Get the free T HE CANADIAN R EGISTRY

Show details

The CANADIAN R REGISTRY THE TENNESSEE WALKING HORSESINCE1982The Canadian Walker April, 2003February,

2021 1

Volume

20, Issue

CREW EXECUTIVE

President:

Sue Gamble, ON7056423746

president@crtwh.ca

VicePresident:

Marjorie

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your t he canadian r form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t he canadian r form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit t he canadian r online

Follow the guidelines below to use a professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit t he canadian r. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

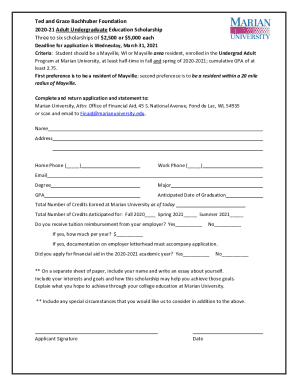

How to fill out t he canadian r

How to fill out t he canadian r

01

To fill out the Canadian R form, follow these steps:

02

Start by obtaining the R form from the appropriate Canadian government website or office.

03

Read the instructions carefully to understand the purpose and requirements of the form.

04

Gather all the necessary information and documents needed to complete the form.

05

Begin filling out the form by providing accurate and complete information in the designated fields.

06

Double-check the form for any errors or omissions before submitting it.

07

Follow any additional instructions provided on the form or in the accompanying documentation.

08

Sign and date the form as required.

09

Make a copy of the completed form for your records.

10

Submit the form as instructed, either online or by mail, along with any required fees or supporting documents.

11

Keep a record of the submission date and any confirmation or reference numbers provided.

Who needs t he canadian r?

01

The Canadian R form may be needed by individuals or businesses who are required to fulfill certain reporting obligations to the Canadian government.

02

This form is typically used for reporting specific financial or tax-related information.

03

The exact criteria for who needs the Canadian R form would depend on the specific regulations and requirements set forth by the Canadian government or relevant authorities.

04

It is advisable to consult the official guidelines or seek professional advice to determine if you need to fill out the Canadian R form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the canadian r?

The Canadian R refers to the Canadian tax form used to report income and deductions for individuals and businesses.

Who is required to file the canadian r?

Any individual or business that earns income in Canada is required to file the Canadian R.

How to fill out the canadian r?

To fill out the Canadian R, you need to gather all relevant income and deduction information, complete the form accurately, and submit it either electronically or by mail.

What is the purpose of the canadian r?

The purpose of the Canadian R is to ensure that individuals and businesses report their income and deductions accurately, and to calculate the amount of tax owed to the Canadian government.

What information must be reported on the canadian r?

The Canadian R requires individuals and businesses to report their taxable income, deductions, credits, and other relevant financial information.

When is the deadline to file the canadian r in 2023?

The deadline to file the Canadian R in 2023 is April 30th for individuals and June 15th for self-employed individuals.

What is the penalty for the late filing of the canadian r?

The penalty for late filing of the Canadian R is usually a percentage of the tax owing, which increases the longer the filing is delayed.

How can I get t he canadian r?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific t he canadian r and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I execute t he canadian r online?

Filling out and eSigning t he canadian r is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I sign the t he canadian r electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your t he canadian r in seconds.

Fill out your t he canadian r online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.