Get the free Real Estate Tax Commitment Book - 15.040

Show details

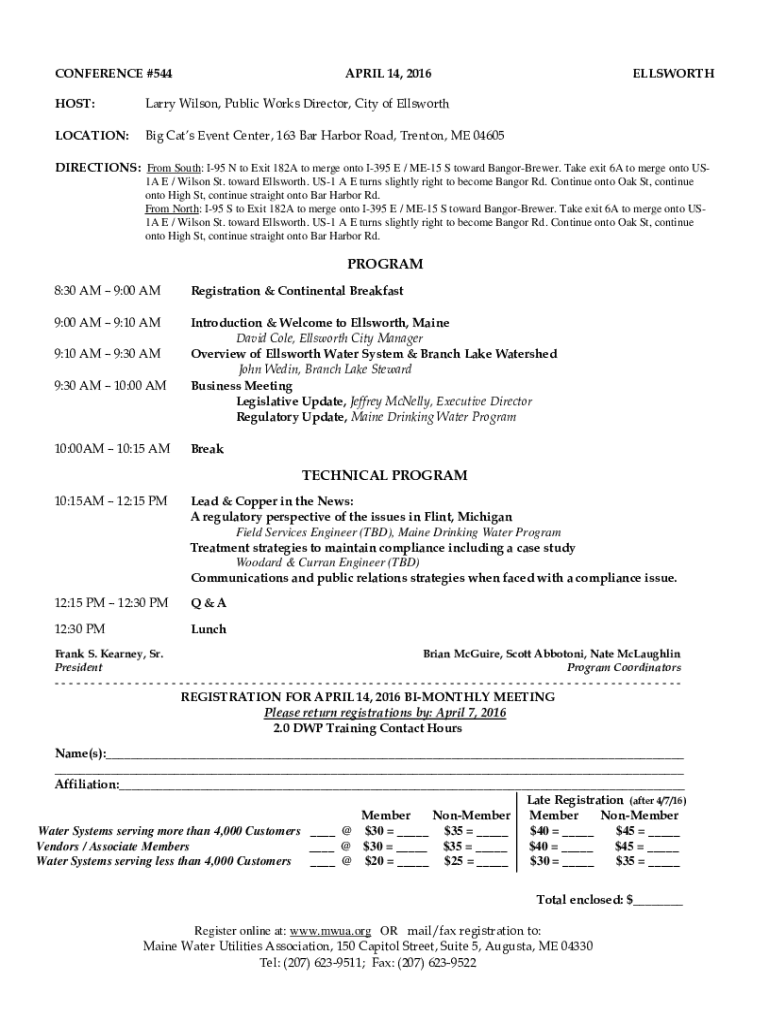

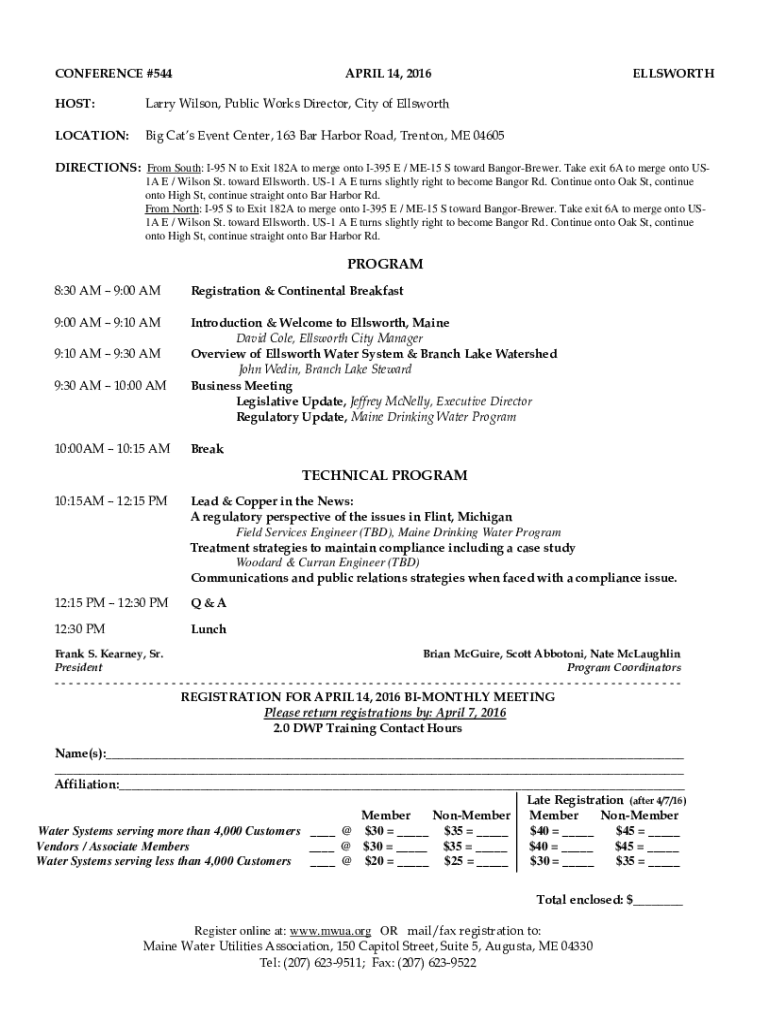

CONFERENCE #544APRIL 14, 2016HOST:Larry Wilson, Public Works Director, City of EllsworthLOCATION:Big Cats Event Center, 163 Bar Harbor Road, Trenton, ME 04605ELLSWORTHDIRECTIONS: From South: I95 N

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign real estate tax commitment

Edit your real estate tax commitment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your real estate tax commitment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing real estate tax commitment online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit real estate tax commitment. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out real estate tax commitment

How to fill out real estate tax commitment

01

Obtain the real estate tax commitment form from the relevant tax authority.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide the details of the property for which you are filling out the tax commitment form, such as the address, parcel number, and legal description.

04

Calculate the assessed value of the property based on the guidelines provided by the tax authority.

05

Determine the applicable tax rate for the property, which may vary depending on its location or usage.

06

Multiply the assessed value by the tax rate to calculate the amount of tax owed.

07

Include any applicable exemptions or deductions that may reduce the tax liability.

08

Double-check all the information provided and make sure it is accurate and complete.

09

Sign and date the tax commitment form.

10

Submit the completed form along with any required supporting documents to the tax authority by the specified deadline.

Who needs real estate tax commitment?

01

Real estate tax commitment is needed by property owners, including individuals, businesses, and organizations, who are responsible for paying property taxes.

02

It is also required by tax professionals, accountants, or anyone assisting property owners in managing their tax obligations.

03

Additionally, government agencies, municipalities, and tax authorities use real estate tax commitment to keep track of property ownership and ensure proper tax collection.

04

Real estate developers, agents, and professionals involved in property transactions may also need tax commitment information to determine the tax implications of buying or selling properties.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send real estate tax commitment to be eSigned by others?

When you're ready to share your real estate tax commitment, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete real estate tax commitment online?

Filling out and eSigning real estate tax commitment is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make edits in real estate tax commitment without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your real estate tax commitment, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is real estate tax commitment?

Real estate tax commitment is a formal declaration by a local government that imposes a tax on real estate properties based on their assessed value.

Who is required to file real estate tax commitment?

Property owners or their representatives are typically required to file real estate tax commitment.

How to fill out real estate tax commitment?

To fill out a real estate tax commitment, property owners must provide their property details, including the assessed value, property description, and any applicable exemptions, on the designated tax form.

What is the purpose of real estate tax commitment?

The purpose of real estate tax commitment is to legally obligate property owners to pay taxes that help fund local services and infrastructure.

What information must be reported on real estate tax commitment?

Information that must be reported includes the property address, owner details, assessed value, tax rates, and any exemptions or deductions applied.

Fill out your real estate tax commitment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Real Estate Tax Commitment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.