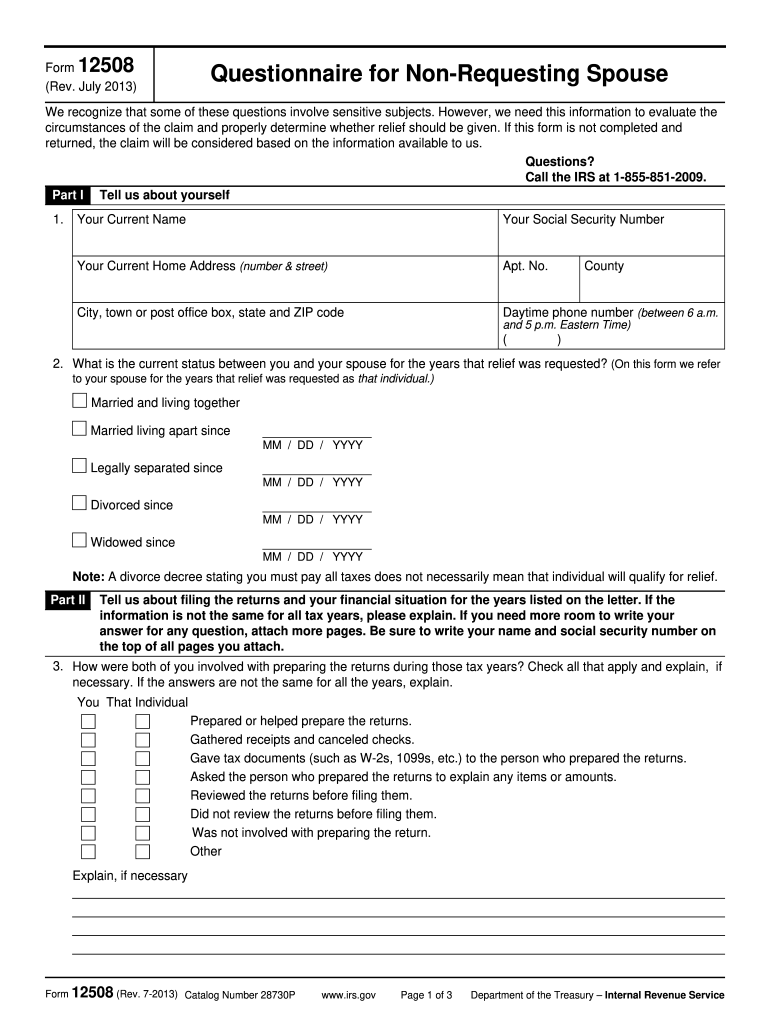

IRS 12508 2013 free printable template

Get, Create, Make and Sign

How to edit irs form 12508 online

IRS 12508 Form Versions

How to fill out irs form 12508 2013

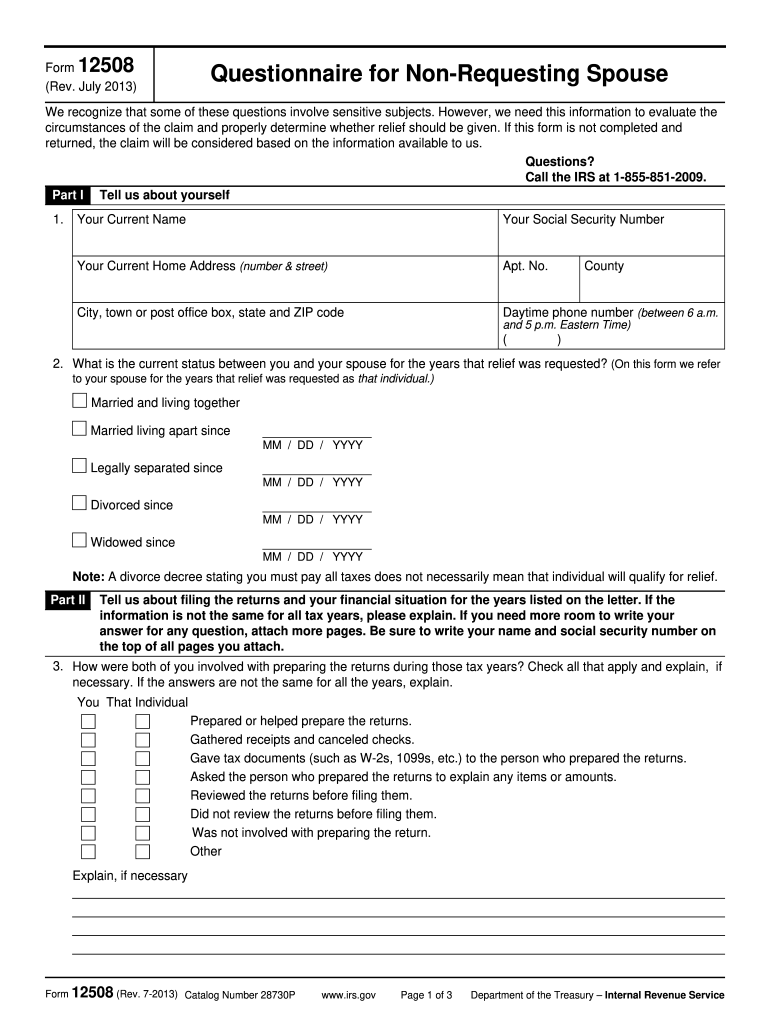

How to fill out IRS Form 12508:

Who needs IRS Form 12508:

Video instructions and help with filling out and completing irs form 12508

Instructions and Help about questionnaire requesting questions form

The purpose of this video is to provide a general idea of what type of documents information and other items are needed to adequately prepare a green card through marriage application this video covers only information pertaining to what is needed from the foreign national spouse or applicant we have provided a separate video covering information needed from the US citizens spouse or petitioner the information needed from the foreign national spouse also known as the applicant is as follows with any immigration application we need basic info like your name and any other names used your social security number you a number your present address phone number date of birth and location of birth the next item covers details pertaining to your present marriage and any previous marriages in this regard you will need to provide dates and locations of all marriages and names and dates of birth of all previous bounces we'll also need details pertaining to your parents and any children you may have we need your parents full names dates of birth cities and countries of birth and current city and country of residents as for any children we'll need their names dates of birth and countries of birth the next item is your 5-year residential history in this regard we need to know the addresses of where you've resided over the past five years including the dates we also need to know the address of any residents who resided of at outside the US for more than one year like your residential history we also need your five-year employment history which will include the name of any employers their addresses your occupation and dates of employment similarly if you've ever worked outside us, we will need to know the details at this point in the questionnaire we start to see some items that are different from what's requested from the US citizen spouse we need details pertaining to membership or affiliations with any organizations associations funds foundations parties clubs or societies we will need to know details of when where and in what status you last enter the U.S. in addition to your current immigration status if you ever had any run-ins with the police or other similar authorities this will need to be disclosed we will need to be aware of whether you have ever applied for permanent residence status or employment authorization in the U.S. like the US citizen the foreign national spouse has to provide lots of documents pertaining to their background you will need to provide the items on the checklist such as the following copy of the bio graphic page of your passport copies of all documents pertaining to your current immigration status and prior immigration statuses copy of your birth certificate copy of your current marriage certificate and any previous divorce decrees info and documents pertaining to any police encounters including citations arrests convictions etc medical exam three US passport photos the adjustment of status filing fee in the amount of a thousand...

Fill letter of non filing : Try Risk Free

People Also Ask about irs form 12508

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your irs form 12508 2013 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.