OK OTC 994 2019 free printable template

Show details

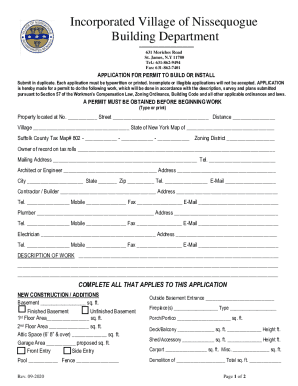

State of Oklahoma Application for Property Valuation Limitation and Additional Homestead Exemption OTC 994 Revised 11-2018 Return to County Assessor by March 15 Applicants Social Security Number Tax Year Co-applicants Social Security Number First Name and Initial if joint application give first names and initials of both Last Name Applicants Date of Birth Present Home Address number and street apartment/condo number or rural route City and State Zip Code Phone Number Part I - Legal...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK OTC 994

Edit your OK OTC 994 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK OTC 994 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OK OTC 994 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit OK OTC 994. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK OTC 994 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OK OTC 994

How to fill out OK OTC 994

01

Gather all necessary information about the transaction and the involved parties.

02

Access the OK OTC 994 form online or through the appropriate department.

03

Fill in the header section with your personal and company details.

04

Provide specific details about the transaction in the designated fields.

05

Ensure accurate compiling of financial information and supporting documentation.

06

Review the form for any errors or omissions.

07

Sign and date the form as required.

08

Submit the completed form to the appropriate authority or organization.

Who needs OK OTC 994?

01

Businesses engaged in over-the-counter transactions.

02

Financial institutions handling OTC trades.

03

Entities required to report certain financial transactions.

Fill

form

: Try Risk Free

People Also Ask about

At what age do you stop paying property taxes in Oklahoma?

The property owner must be age 65 or over as of January 1st to qualify. Gross household income from the preceding year does not exceed the 2023 maximum income qualification of $85,300. This includes income from all sources (including all persons occupying the home), except gifts.

Do you get money back from homestead?

Qualifying homeowners can get up to $100,000 deducted from the assessed value of their home. Exemptions increase based on age, and can be claimed by seniors, the disabled and veterans. Qualifying homeowners can get 50% the value of their primary residence (up to $100,000) deducted from property tax.

How much does a Homestead Exemption save you in Oklahoma?

What are the benefits of Homestead Exemption? As noted above, the Homestead Exemption of $1,000 assessed valuation reduces the real property tax by the amount of the millage levy effective in your area. This is $60 to $114 depending on your area of the county.

Who qualifies for Homestead Exemption in Oklahoma?

Qualifying. To qualify for Homestead Exemption, you must own and occupy your property as of January 1. If you apply after March 15, the exemption goes into effect the following year. It's important to note that though a person may own multiple properties, Homestead Exemption can apply only to the one where you live.

At what age do you stop paying property taxes in Oklahoma?

Head-of-household (as defined below) must be age 65 or older prior to January 1, of current year. Head-of-household must be an owner of and occupy the Homestead property on January 1, of current year. Gross household income (as defined below) cannot exceed the current H.U.D.

At what age do you stop paying property taxes in Louisiana?

a) Owned and occupied by a person who is 65 years of age or older. b) Owned and occupied by a person who has a 50% or greater military service-related disability. c) Last owned and occupied by a member of the armed forces who was killed or is missing in action, or who is a prisoner of war.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify OK OTC 994 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your OK OTC 994 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit OK OTC 994 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign OK OTC 994 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete OK OTC 994 on an Android device?

Complete OK OTC 994 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is OK OTC 994?

OK OTC 994 is a document used for reporting certain transactions and activities related to over-the-counter (OTC) trading in the state of Oklahoma.

Who is required to file OK OTC 994?

Individuals or entities engaged in OTC trading transactions in Oklahoma are required to file OK OTC 994.

How to fill out OK OTC 994?

To fill out OK OTC 994, complete the designated fields with accurate details regarding the transactions, including relevant identifiers, dates, and amounts, then submit it to the appropriate regulatory authority.

What is the purpose of OK OTC 994?

The purpose of OK OTC 994 is to ensure transparency and compliance in OTC trading by documenting and reporting specific activities to regulatory authorities.

What information must be reported on OK OTC 994?

OK OTC 994 must report information including transaction details, parties involved, trade dates, and the monetary amounts associated with the OTC transactions.

Fill out your OK OTC 994 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK OTC 994 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.