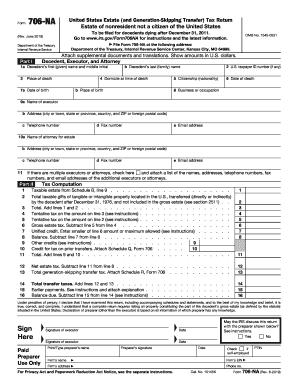

IRS 706-NA 2013 free printable template

Instructions and Help about IRS 706-NA

How to edit IRS 706-NA

How to fill out IRS 706-NA

About IRS 706-NA 2013 previous version

What is IRS 706-NA?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 706-NA

What should I do if I realize I've made a mistake on my IRS 706 NA form after submission?

If you realize there’s an error on your submitted IRS 706 NA 2013-2019, you’ll need to file an amendment. The process generally involves completing a new form, indicating the corrections, and submitting it along with an explanation of the changes. Keeping a copy of both documents ensures proper documentation.

How can I check the status of my IRS 706 NA form after filing?

To track your IRS 706 NA 2013-2019 after submission, you can contact the IRS directly or utilize the IRS online portal, where you can verify receipt and processing. Be prepared to provide your Social Security Number and other identifying information to obtain accurate updates.

What are common pitfalls when filing the IRS 706 NA form and how can they be avoided?

Common pitfalls when filing the IRS 706 NA 2013-2019 include incorrect data entry, missing signatures, and failing to comply with e-file requirements. Double-checking all entries and ensuring that you follow the IRS guidelines will help you avoid these mistakes and ensure a smoother filing process.

What should I do if my IRS 706 NA form is rejected upon e-filing?

In the event of an e-filing rejection for your IRS 706 NA 2013-2019, carefully review the rejection message for specific error codes. This information will guide you on what needs correction. After addressing the issues, you can resubmit the form electronically or via mail, depending on the situation.

Are there any special considerations for nonresidents filing the IRS 706 NA form?

Nonresidents submitting the IRS 706 NA 2013-2019 must be aware of specific requirements, including additional documentation to show U.S. tax withholding and compliance with U.S. laws. They may also need to work with an authorized representative to ensure proper representation and responsiveness to IRS inquiries.