OK OTC 994 2016 free printable template

Show details

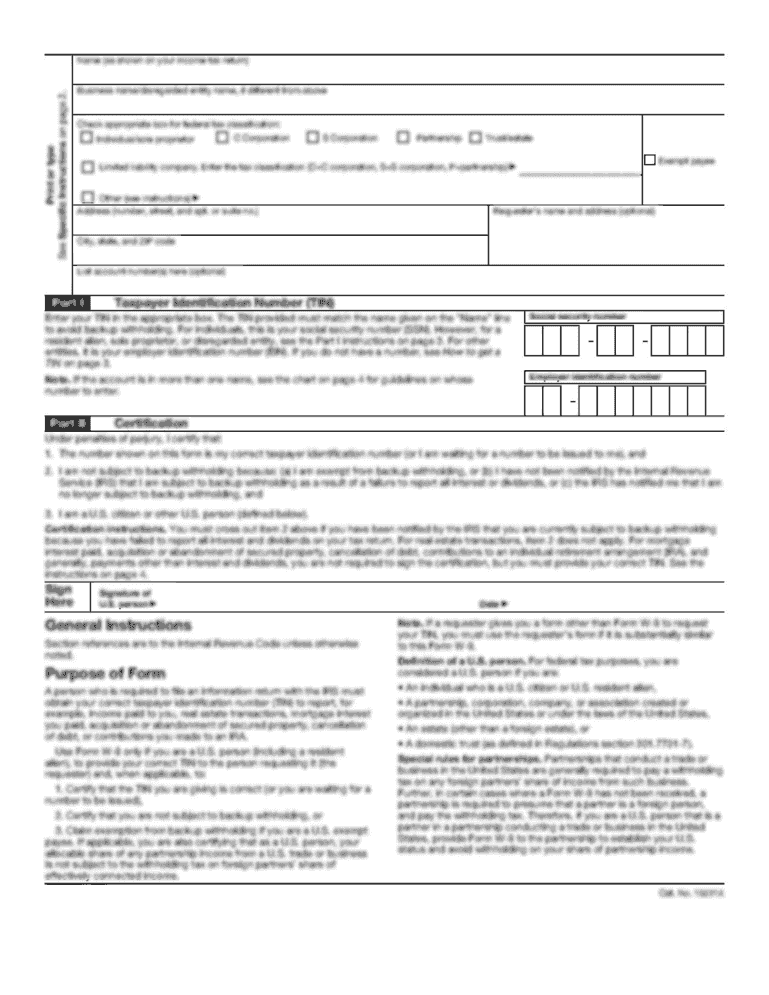

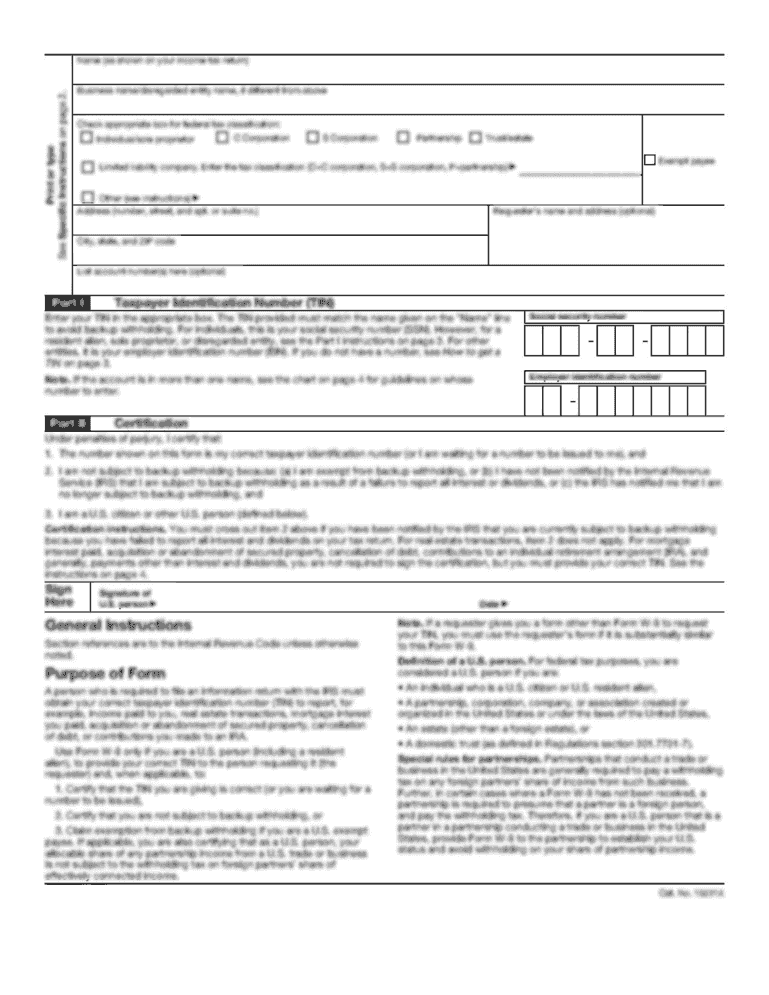

OTC Revised 11-2015 State of Oklahoma Tax Year Application for Property Valuation Limitation and Additional Homestead Exemption County 2016 Applicants Social Security Number Co-applicants Social Security Number Return to County Assessor by March 15 First Name and Initial if joint application give first names and initials of both Last Name Applicants Date of Birth Present Home Address number and street apartment/condo number or rural route City and State Zip Code Phone Number Part I - Legal...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign oklahoma tax homestead exemption

Edit your oklahoma tax homestead exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma tax homestead exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing oklahoma tax homestead exemption online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit oklahoma tax homestead exemption. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK OTC 994 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out oklahoma tax homestead exemption

How to fill out OK OTC 994

01

Obtain the OK OTC 994 form from the appropriate regulatory agency or website.

02

Carefully read the instructions provided with the form.

03

Fill in your personal information, including your name, address, and contact details in the designated sections.

04

Provide details of the over-the-counter items you are reporting, including product names, quantities, and any relevant identification numbers.

05

Complete any required declarations or certifications as specified on the form.

06

Review the completed form for accuracy and completeness.

07

Submit the form as directed, either by mail or online, ensuring to keep a copy for your records.

Who needs OK OTC 994?

01

Individuals or businesses who sell or distribute over-the-counter products.

02

Regulatory agencies monitoring the sale of OTC items.

03

Health care professionals or organizations conducting research on OTC products.

Instructions and Help about oklahoma tax homestead exemption

Fill

form

: Try Risk Free

People Also Ask about

What is the homestead exemption for seniors in Oklahoma?

(4) Maximum household income qualification for the Additional Homestead Exemption is $25,000.00 for all counties. (5) If age 65 or over and have been granted an Additional Homestead Exemption no application is required unless your gross household income exceeded $25,000.00.

How do you qualify for homestead exemption in Oklahoma?

Anyone who is 65 or older or totally disabled, who is head of household, and a resident of the state of Oklahoma during the previous year and whose gross household income does not exceed 12,000 is qualified for this program.

Do you have to file for homestead exemption in Oklahoma?

Any purchaser or new owner of real property must file an application for homestead exemption as herein provided. E. The application for homestead exemption shall be filed with the county assessor of the county in which the homestead is located.

Who is exempt from paying property taxes in Oklahoma?

You may qualify for a real and personal property tax exemption. You must be an Oklahoma resident and eligible for homestead exemption. An exemption from property tax on homesteads is available for 100% disabled veterans. The exemption would apply to 100% disability rated veterans and their surviving spouses.

Do I need to file a homestead exemption every year in Oklahoma?

Any taxpayer who has been granted a Homestead Exemption and who continues to occupy the homestead property, shall not be required to re-apply for Homestead Exemption unless the deed is changed for some reason such as sale, divorce, death, etc; and provided that all personal property taxes appearing on the lien docket

Does Oklahoma have a senior property tax exemption?

Senior citizens (65 and Older) earning $85,300 or less are eligible for the Senior Valuation Freeze which can reduce your property tax bill over time. This will freeze the taxable, or assessed value, of your residential property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my oklahoma tax homestead exemption directly from Gmail?

oklahoma tax homestead exemption and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send oklahoma tax homestead exemption to be eSigned by others?

Once your oklahoma tax homestead exemption is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I sign the oklahoma tax homestead exemption electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your oklahoma tax homestead exemption and you'll be done in minutes.

What is OK OTC 994?

OK OTC 994 is a form used for reporting certain tax information related to the operation of tobacco products and the sale of over-the-counter (OTC) drugs in the state of Oklahoma.

Who is required to file OK OTC 994?

Entities or individuals involved in the manufacturing, distribution, or sale of tobacco products and OTC drugs in Oklahoma are required to file the OK OTC 994 form.

How to fill out OK OTC 994?

To fill out OK OTC 994, provide the required information in the designated fields, ensuring accuracy in reporting quantities, values, and compliance data, as per the instructions provided with the form.

What is the purpose of OK OTC 994?

The purpose of OK OTC 994 is to ensure compliance with state tax regulations by providing accurate reporting of tobacco and OTC drug transactions for taxation and regulatory oversight.

What information must be reported on OK OTC 994?

The information that must be reported on OK OTC 994 includes details about product quantities, sales figures, tax identification numbers, and any relevant compliance information as specified by Oklahoma tax regulations.

Fill out your oklahoma tax homestead exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oklahoma Tax Homestead Exemption is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.