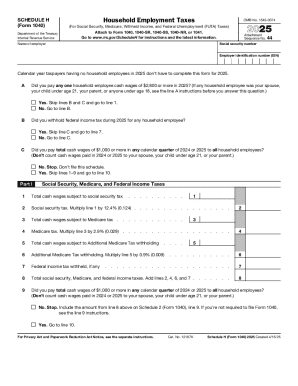

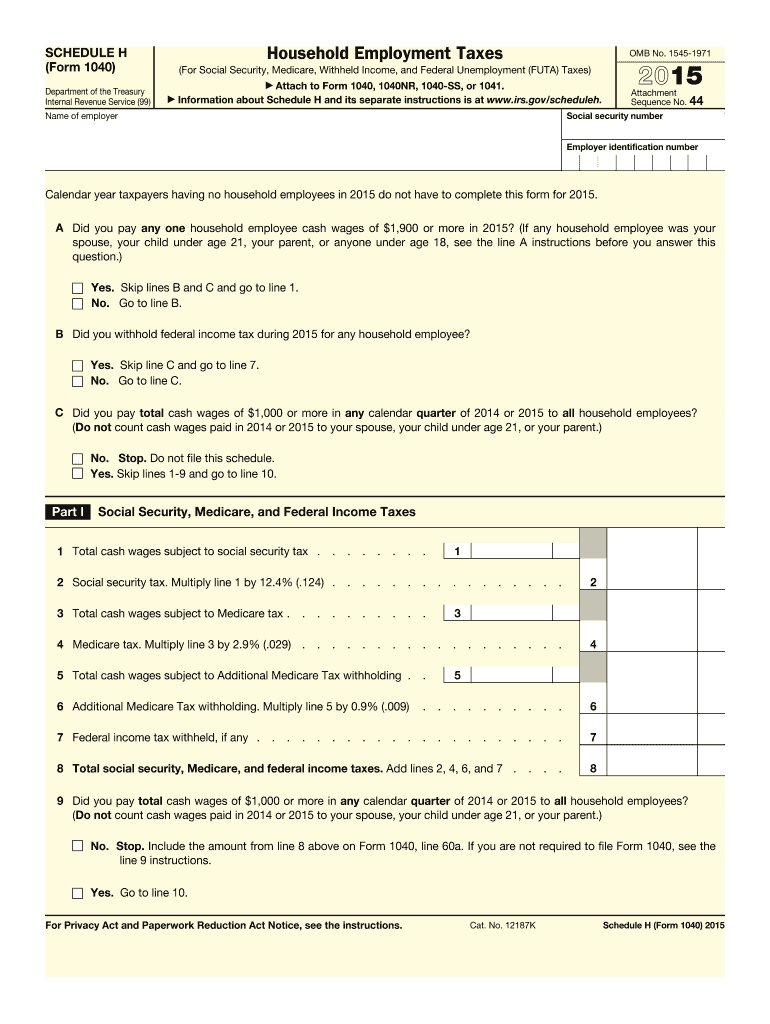

IRS 1040 - Schedule H 2015 free printable template

Instructions and Help about IRS 1040 - Schedule H

How to edit IRS 1040 - Schedule H

How to fill out IRS 1040 - Schedule H

About IRS 1040 - Schedule H 2015 previous version

What is IRS 1040 - Schedule H?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

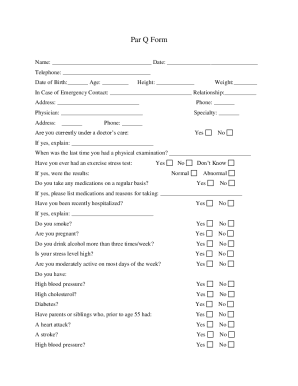

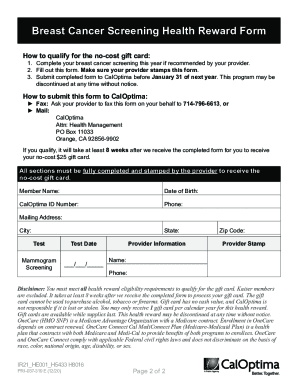

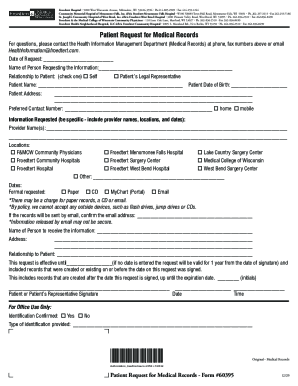

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1040 - Schedule H

What should I do if I realize I've made a mistake after filing my IRS 1040 - Schedule H?

If you've made an error on your IRS 1040 - Schedule H, you can file an amended return using Form 1040-X. Ensure that you clearly indicate the corrections and attach a revised Schedule H. It's important to submit this as soon as the mistake is noticed to avoid potential complications.

How can I verify the status of my submitted IRS 1040 - Schedule H?

To check the status of your IRS 1040 - Schedule H, you can use the IRS's 'Where's My Refund?' tool if you filed electronically. Alternatively, if you mailed your return, you may call the IRS directly. Be prepared to provide personal information for verification.

What should I be aware of regarding e-signature on IRS 1040 - Schedule H?

When e-filing your IRS 1040 - Schedule H, an electronic signature is usually accepted, provided you follow IRS protocols for e-filing. Keep in mind that it's crucial to securely authenticate your identity to prevent unauthorized submissions.

What common errors should I avoid when filing IRS 1040 - Schedule H?

Common errors include incorrect Social Security numbers, mismatched names, and failing to report taxable responsibilities accurately. Always double-check the information and ensure all fields are completed appropriately to avoid delays or rejections.

What if my IRS 1040 - Schedule H submission is rejected; can I get a refund?

If your submission of IRS 1040 - Schedule H is rejected, you generally do not incur a fee for the rejected return. However, fix any issues and resubmit promptly to ensure compliance and avoid potential late fines.