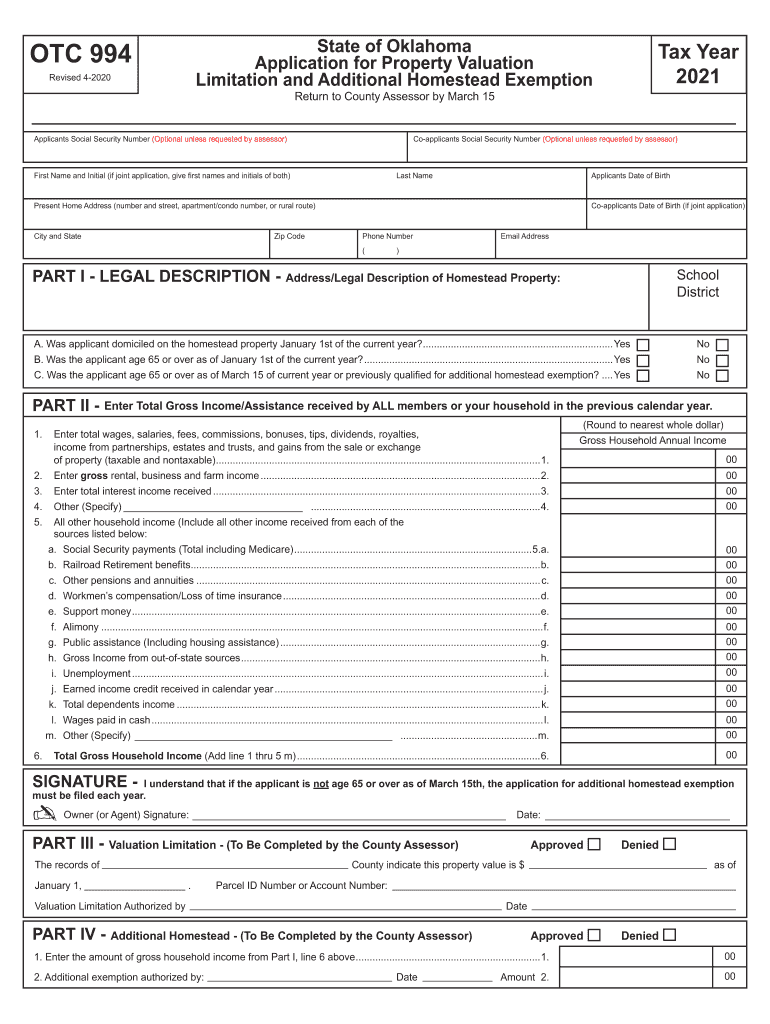

OK OTC 994 2021 free printable template

Get, Create, Make and Sign oklahoma tax homestead exemption

How to edit oklahoma tax homestead exemption online

Uncompromising security for your PDF editing and eSignature needs

OK OTC 994 Form Versions

How to fill out oklahoma tax homestead exemption

How to fill out OK OTC 994

Who needs OK OTC 994?

Instructions and Help about oklahoma tax homestead exemption

Hello folks this is stephen from secrets of tax lien investing tonight we are doing the webinar now i know we usually have the weekly webinar and i was not sure exactly what my timetable would be and if i was going to be able to buy be by the computer with the internet at the right time this evening so i was not able to so what im going to do is im just going to go ahead and record a webinar send it out to you guys to listen to so tonight where were going to be talking about is how to get started with over-the-counter tax lien investing so were going to talk about over two pounds of tax liens were going to talk about over-the-counter tax deeds and were going to go through exactly how to get started with tax lien and tax deed investing so were going to have a lot of information were going to go over this evening also if youre watching this at a later date were going to go through and look at some live over-the-counter tax liens you can purchase online so weve got a lot of information this evening lets go ahead and get started so this is some of the topics that were going to talk about today were going to talk about what is over-the-counter investing were also going to talk about how does over-the-counter tax liens and deeds work out over-the-counter tax liens and deeds work why does the county have over-the-counter properties were also going to talk about what type of properties can I find in over-the-counter lists and over-the-counter sales you know what type of properties connect by were going to go through all this information and were actually going to look at tax and certificates online that you can purchase this evening so lets go ahead and talk about over-the-counter tax liens and deeds so first of all I want to go over some quick basics just so we all have an understanding of what is tax liens what is tax deeds and what is Redemption deeds I think its important and were going to go through it quickly Im sure most of you have probably already went through this before but I could quickly want to do it in most of the webinars that I that I teach mostly because we have new students coming in and also it helps you you know you cant learn too much about tax liens indeed so lets go ahead and get through it quickly and then well get into over-the-counter so as far as tax lien certificates tax lien certificates tax liens are the enforcement method used by the government for the collection of property taxes so tax liens are lien against world property now these tax liens can be offered to us as investors what we do is we pay off the delinquent taxes and we can purchase these Evoque either at an auction a live auction at the county courthouse we can purchase them online or we can purchase them over the counter now taxing certificates they pay investors a rate of return and they give the property owners a Redemption period to repay the taxes now one thing thats incredibly important about taxing certificates is the tax lien has a foreclosure right if...

People Also Ask about

What is the homestead exemption for seniors in Oklahoma?

How do you qualify for homestead exemption in Oklahoma?

Do you have to file for homestead exemption in Oklahoma?

Who is exempt from paying property taxes in Oklahoma?

Do I need to file a homestead exemption every year in Oklahoma?

Does Oklahoma have a senior property tax exemption?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send oklahoma tax homestead exemption for eSignature?

How do I execute oklahoma tax homestead exemption online?

Can I edit oklahoma tax homestead exemption on an iOS device?

What is OK OTC 994?

Who is required to file OK OTC 994?

How to fill out OK OTC 994?

What is the purpose of OK OTC 994?

What information must be reported on OK OTC 994?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.