Get the free Gifts of $500 or more in value given to the Texas Workforce Commission

Show details

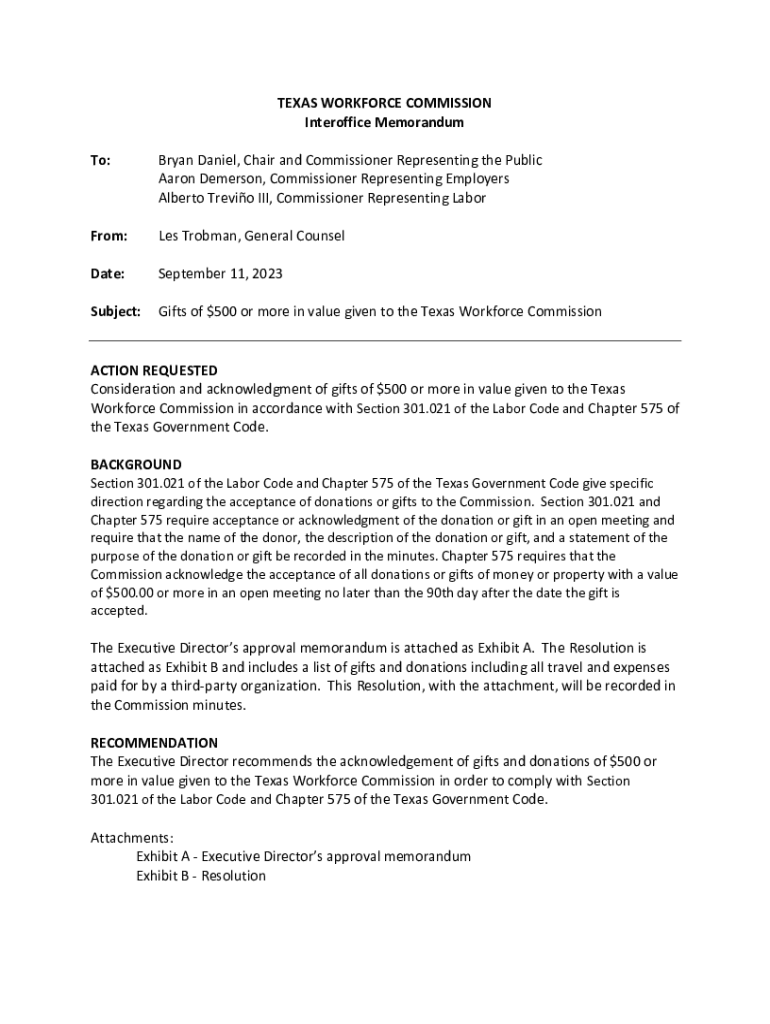

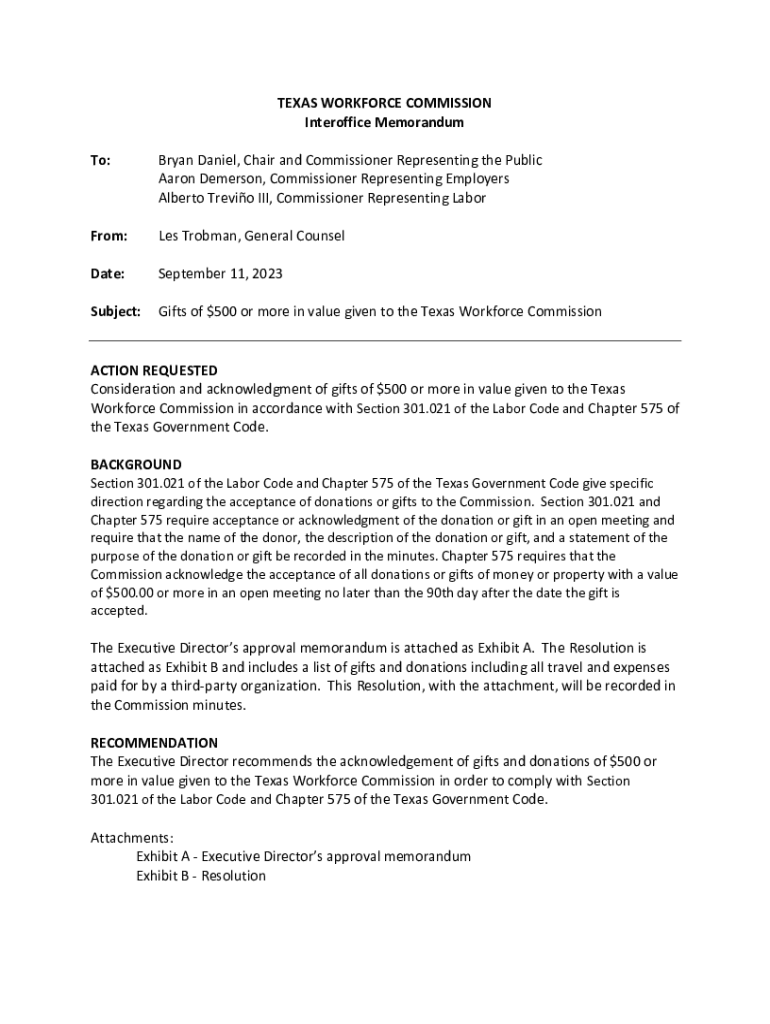

TEXAS WORKFORCE COMMISSION Interoffice Memorandum To:Bryan Daniel, Chair and Commissioner Representing the Public Aaron Demerson, Commissioner Representing Employers Alberto Trevio III, Commissioner

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gifts of 500 or form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gifts of 500 or form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gifts of 500 or online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit gifts of 500 or. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

How to fill out gifts of 500 or

How to fill out gifts of 500 or

01

To fill out gifts of 500 or, follow these steps:

02

Start by gathering all the necessary information required for filling out the gift form.

03

Make sure you have the correct gift amount of 500 or in the specified currency.

04

Begin by filling out the recipient's name and contact information in the appropriate fields.

05

Provide any additional details or special instructions in the designated section.

06

Double-check all the information entered for accuracy and completeness.

07

Sign and date the gift form to confirm your intent to give the gift.

08

Submit the filled-out gift form through the designated channels, such as mailing it or delivering it in person.

09

Retain a copy of the gift form for your records.

Who needs gifts of 500 or?

01

Gifts of 500 or may be needed by various individuals or entities, such as:

02

- Charitable organizations that rely on donations to support their causes and projects.

03

- Individuals in need who may require financial assistance.

04

- Event organizers who use gifts as prizes or giveaways during their events.

05

- Institutions or foundations that provide financial aid or scholarships to deserving individuals.

06

- Contributors to crowdfunding campaigns or fundraisers supporting specific initiatives.

07

- Non-profit organizations that depend on gifts for funding their activities.

08

Overall, various individuals, organizations, and causes may benefit from gifts of 500 or.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gifts of 500 or?

Gifts of 500 or refers to gifts that have a value of $500 or more.

Who is required to file gifts of 500 or?

Individuals or entities who receive gifts of $500 or more are required to file gifts of 500 or.

How to fill out gifts of 500 or?

To fill out gifts of 500 or, you need to gather the necessary information about the gift, such as its value, donor's information, and date of receiving. Then you can use the appropriate form provided by the relevant authority to report the gift.

What is the purpose of gifts of 500 or?

The purpose of gifts of 500 or is to track and report high-value gifts received by individuals or entities for tax or regulatory purposes.

What information must be reported on gifts of 500 or?

The information that must be reported on gifts of 500 or typically includes the value of the gift, donor's name and contact information, date of receiving the gift, and any relevant details about the nature of the gift.

When is the deadline to file gifts of 500 or in 2023?

The deadline to file gifts of 500 or in 2023 may vary depending on the jurisdiction or tax regulations. It is advisable to consult the relevant authority or seek professional advice to determine the specific deadline.

What is the penalty for the late filing of gifts of 500 or?

The penalty for the late filing of gifts of 500 or can also vary depending on the jurisdiction or tax regulations. It is advisable to consult the relevant authority or seek professional advice to understand the specific penalties and consequences for late filing.

Where do I find gifts of 500 or?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the gifts of 500 or in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I execute gifts of 500 or online?

With pdfFiller, you may easily complete and sign gifts of 500 or online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for the gifts of 500 or in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your gifts of 500 or in minutes.

Fill out your gifts of 500 or online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.