OK OTC 994 2011 free printable template

Show details

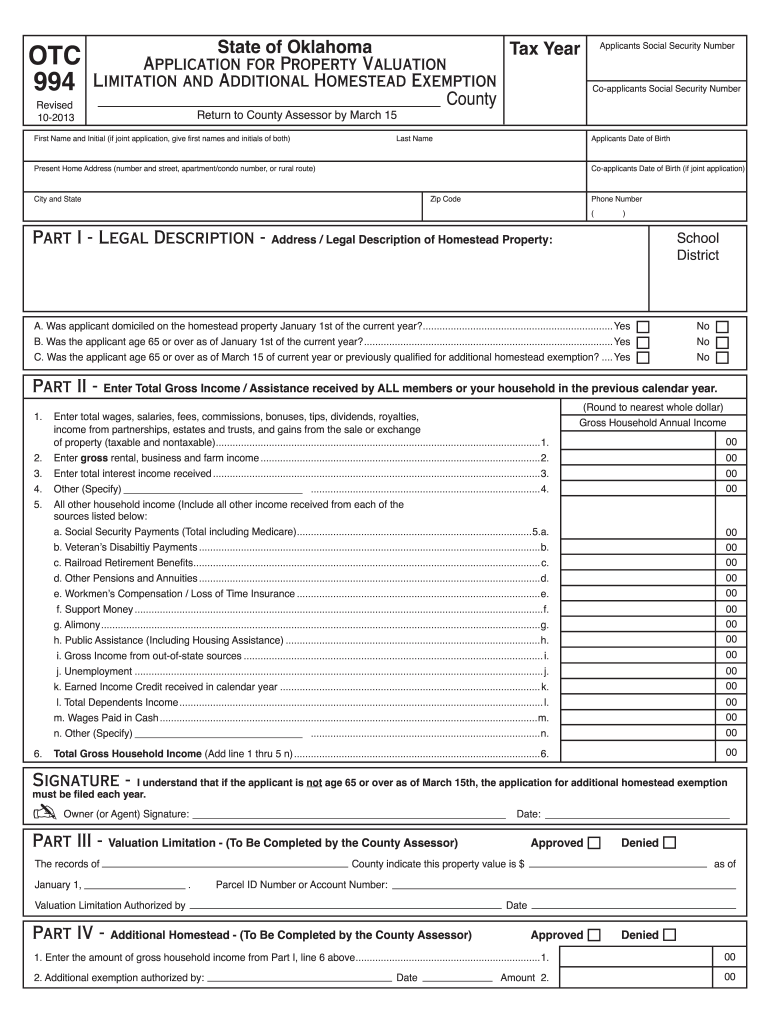

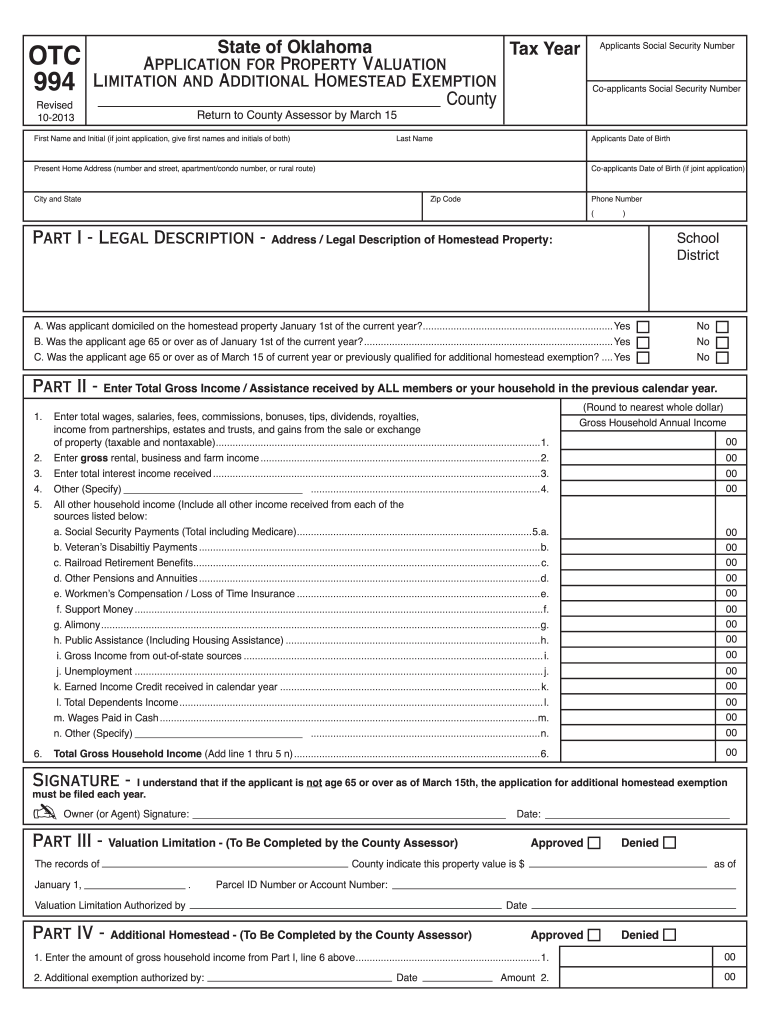

OTC 994 Revised 5-2011 State of Oklahoma Tax Year Application for Property Valuation Limitation and Additional Homestead Exemption County Return to County Assessor by March 15 Last Name Applicants

pdfFiller is not affiliated with any government organization

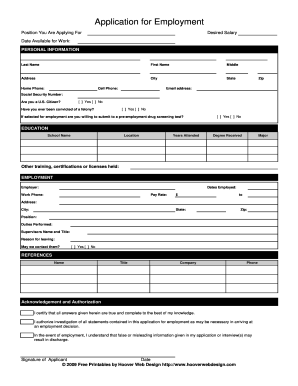

Get, Create, Make and Sign otc 994 2011 form

Edit your otc 994 2011 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your otc 994 2011 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit otc 994 2011 form online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit otc 994 2011 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK OTC 994 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out otc 994 2011 form

How to fill out OK OTC 994

01

Begin by gathering all required personal and business information.

02

Ensure you have your Taxpayer Identification Number (TIN) ready.

03

Fill in the applicant's name and address accurately.

04

Indicate the type of transaction by checking the appropriate box.

05

Provide detailed descriptions for the items being reported.

06

Verify the date and amount associated with each transaction.

07

Confirm that the form is signed and dated by the responsible party.

08

Review the completed form for accuracy before submission.

Who needs OK OTC 994?

01

Businesses engaged in sales of over-the-counter (OTC) products.

02

Companies involved in transactions that meet the reporting thresholds.

03

Tax professionals assisting clients with OTC product sales.

Instructions and Help about otc 994 2011 form

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for double homestead exemption in Oklahoma?

If you are head of household and qualify for homestead exemption, you may also qualify for additional homestead. You may receive an additional $1,000 assessment exemption if the gross household income from all sources did not exceed $25,000 for the past calendar year.

At what age do you stop paying property taxes in Louisiana?

a) Owned and occupied by a person who is 65 years of age or older. b) Owned and occupied by a person who has a 50% or greater military service-related disability. c) Last owned and occupied by a member of the armed forces who was killed or is missing in action, or who is a prisoner of war.

Does Louisiana have a senior discount on property taxes?

To qualify for the Senior Citizens Special Assessment Level Homestead Exemption "freeze" you must meet both of the following: You must be 65 years of age or older by the end of the year in which you are applying. Additionally you must meet the income requirement as set forth by the Louisiana legislature.

How much does homestead exemption save you in Oklahoma?

ADDITIONAL HOMESTEAD EXEMPTION This exemption will save you an additional $75 to $130 in taxes. Regardless of age, if the annual gross household income from all sources, received by all persons occupying the same household is $25,000 OR LESS you qualify for the additional exemption.

Do you have to file homestead exemption every year in Oklahoma?

FACTS TO REMEMBER 1. New Homestead Exemptions are filed by March 15th to be applied for the current tax year. 2. Additional Homestead Exemptions must be renewed every year between January 1 and March 15.

What is the senior freeze in Louisiana?

To qualify for a Senior Citizen's Special Assessment or “Senior Freeze” you must be 65 years of age or older and meet the income requirement set forth by the Louisiana legislature. The income requirement changes annually – please call the Assessor's Office to inquire.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send otc 994 2011 form to be eSigned by others?

otc 994 2011 form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for signing my otc 994 2011 form in Gmail?

Create your eSignature using pdfFiller and then eSign your otc 994 2011 form immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit otc 994 2011 form straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing otc 994 2011 form right away.

What is OK OTC 994?

OK OTC 994 is a form used for reporting certain transactions and activities related to the Oklahoma Tax Commission's oversight of collection and reporting of tax information.

Who is required to file OK OTC 994?

Individuals or entities engaged in specific financial transactions that fall under the Oklahoma Tax Commission's regulations are required to file OK OTC 994.

How to fill out OK OTC 994?

To fill out OK OTC 994, you need to provide specific details regarding the transactions, including amounts, dates, and parties involved, following the guidelines provided by the Oklahoma Tax Commission.

What is the purpose of OK OTC 994?

The purpose of OK OTC 994 is to ensure compliance with state tax regulations and to provide a clear record of financial transactions that may impact tax obligations.

What information must be reported on OK OTC 994?

The information that must be reported on OK OTC 994 includes transaction specifics such as the date, amount, type of transaction, and any relevant parties involved.

Fill out your otc 994 2011 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Otc 994 2011 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.