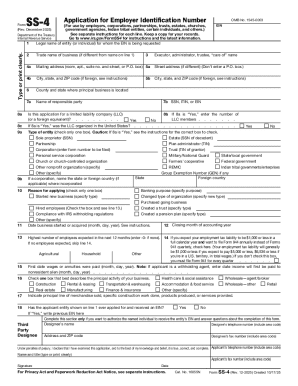

KS DoR K-40 2023-2026 free printable template

Instructions and Help about KS DoR K-40

How to edit KS DoR K-40

How to fill out KS DoR K-40

Latest updates to KS DoR K-40

All You Need to Know About KS DoR K-40

What is KS DoR K-40?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about KS DoR K-40

What should I do if I need to correct a mistake on my KS DoR K-40 after filing?

If you realize you've made an error on your KS DoR K-40 after submission, you will need to file an amended return. This involves using the same form, marking it as amended, and clearly indicating the changes. Make sure to keep copies of all submissions for your records, as this information will be important if questions arise later.

How can I verify the status of my KS DoR K-40 submission?

To verify the status of your KS DoR K-40, you can contact the Kansas Department of Revenue directly or use any online tracking services they provide. It's also helpful to keep your confirmation number from the e-filing process, as this can assist you in locating your submission quickly.

What are the privacy concerns regarding the KS DoR K-40 form?

When filing the KS DoR K-40, your personal information is collected and must be handled with care to protect your privacy. The Kansas Department of Revenue implements measures to ensure data security, but it’s advisable to review their privacy policy to understand how your information will be used and stored.

Are there any specific fees associated with electronically filing the KS DoR K-40?

Yes, e-filing your KS DoR K-40 may incur service fees, which differ based on the service provider you choose to use. Be sure to review any associated costs during the filing process to avoid surprises. Always confirm with your e-filing service about their fee structure prior to submission.

What steps should I take if I receive a notice or audit related to my KS DoR K-40?

If you receive a notice or audit regarding your KS DoR K-40, it's crucial to read the notification carefully to understand the concerns raised. Gather all relevant documentation, respond promptly, and consider consulting with a tax professional for guidance on how to handle the situation effectively.

See what our users say